Question

8. The Gradowski Corporation had net income of $ 150,000 during 19x5, with 10,000 shares of common stock outstanding. It also had 1,000 shares

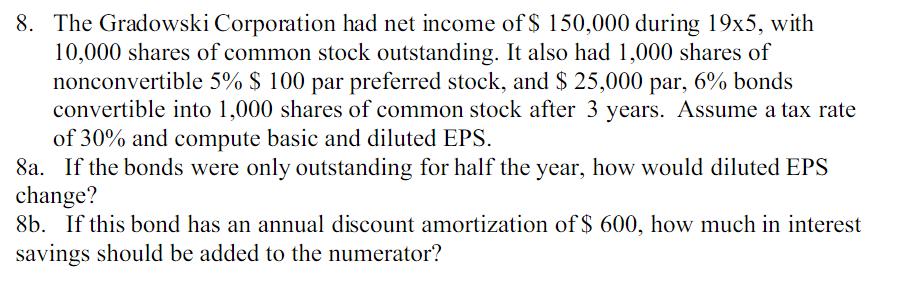

8. The Gradowski Corporation had net income of $ 150,000 during 19x5, with 10,000 shares of common stock outstanding. It also had 1,000 shares of nonconvertible 5% $ 100 par preferred stock, and $ 25,000 par, 6% bonds convertible into 1,000 shares of common stock after 3 years. Assume a tax rate of 30% and compute basic and diluted EPS. 8a. If the bonds were only outstanding for half the year, how would diluted EPS change? 8b. If this bond has an annual discount amortization of $ 600, how much in interest savings should be added to the numerator?

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

As per the policy of our company In case of multiple questions asked then we are allowed to answer o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Accounting

Authors: Belverd E. Needles, Marian Powers and Susan V. Crosson

12th edition

978-1133603054, 113362698X, 9781285607047, 113360305X, 978-1133626985

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App