Question

On April 18, 2010, Petros buys all the assets of BrigidsMuffler Shop. Included in the purchase price of $295,000 is a payment of $20,000 to

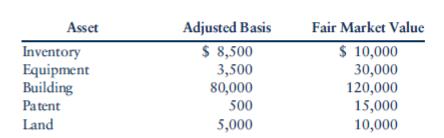

The patent is on a special muffler that Brigid developed and patented 5 years ago. Petros would like to know the maximum amount of the deduction he will be allowed on the purchase of Brigid’s assets for 2010.

Asset Adjusted Basis Fair Market Value Inventory Equipment Building $ 8,500 3,500 80,000 $ 10,000 30,000 120,000 15,000 10,000 Patent 500 Land 5,000

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Determine maximum allowable costrecovery deductions fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Concepts In Federal Taxation 2018

Authors: Kevin E. Murphy, Mark Higgins

25th Edition

1337386073, 1337386074, 9781337516532, 1337516538, 9781337389945, 978-1337386074

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App