They buys a rental house in 2010 for $75,000. In 2017, she sells it for $86,000. They

Question:

a. What is the amount and character of the gain on the sale?

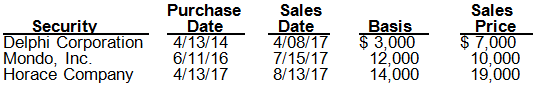

b. They also sells the following securities:

Determine the amount of tax that Thuy will pay on her capital asset transactions. Assume that she is in the 35% marginal tax rate bracket.

Transcribed Image Text:

Sales Sales Purchase Date 4/13/14 Security Date Basis Price Delphi Corporation Mondo, Inc. Horace Company $ 3,000 $ 7,000 10,000 19,000 7/15/17 8/13/17 12,000 14,000 4/13/17

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (14 reviews)

a They realizes a 33000 gain on the sale The rental house is Section 1250 property but there is no d...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Concepts In Federal Taxation 2018

ISBN: 9781337386074

25th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted:

Students also viewed these Business questions

-

Walter, a single taxpayer, purchased a limited partnership interest in a tax shelter in 1985. He also acquired a rental house in 2012, which he actively manages. During 2012, Walter's share of the...

-

3. Walter, a single taxpayer, purchased a limited partnership interest in a tax shelter in 1985. He also acquired a rental house in 2013, which he actively manages. During 2013, Walter's share of the...

-

Walter, a single taxpayer, purchased a limited partnership interest in a tax shelter in 1985. He also acquired a rental house in 2014, which he actively manages. During 2014, Walters share of the...

-

In 2012, the average credit score for loans that were purchased through Fannie Mae was 766. A random sample of 35 mortgages were selected, and it was found that the average credit score was 771with a...

-

By how much does the pressure of gas at 0C decrease for each decrease in temperature of 1 Celsius degree when the volume is held constant?

-

Multiple Choice $52,000 $51,600 $52,200 $52,400

-

No

-

Rena Reynolds, one of your firm's workers, has just come into the payroll department and says to you: ''I am thinking of amending my Form W-4 so that an additional $10 is withheld each week. That way...

-

You borrow the following from your friends: $800 from John and $400 from Mary. John charges you 6% and Mary charges you 9%. What is your combined cost of borrowing from your friends?2. What are your...

-

Suppose that Central High School has preferences that can be represented by the utility function U(C,X) = CX2. Let us try to determine how the various plans described in the last problem will affect...

-

Anton purchases a building on May 4, 2000, at a cost of $270,000. The land is properly allocated $30,000 of the cost. Anton sells the building on October 18, 2017, for $270,000. What is the character...

-

Bonnie wants to trade her Snow Bird, Utah, condominium, which she has held for investment, for investment property in Steamboat Springs or Crested Butte, Colo. On April 20, 2017, she transfers title...

-

1. If a mail survey were used, what would be the pros, cons, and special considerations associated with achieving the overriding objective of the survey? 2. Many telephone data-collection companies...

-

4. Consider the RC circuit shown below: R C C2 The capacitors are connected in parallel. Use C = 120 F, C = 30F, R = 5002, and = 40V. The capacitors are initially uncharged and at t=0 the switch is...

-

The DuPont equation shows the relationships among asset management, debt management, and profitability of improving the firm's performance. Its equation is: ratios. Management can use the DuPont...

-

38. A pendulum bob of mass 0.200 kg is pulled to one side such that it has a height of 0.50 m relative to its rest position (that is, its lowest point). It is then released so that it swings back and...

-

Let A in K ^ ( n \ times n ) be an ( n \ times n ) - matrix. Show that there ist a basis B of K ^ n that consists of eigenvectors of A .

-

Using the "you" view is an effective way for writers to avoid taking on blame in business messages. O True False

-

Data for Research Enterprises follows: compute the dollar amount of change and the percentage of change in Research Enterprises working capital each year during 2025 and 2024. What do the calculated...

-

Show, if u(x, y) and v(x, y) are harmonic functions, that u + v must be a harmonic function but that uv need not be a harmonic function. Is e"e" a harmonic function?

-

One primary problem in properly accounting for property dispositions is differentiating capital assets and Section 1231 property. Why is it important to correctly identify as either a capital asset...

-

Explain the look back rule as it applies to the Section 1231 netting procedure.

-

The chapter noted that all depreciable property is subject to the depreciation recapture rules. What is the intent of the depreciation recapture rules?

-

The company sold merchandise to a customer on March 31, 2020, for $100,000. The customer paid with a promissory note that has a term of 18 months and an annual interest rate of 9%. The companys...

-

imer 2 0 2 4 Question 8 , PF 8 - 3 5 A ( similar to ) HW Score: 0 % , 0 of 1 0 0 points lework CH 8 Part 1 of 6 Points: 0 of 1 5 Save The comparative financial statements of Highland Cosmetic Supply...

-

An investor wants to purchase a zero coupon bond from Timberlake Industries today. The bond will mature in exactly 5.00 years with a redemption value of $1,000. The investor wants a 12.00% annual...

Study smarter with the SolutionInn App