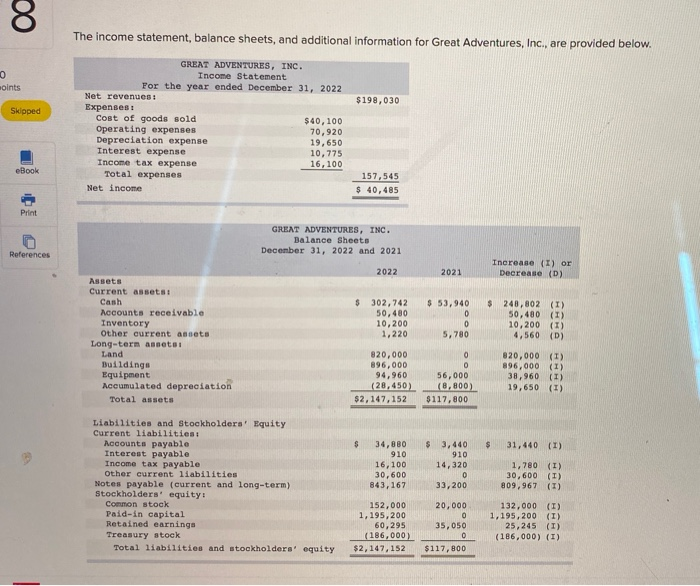

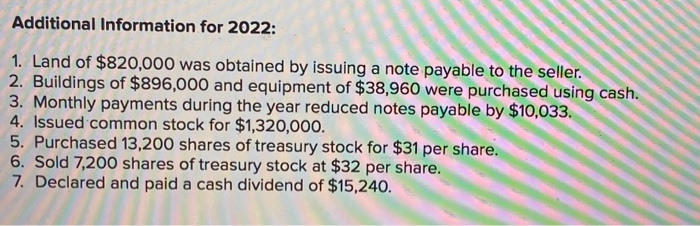

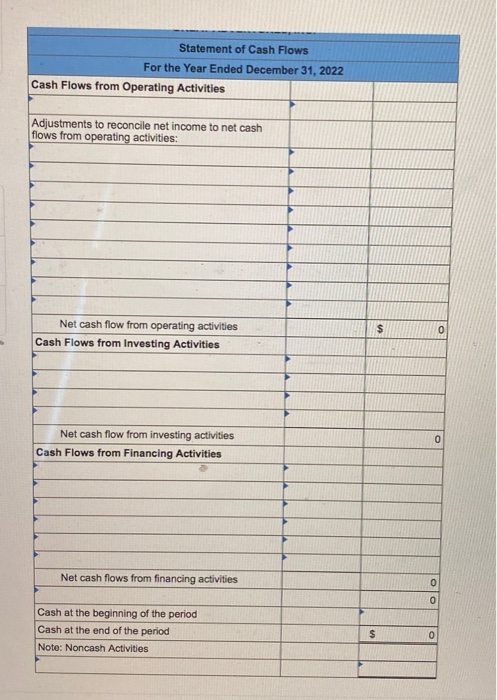

8 The income statement, balance sheets, and additional information for Great Adventures, Inc., are provided below. 0 oints $198,030 Skipped GREAT ADVENTURES, INC. Income Statement For the year ended December 31, 2022 Net revenues : Expenses Cost of goods sold $40,100 Operating expenses 70,920 Depreciation expense 19,650 Interest expense 10,775 Income tax expense 16,100 Total expenses Net income eBook 157,545 $ 40,485 Print D. GREAT ADVENTURES, INC. Balance Sheets December 31, 2022 and 2021 References 2022 2021 Increase (I) or Decrease (D) $ 302,742 50,480 10,200 1,220 $ 53,940 0 0 5,780 $ 240,802 (I) 50,480 (I) 10,200 (1) 4,560 (D) Assets Current assets: Cash Accounts receivable Inventory Other current assets Long-term assets Land Buildings Equipment Accumulated depreciation Total assets 820,000 896,000 94,960 (28,450) $2,147,152 0 0 56,000 (B, 800) $117,800 820,000 (1) 896,000 (1) 38,960 (1) 19,650 (1) 31,440 (1) 5 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Other current liabilities Notes payable (current and long-term) Stockholders' equity! Common stock Paid-in capital Retained earnings Treasury stock Total liabilities and stockholders' equity 34,880 910 16,100 30,600 843,167 3,440 910 14,320 0 33,200 1,780 (1) 30,600 (I) 809,967 (I) 152,000 1,195,200 60,295 (186,000) $2,147,152 20,000 0 35,050 0 $117,800 132,000 (1) 1,195,200 (1) 25, 245 (I) (186,000) (1) Additional Information for 2022: 1. Land of $820,000 was obtained by issuing a note payable to the seller. 2. Buildings of $896,000 and equipment of $38,960 were purchased using cash. 3. Monthly payments during the year reduced notes payable by $10,033. 4. Issued common stock for $1,320,000. 5. Purchased 13,200 shares of treasury stock for $31 per share. 6. Sold 7,200 shares of treasury stock at $32 per share. 7. Declared and paid a cash dividend of $15,240. Statement of Cash Flows For the Year Ended December 31, 2022 Cash Flows from Operating Activities Adjustments to reconcile net income to net cash flows from operating activities: $ 0 Net cash flow from operating activities Cash Flows from Investing Activities 0 Net cash flow from investing activities Cash Flows from Financing Activities Net cash flows from financing activities 0 0 Cash at the beginning of the period Cash at the end of the period Note: Noncash Activities $ 0