Answered step by step

Verified Expert Solution

Question

1 Approved Answer

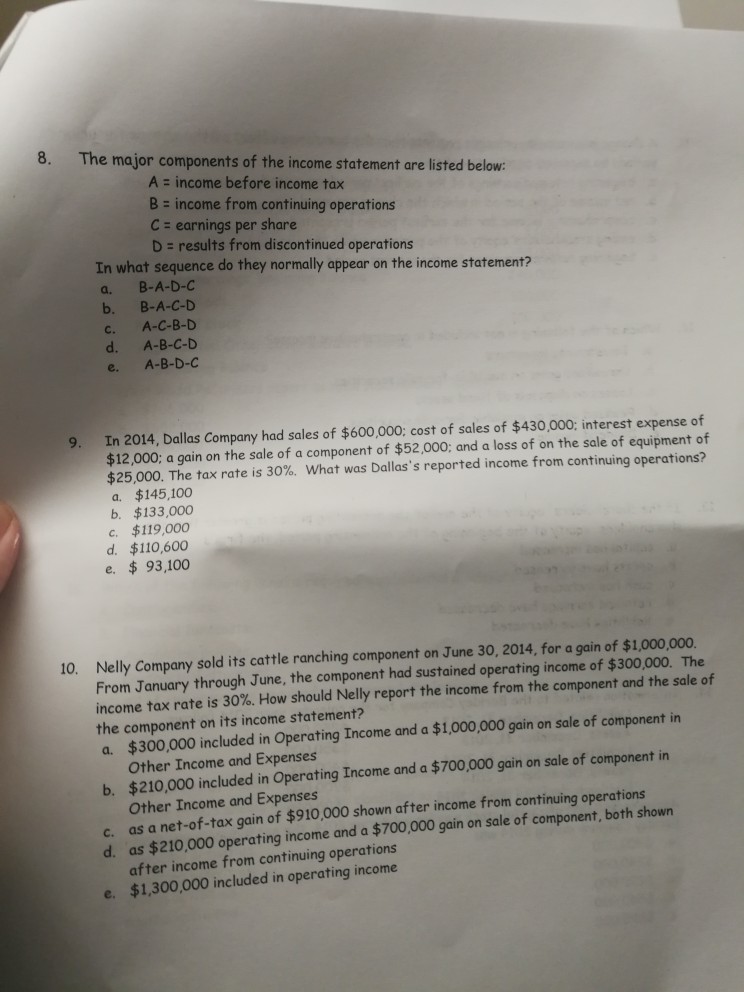

8 The major components of the income statement are listed below: A = income before income tax B income from continuing operations C earnings per

8 The major components of the income statement are listed below: A = income before income tax B income from continuing operations C earnings per share D results from discontinued operations In what sequence do they normally appear on the income statement? a. B-A-D-C b. B-A-C-D c. A-C-B-D d. A-B-C-D e. A-B-D-c In 2014, Dallas Company had sales of $600,000; cost of sales of $430,000: interest expense of $12,000; a gain on the sale of a component of $52,000; and a loss of on the sale of equipment of $25,000, The tax rate is 30%, what was Dallas's reported income from continuing operations? a $145,100 b. $133,000 c $119,000 d $110,600 e, -$ 93,100 9. 10. Nelly Company sold its cattle ranching component on June 30, 2014, for a gain of $1,000,000. From January through June, the component had sustained operating income of $300,000. The income tax rate is 30%. How should Nelly report the income from the component and the sale of the component on its income statement? a. $300,000 included in Operating Income and a $1,000,000 gain on sale of component in Other Income and Expenses $210,000 included in Operating Income and a $700,000 gain on sale of component in Other Income and Expenses c. as a net-of-tax gain of $910,000 shown after income from continuing operations d. as $210,000 operating income and a $700,000 gain on sale of component, both shown after income from continuing operations $1,300,000 included in operating income e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started