Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. The spot price of copper is $3.87 per 1b, and the forward price for delivery in three months is $3.94 per lb. Suppose you

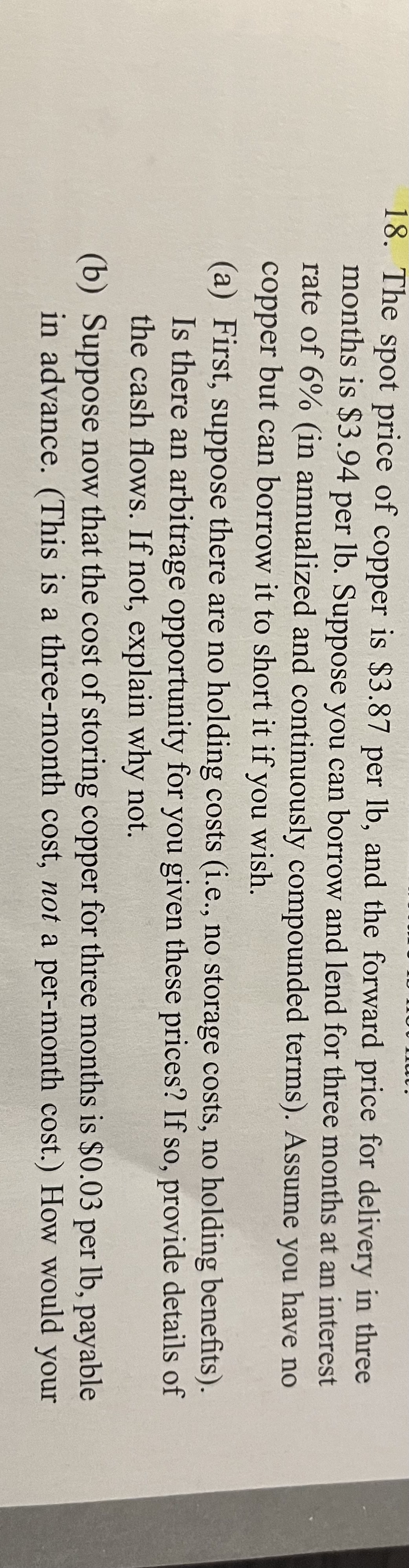

8. The spot price of copper is $3.87 per 1b, and the forward price for delivery in three months is $3.94 per lb. Suppose you can borrow and lend for three months at an interest rate of 6% (in annualized and continuously compounded terms). Assume you have no copper but can borrow it to short it if you wish. (a) First, suppose there are no holding costs (i.e., no storage costs, no holding benefits). Is there an arbitrage opportunity for you given these prices? If so, provide details of the cash flows. If not, explain why not. (b) Suppose now that the cost of storing copper for three months is $0.03 per lb, payable in advance. (This is a three-month cost, not a per-month cost.) How would your

8. The spot price of copper is $3.87 per 1b, and the forward price for delivery in three months is $3.94 per lb. Suppose you can borrow and lend for three months at an interest rate of 6% (in annualized and continuously compounded terms). Assume you have no copper but can borrow it to short it if you wish. (a) First, suppose there are no holding costs (i.e., no storage costs, no holding benefits). Is there an arbitrage opportunity for you given these prices? If so, provide details of the cash flows. If not, explain why not. (b) Suppose now that the cost of storing copper for three months is $0.03 per lb, payable in advance. (This is a three-month cost, not a per-month cost.) How would your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started