Answered step by step

Verified Expert Solution

Question

1 Approved Answer

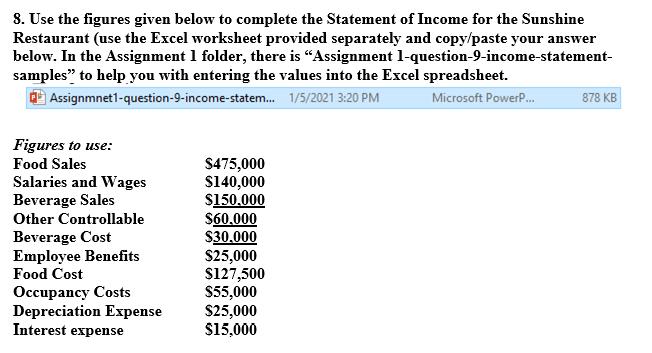

8. Use the figures given below to complete the Statement of Income for the Sunshine Restaurant (use the Excel worksheet provided separately and copy/paste

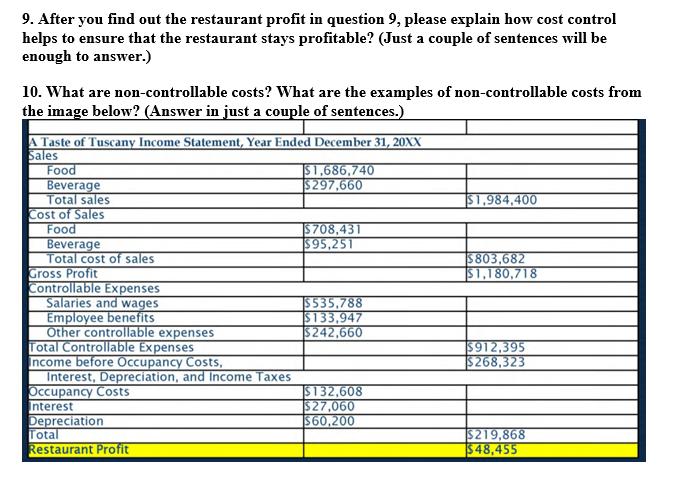

8. Use the figures given below to complete the Statement of Income for the Sunshine Restaurant (use the Excel worksheet provided separately and copy/paste your answer below. In the Assignment 1 folder, there is "Assignment 1-question-9-income-statement- samples" to help you with entering the values into the Excel spreadsheet. Assignmnet1-question-9-income-statem... 1/5/2021 3:20 PM Microsoft PowerP... 878 KB Figures to use: Food Sales $475,000 Salaries and Wages $140,000 Beverage Sales $150,000 Other Controllable $60,000 Beverage Cost $30.000 Employee Benefits $25,000 Food Cost $127,500 Occupancy Costs $55,000 Depreciation Expense $25,000 Interest expense $15,000 9. After you find out the restaurant profit in question 9, please explain how cost control helps to ensure that the restaurant stays profitable? (Just a couple of sentences will be enough to answer.) 10. What are non-controllable costs? What are the examples of non-controllable costs from the image below? (Answer in just a couple of sentences.) A Taste of Tuscany Income Statement, Year Ended December 31, 20XX Sales Food Beverage Total sales Cost of Sales Food $1,686,740 $297,660 $1,984,400 $708,431 Beverage $95,251 Total cost of sales Gross Profit Controllable Expenses $803,682 $1,180,718 Salaries and wages $535,788 Employee benefits $133,947 Other controllable expenses $242,660 Total Controllable Expenses $912,395 Income before Occupancy Costs, $268,323 Interest, Depreciation, and Income Taxes Occupancy Costs $132,608 Interest $27,060 Depreciation $60,200 Total Restaurant Profit $219,868 $48,455

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started