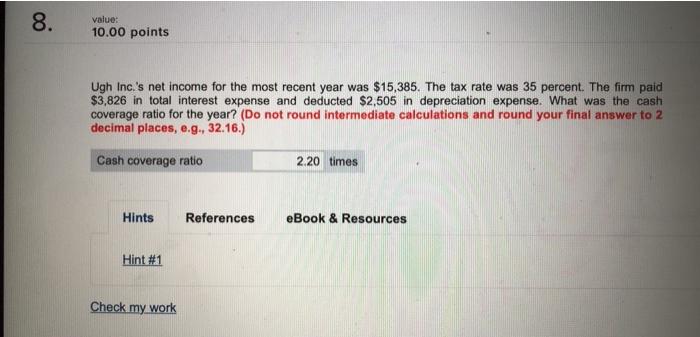

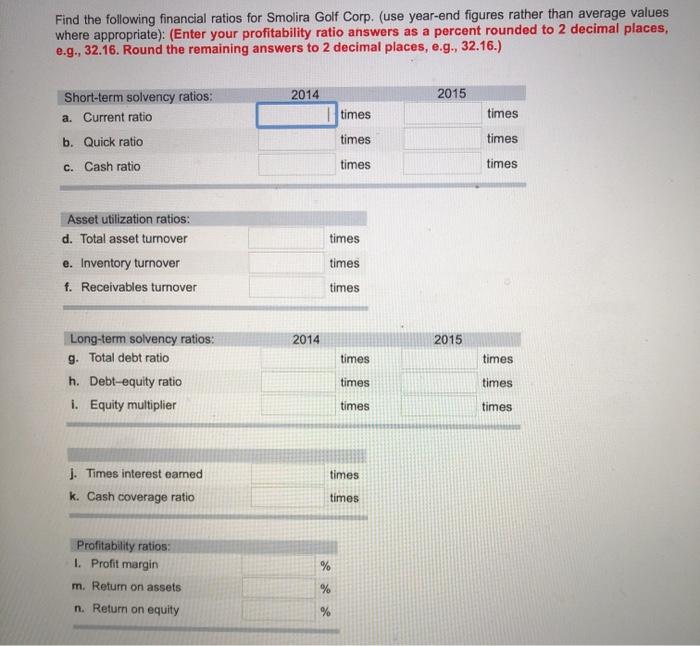

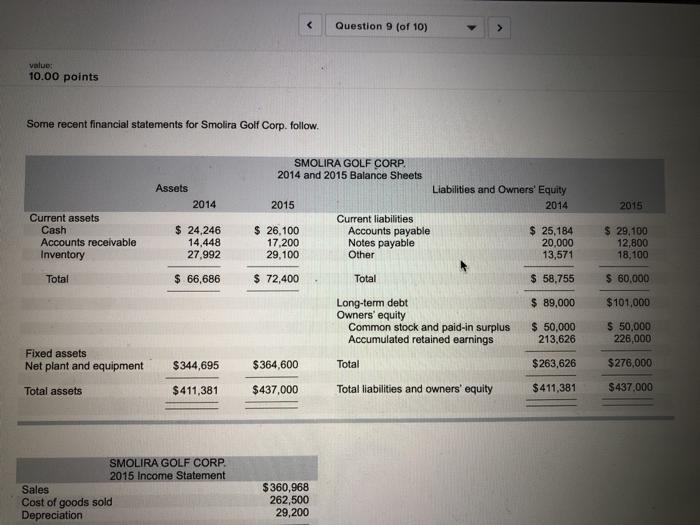

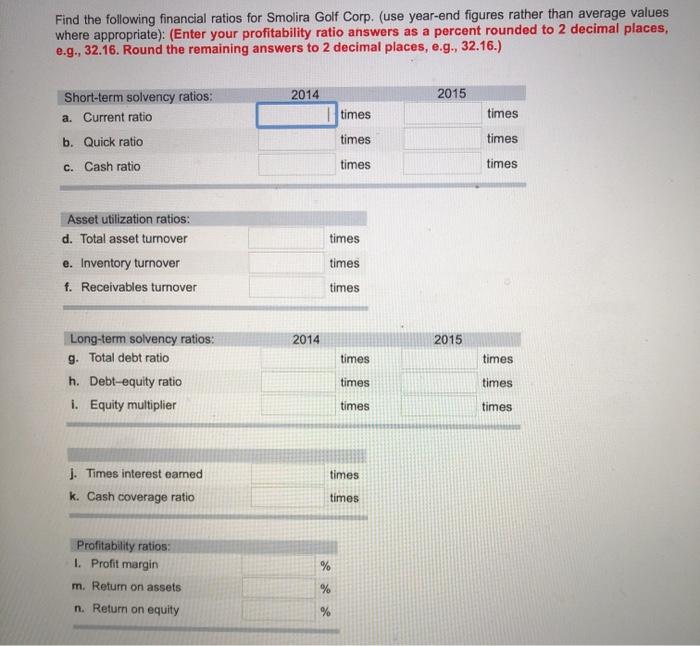

8. value: 10.00 points Ugh Inc.'s net income for the most recent year was $15,385. The tax rate was 35 percent. The firm paid $3,826 in total interest expense and deducted $2,505 in depreciation expense. What was the cash coverage ratio for the year? (Do not round intermediate calculations and round your final answer to 2 decimal places, e.g., 32.16.) Cash coverage ratio 2.20 times Hints References eBook & Resources Hint #1 Check my work Find the following financial ratios for Smolira Golf Corp. (use year-end figures rather than average values where appropriate): (Enter your profitability ratio answers as a percent rounded to 2 decimal places, e.g., 32.16. Round the remaining answers to 2 decimal places, e.g., 32.16.) 2014 2015 Short-term solvency ratios: a. Current ratio b. Quick ratio 1 times times times times c. Cash ratio times times times Asset utilization ratios: d. Total asset turnover e. Inventory turnover f. Receivables turnover times times 2014 2015 times times Long-term solvency ratios: g. Total debt ratio h. Debt-equity ratio I. Equity multiplier times times times times times 1. Timos interest eamed k. Cash coverage ratio times % Profitability ratios 1. Profit margin m. Return on assets n. Return on equity % % Question 9 (of 10) value: 10.00 points Some recent financial statements for Smolira Golf Corp. follow. Assets 2014 SMOLIRA GOLF CORP. 2014 and 2015 Balance Sheets Liabilities and Owners' Equity 2015 2014 Current liabilities $ 26,100 Accounts payable $ 25,184 17,200 Notes payable 20.000 29,100 Other 13,571 2015 Current assets Cash Accounts receivable Inventory $ 24,246 14,448 27.992 $ 29,100 12,800 18.100 Total $ 66,686 $ 72,400 Total $ 58,755 $ 60,000 $ 89,000 $101,000 Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings $ 50,000 213,626 $ 50,000 226,000 Fixed assets Net plant and equipment $344,695 $364,600 Total $263,626 $276,000 Total assets $411,381 $437,000 Total liabilities and owners' equity $411,381 $437.000 SMOLIRA GOLF CORP. 2015 Income Statement Sales Cost of goods sold Depreciation $360,968 262,500 29,200