Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. What does the bank profits/capital channel of monetary policy focus on? a. The impact of central bank capital on monetary policy b. How monetary

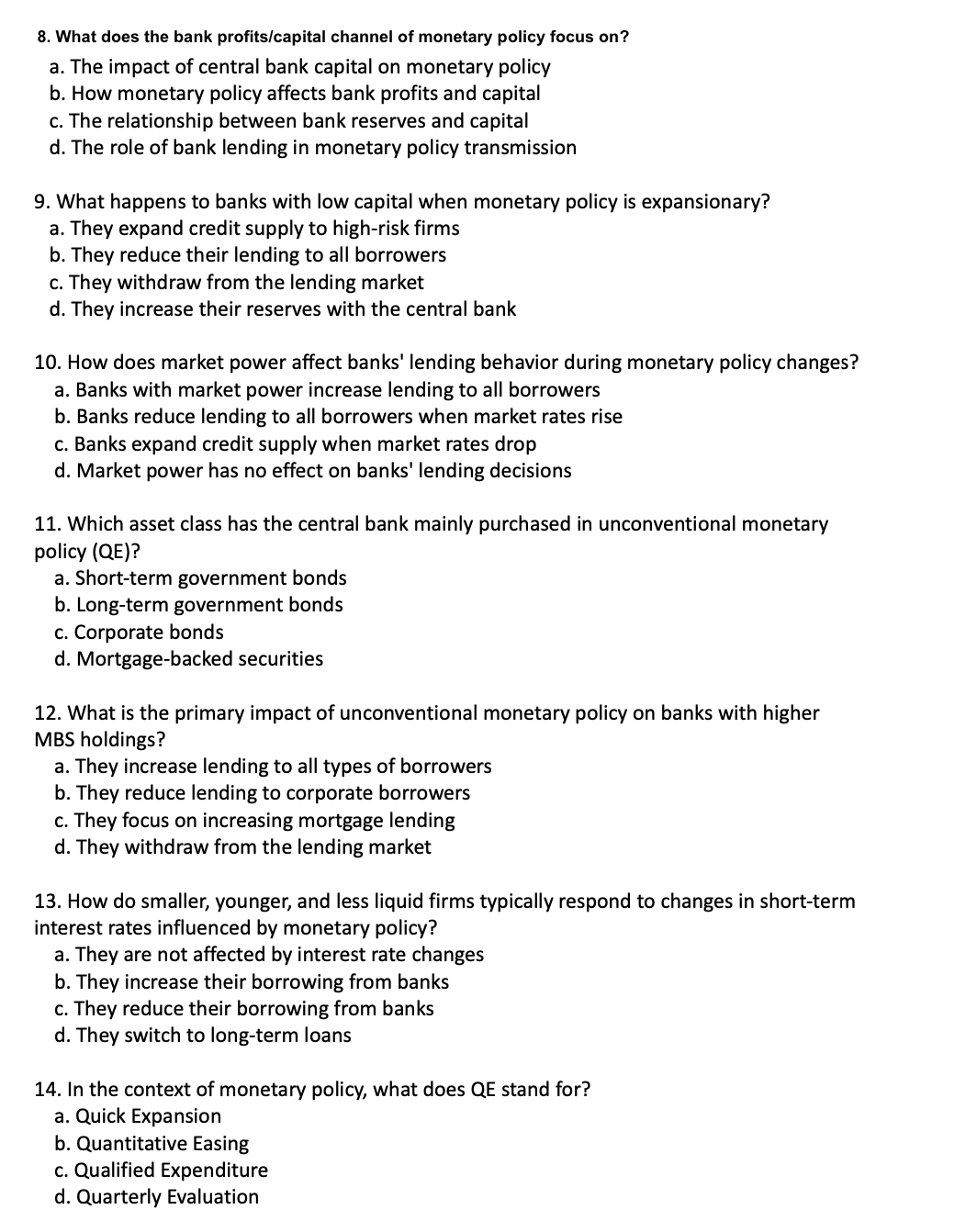

8. What does the bank profits/capital channel of monetary policy focus on? a. The impact of central bank capital on monetary policy b. How monetary policy affects bank profits and capital c. The relationship between bank reserves and capital d. The role of bank lending in monetary policy transmission 9. What happens to banks with low capital when monetary policy is expansionary? a. They expand credit supply to high-risk firms b. They reduce their lending to all borrowers c. They withdraw from the lending market d. They increase their reserves with the central bank 10. How does market power affect banks' lending behavior during monetary policy changes? a. Banks with market power increase lending to all borrowers b. Banks reduce lending to all borrowers when market rates rise c. Banks expand credit supply when market rates drop d. Market power has no effect on banks' lending decisions 11. Which asset class has the central bank mainly purchased in unconventional monetary policy (QE)? a. Short-term government bonds b. Long-term government bonds c. Corporate bonds d. Mortgage-backed securities 12. What is the primary impact of unconventional monetary policy on banks with higher MBS holdings? a. They increase lending to all types of borrowers b. They reduce lending to corporate borrowers c. They focus on increasing mortgage lending d. They withdraw from the lending market 13. How do smaller, younger, and less liquid firms typically respond to changes in short-term interest rates influenced by monetary policy? a. They are not affected by interest rate changes b. They increase their borrowing from banks c. They reduce their borrowing from banks d. They switch to long-term loans 14. In the context of monetary policy, what does QE stand for? a. Quick Expansion b. Quantitative Easing c. Qualified Expenditure d. Quarterly Evaluation

8. What does the bank profits/capital channel of monetary policy focus on? a. The impact of central bank capital on monetary policy b. How monetary policy affects bank profits and capital c. The relationship between bank reserves and capital d. The role of bank lending in monetary policy transmission 9. What happens to banks with low capital when monetary policy is expansionary? a. They expand credit supply to high-risk firms b. They reduce their lending to all borrowers c. They withdraw from the lending market d. They increase their reserves with the central bank 10. How does market power affect banks' lending behavior during monetary policy changes? a. Banks with market power increase lending to all borrowers b. Banks reduce lending to all borrowers when market rates rise c. Banks expand credit supply when market rates drop d. Market power has no effect on banks' lending decisions 11. Which asset class has the central bank mainly purchased in unconventional monetary policy (QE)? a. Short-term government bonds b. Long-term government bonds c. Corporate bonds d. Mortgage-backed securities 12. What is the primary impact of unconventional monetary policy on banks with higher MBS holdings? a. They increase lending to all types of borrowers b. They reduce lending to corporate borrowers c. They focus on increasing mortgage lending d. They withdraw from the lending market 13. How do smaller, younger, and less liquid firms typically respond to changes in short-term interest rates influenced by monetary policy? a. They are not affected by interest rate changes b. They increase their borrowing from banks c. They reduce their borrowing from banks d. They switch to long-term loans 14. In the context of monetary policy, what does QE stand for? a. Quick Expansion b. Quantitative Easing c. Qualified Expenditure d. Quarterly Evaluation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started