Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. What is Targets liability unrecognized tax benefits as of February 3, 2018? If target were to prevail in court and realize $50 million more

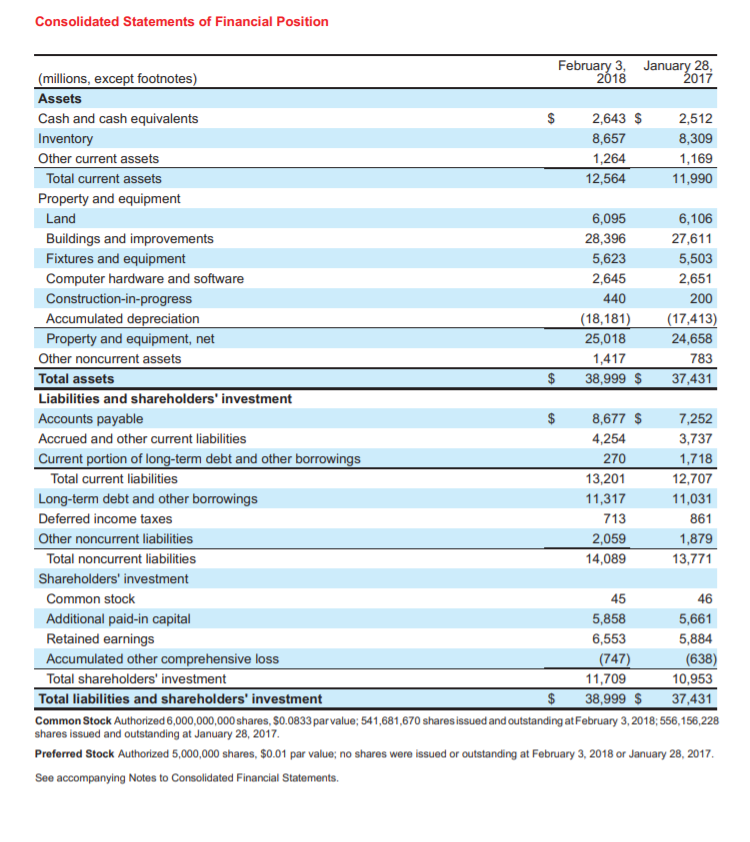

8. What is Targets liability unrecognized tax benefits as of February 3, 2018? If target were to prevail in court and realize $50 million more in tax savings than it thought more likely than not to occur, what would be the effect on the liability for unrecognized tax benefits and on net income?

Consolidated Statements of Financial Position Februari January 30 200 (millions, except footnotes) Assets Cash and cash equivalents 2,643 $ 2,512 Inventory 8,657 8,309 Other current assets 1,264 1,169 Total current assets 12,564 11,990 Property and equipment Land 6,095 6,106 Buildings and improvements 28,396 27,611 Fixtures and equipment 5,623 5,503 Computer hardware and software 2,645 2,651 Construction-in-progress 440 Accumulated depreciation (18,181) (17,413) Property and equipment, net 25,018 24,658 Other noncurrent assets 1,417 783 Total assets $ 38,999 $ 37,431 Liabilities and shareholders' investment Accounts payable $ 8,677 $ 7,252 Accrued and other current liabilities 4,254 3,737 Current portion of long-term debt and other borrowings 270 1,718 Total current liabilities 13,201 12,707 Long-term debt and other borrowings 11,317 11,031 Deferred income taxes 713 861 Other noncurrent liabilities 2,059 1,879 Total noncurrent liabilities 14,089 13,771 Shareholders' investment Common stock 45 Additional paid-in capital 5,858 5,661 Retained earnings 6,553 5,884 Accumulated other comprehensive loss (747) (638) Total shareholders' investment 11,709 10,953 Total liabilities and shareholders' investment $ 38,999 $ 37,431 Common Stock Authorized 6,000,000,000 shares, $0.0833 par value; 541,681,670 shares issued and outstanding at February 3, 2018; 556,156,228 shares issued and outstanding at January 28, 2017 Preferred Stock Authorized 5,000,000 shares, $0.01 par value; no shares were issued or outstanding at February 3, 2018 or January 28, 2017 See accompanying Notes to Consolidated Financial Statements 46 Consolidated Statements of Financial Position Februari January 30 200 (millions, except footnotes) Assets Cash and cash equivalents 2,643 $ 2,512 Inventory 8,657 8,309 Other current assets 1,264 1,169 Total current assets 12,564 11,990 Property and equipment Land 6,095 6,106 Buildings and improvements 28,396 27,611 Fixtures and equipment 5,623 5,503 Computer hardware and software 2,645 2,651 Construction-in-progress 440 Accumulated depreciation (18,181) (17,413) Property and equipment, net 25,018 24,658 Other noncurrent assets 1,417 783 Total assets $ 38,999 $ 37,431 Liabilities and shareholders' investment Accounts payable $ 8,677 $ 7,252 Accrued and other current liabilities 4,254 3,737 Current portion of long-term debt and other borrowings 270 1,718 Total current liabilities 13,201 12,707 Long-term debt and other borrowings 11,317 11,031 Deferred income taxes 713 861 Other noncurrent liabilities 2,059 1,879 Total noncurrent liabilities 14,089 13,771 Shareholders' investment Common stock 45 Additional paid-in capital 5,858 5,661 Retained earnings 6,553 5,884 Accumulated other comprehensive loss (747) (638) Total shareholders' investment 11,709 10,953 Total liabilities and shareholders' investment $ 38,999 $ 37,431 Common Stock Authorized 6,000,000,000 shares, $0.0833 par value; 541,681,670 shares issued and outstanding at February 3, 2018; 556,156,228 shares issued and outstanding at January 28, 2017 Preferred Stock Authorized 5,000,000 shares, $0.01 par value; no shares were issued or outstanding at February 3, 2018 or January 28, 2017 See accompanying Notes to Consolidated Financial Statements 46

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started