Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. Which of the following is NOT a factor in determining whether an individual has ceased to be a Canadian resident? A. The individual's spouse

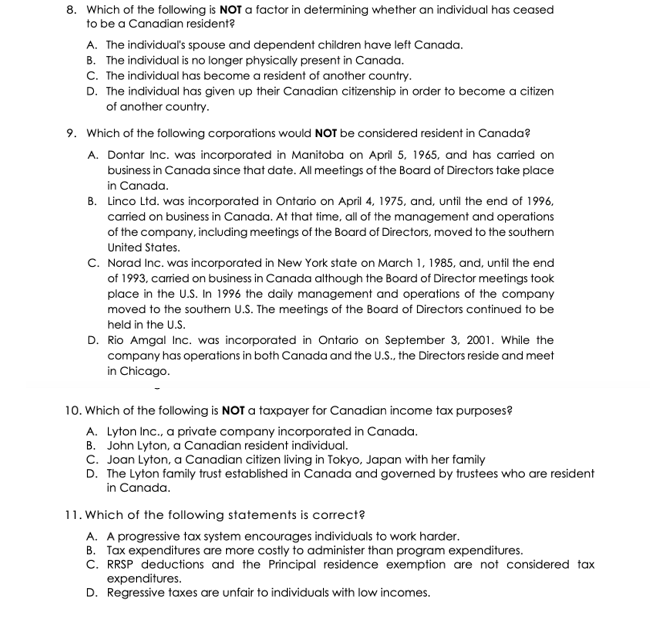

8. Which of the following is NOT a factor in determining whether an individual has ceased to be a Canadian resident? A. The individual's spouse and dependent children have left Canada. B. The individual is no longer physically present in Canada. C. The individual has become a resident of another country. D. The individual has given up their Canadian citizenship in order to become a citizen of another country. 9. Which of the following corporations would NOT be considered resident in Canada? A. Dontar Inc. was incorporated in Manitoba on April 5, 1965, and has carried on business in Canada since that date. All meetings of the Board of Directors take place in Canada. B. Linco Ltd. was incorporated in Ontario on April 4, 1975, and, until the end 1996 , carried on business in Canada. At that time, all of the management and operations of the company, including meetings of the Board of Directors, moved to the southern United States. C. Norad Inc. was incorporated in New York state on March 1, 1985, and, until the end of 1993. carried on business in Canada although the Board of Director meetings took place in the U.S. In 1996 the daily management and operations of the company moved to the southern U.S. The meetings of the Board of Directors continued to be held in the U.S. D. Rio Amgal Inc. was incorporated in Ontario on September 3, 2001. While the company has operations in both Canada and the U.S., the Directors reside and meet in Chicago. 10. Which of the following is NOT a taxpayer for Canadian income tax purposes? A. Lyton Inc., a private company incorporated in Canada. B. John Lyton, a Canadian resident individual. C. Joan Lyton, a Canadian citizen living in Tokyo, Japan with her family D. The Lyton family trust established in Canada and governed by trustees who are resident in Canada. 11. Which of the following statements is correct? A. A progressive tax system encourages individuals to work harder. B. Tax expenditures are more costly to administer than program expenditures. C. RRSP deductions and the Principal residence exemption are not considered tax expenditures. D. Regressive taxes are unfair to individuals with low incomes

8. Which of the following is NOT a factor in determining whether an individual has ceased to be a Canadian resident? A. The individual's spouse and dependent children have left Canada. B. The individual is no longer physically present in Canada. C. The individual has become a resident of another country. D. The individual has given up their Canadian citizenship in order to become a citizen of another country. 9. Which of the following corporations would NOT be considered resident in Canada? A. Dontar Inc. was incorporated in Manitoba on April 5, 1965, and has carried on business in Canada since that date. All meetings of the Board of Directors take place in Canada. B. Linco Ltd. was incorporated in Ontario on April 4, 1975, and, until the end 1996 , carried on business in Canada. At that time, all of the management and operations of the company, including meetings of the Board of Directors, moved to the southern United States. C. Norad Inc. was incorporated in New York state on March 1, 1985, and, until the end of 1993. carried on business in Canada although the Board of Director meetings took place in the U.S. In 1996 the daily management and operations of the company moved to the southern U.S. The meetings of the Board of Directors continued to be held in the U.S. D. Rio Amgal Inc. was incorporated in Ontario on September 3, 2001. While the company has operations in both Canada and the U.S., the Directors reside and meet in Chicago. 10. Which of the following is NOT a taxpayer for Canadian income tax purposes? A. Lyton Inc., a private company incorporated in Canada. B. John Lyton, a Canadian resident individual. C. Joan Lyton, a Canadian citizen living in Tokyo, Japan with her family D. The Lyton family trust established in Canada and governed by trustees who are resident in Canada. 11. Which of the following statements is correct? A. A progressive tax system encourages individuals to work harder. B. Tax expenditures are more costly to administer than program expenditures. C. RRSP deductions and the Principal residence exemption are not considered tax expenditures. D. Regressive taxes are unfair to individuals with low incomes Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started