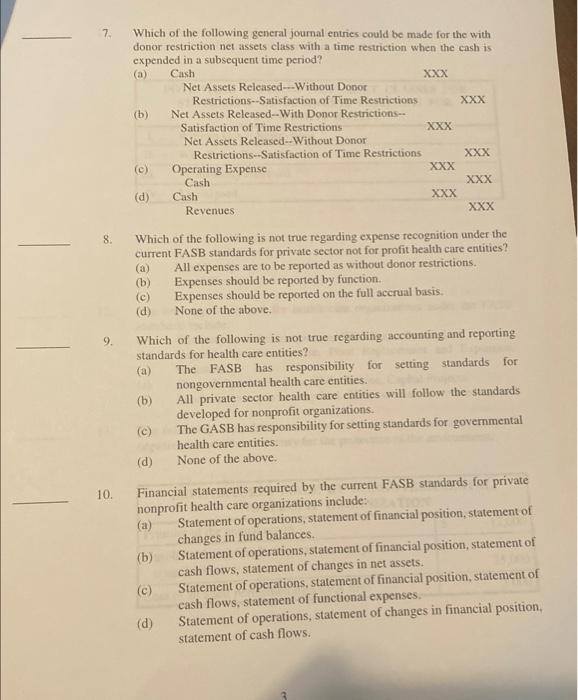

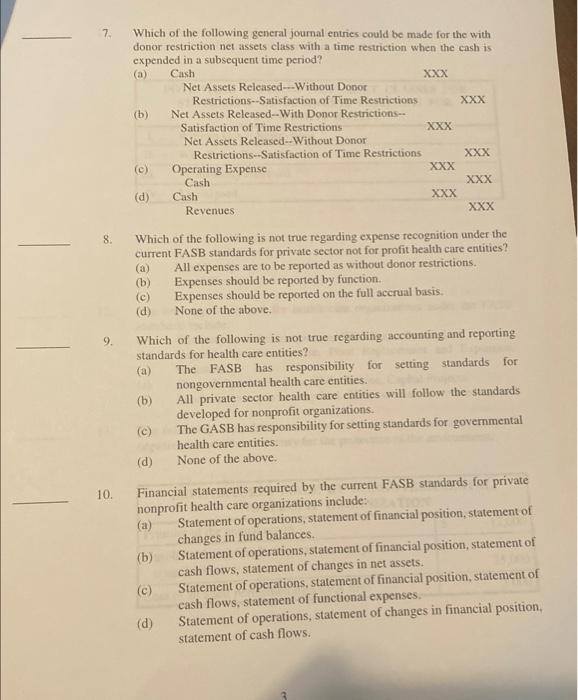

8. Which of the following is not true regarding expense recognition under the current FASB standards for private sector not for profit health care entities? (a) All expenses are to be reported as without donor restrictions. (b) Expenses should be reported by function. (c) Expenses should be reported on the full accrual basis. (d) None of the above. 9. Which of the following is not true regarding accounting and reporting standards for health care entities? (a) The FASB has responsibility for setting standards for nongovernmental health care entities. (b) All private sector health care entities will follow the standards developed for nonprofit organizations: (c) The GASB has responsibility for setting standards for governmental health care entities. (d) None of the above. 10. Financial statements required by the current FASB standards for private nonprofit health care organizations include: (a) Statement of operations, statement of financial position, statement of changes in fund balances. (b) Statement of operations, statement of financial position, statement of cash flows, statement of changes in net assets. (c) Statement of operations, statement of financial position, statement of cash flows, statement of functional expenses. (d) Statement of operations, statement of changes in financial position. statement of cash flows. 8. Which of the following is not true regarding expense recognition under the current FASB standards for private sector not for profit health care entities? (a) All expenses are to be reported as without donor restrictions. (b) Expenses should be reported by function. (c) Expenses should be reported on the full accrual basis. (d) None of the above. 9. Which of the following is not true regarding accounting and reporting standards for health care entities? (a) The FASB has responsibility for setting standards for nongovernmental health care entities. (b) All private sector health care entities will follow the standards developed for nonprofit organizations: (c) The GASB has responsibility for setting standards for governmental health care entities. (d) None of the above. 10. Financial statements required by the current FASB standards for private nonprofit health care organizations include: (a) Statement of operations, statement of financial position, statement of changes in fund balances. (b) Statement of operations, statement of financial position, statement of cash flows, statement of changes in net assets. (c) Statement of operations, statement of financial position, statement of cash flows, statement of functional expenses. (d) Statement of operations, statement of changes in financial position. statement of cash flows