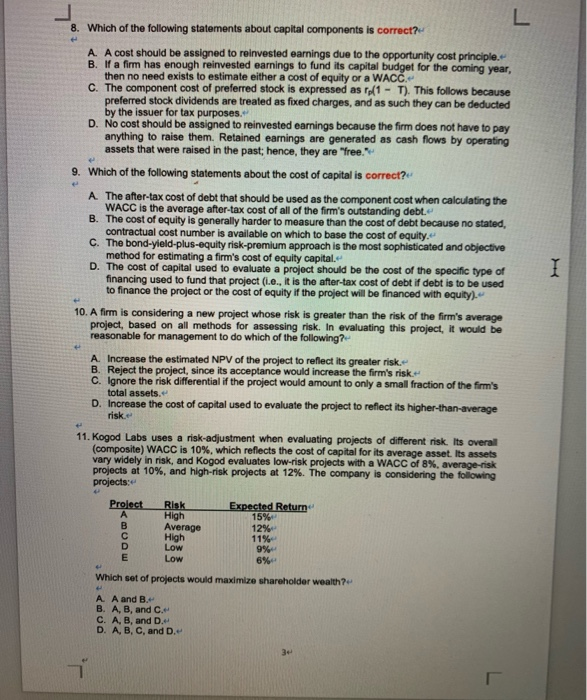

8. Which of the following statements about capital components is correct? A. A cost should be assigned to reinvested earnings due to the opportunity cost principle B. If a firm has enough reinvested earnings to fund its capital budget for the coming year then no need exists to estimate either a cost of equity or a WACC. C. The component cost of preferred stock is expressed as ro(1 - T). This follows because preferred stock dividends are treated as fixed charges, and as such they can be deducted by the issuer for tax purposes. D. No cost should be assigned to reinvested earnings because the firm does not have to pay anything to raise them. Retained earnings are generated as cash flows by operating assets that were raised in the past; hence, they are free 9. Which of the following statements about the cost of capital is correct? A. The after-tax cost of debt that should be used as the component cost when calculating the WACC is the average after-tax cost of all of the firm's outstanding debt. B. The cost of equity is generally harder to measure than the cost of debt because no stated, contractual cost number is available on which to base the cost of equity. C. The bond-yield-plus-equity risk-premium approach is the most sophisticated and objective method for estimating a firm's cost of equity capital. D. The cost of capital used to evaluate a project should be the cost of the specific type of financing used to fund that project (.e. It is the after-tax cost of debt if debt is to be used to finance the project or the cost of equity if the project will be financed with equity). 10. A firm is considering a new project whose risk is greater than the risk of the firm's average project, based on all methods for assessing risk. In evaluating this project, it would be reasonable for management to do which of the following? A. Increase the estimated NPV of the project to reflect its greater risk. B. Reject the project, since its acceptance would increase the firm's risk. c. Ignore the risk differential if the project would amount to only a small fraction of the firm's total assets. D. Increase the cost of capital used to evaluate the project to reflect its higher-than-average riske 11. Kogod Labs uses a risk-adjustment when evaluating projects of different risk. Its overal (composite) WACC is 10%, which reflects the cost of capital for its average asset. Its assets vary widely in risk, and Kogod evaluates low-risk projects with a WACC of 8%, average risk projects at 10%, and high-risk projects at 12%. The company is considering the following projects: Project Risk Expected Return High 15% Average 12% High 11% Low 9% Low Which set of projects would maximize shareholder wealth? A A and B B. A, B, and C. c. A, B, and D. D. A, B, C, and D