Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. Yesterday, you entered into a futures contract to sell 62,500 at $1.50 per . Your initial performance bond is $1,500 and your maintenance level

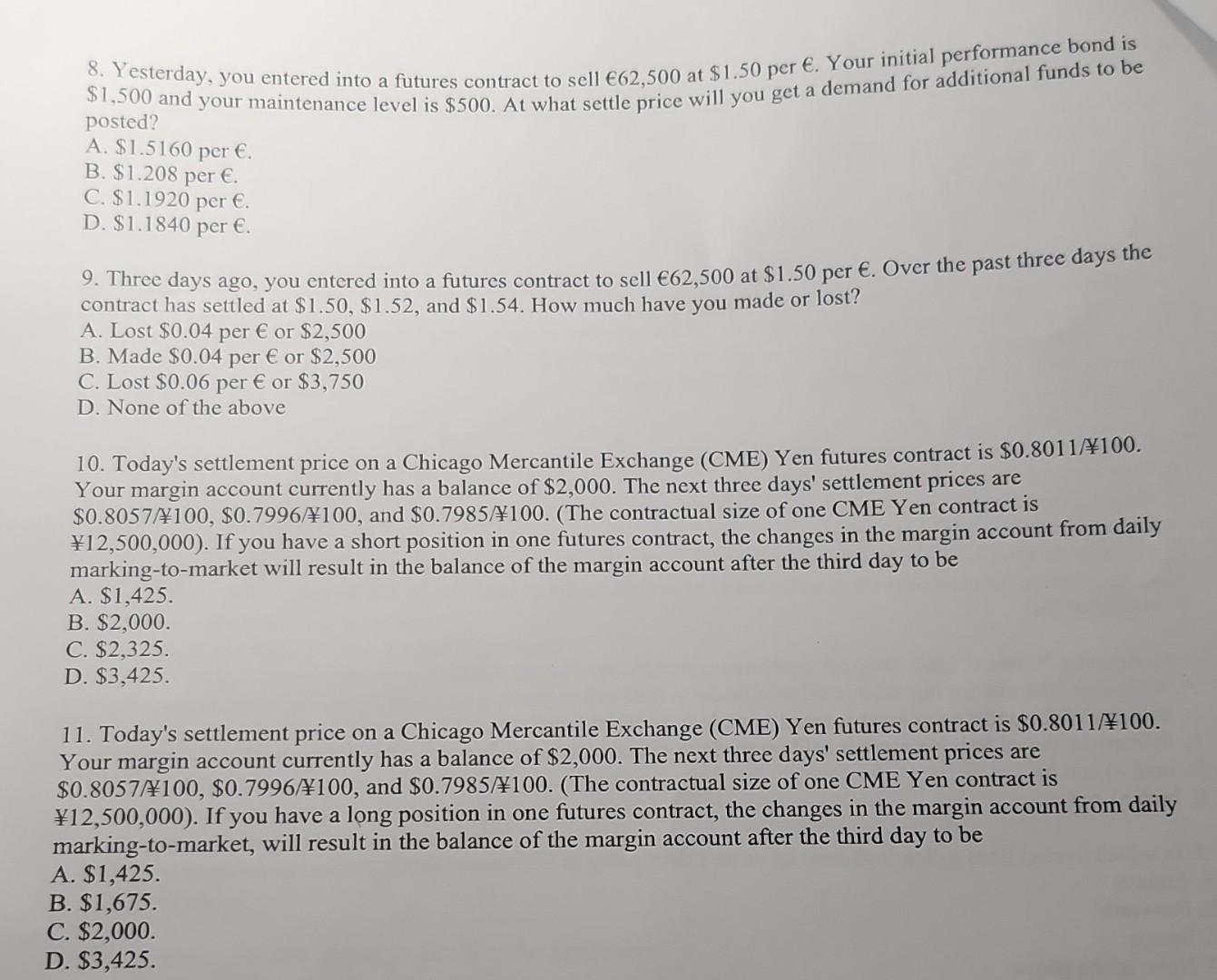

8. Yesterday, you entered into a futures contract to sell 62,500 at $1.50 per . Your initial performance bond is $1,500 and your maintenance level is $500. At what settle price will you get a demand for additional funds to be posted? A. $1.5160 per . B. $1.208 per . C. $1.1920 per . D. $1.1840 per . 9. Three days ago, you entered into a futures contract to sell 62,500 at $1.50 per . Over the past three days the contract has settled at $1.50,$1.52, and $1.54. How much have you made or lost? A. Lost $0.04 per or $2,500 B. Made $0.04 per or $2,500 C. Lost $0.06 per or $3,750 D. None of the above 10. Today's settlement price on a Chicago Mercantile Exchange (CME) Yen futures contract is $0.8011100. Your margin account currently has a balance of $2,000. The next three days' settlement prices are $0.8057100,$0.7996/100, and $0.7985/100. (The contractual size of one CME Yen contract is 12,500,000 ). If you have a short position in one futures contract, the changes in the margin account from daily marking-to-market will result in the balance of the margin account after the third day to be A. $1,425. B. $2,000. C. $2,325. D. $3,425. 11. Today's settlement price on a Chicago Mercantile Exchange (CME) Yen futures contract is $0.8011/100. Your margin account currently has a balance of $2,000. The next three days' settlement prices are $0.8057100,$0.7996/100, and $0.7985/100. (The contractual size of one CME Yen contract is 12,500,000 ). If you have a long position in one futures contract, the changes in the margin account from daily marking-to-market, will result in the balance of the margin account after the third day to be A. $1,425. B. $1,675. C. $2,000. $3,425

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started