Answered step by step

Verified Expert Solution

Question

1 Approved Answer

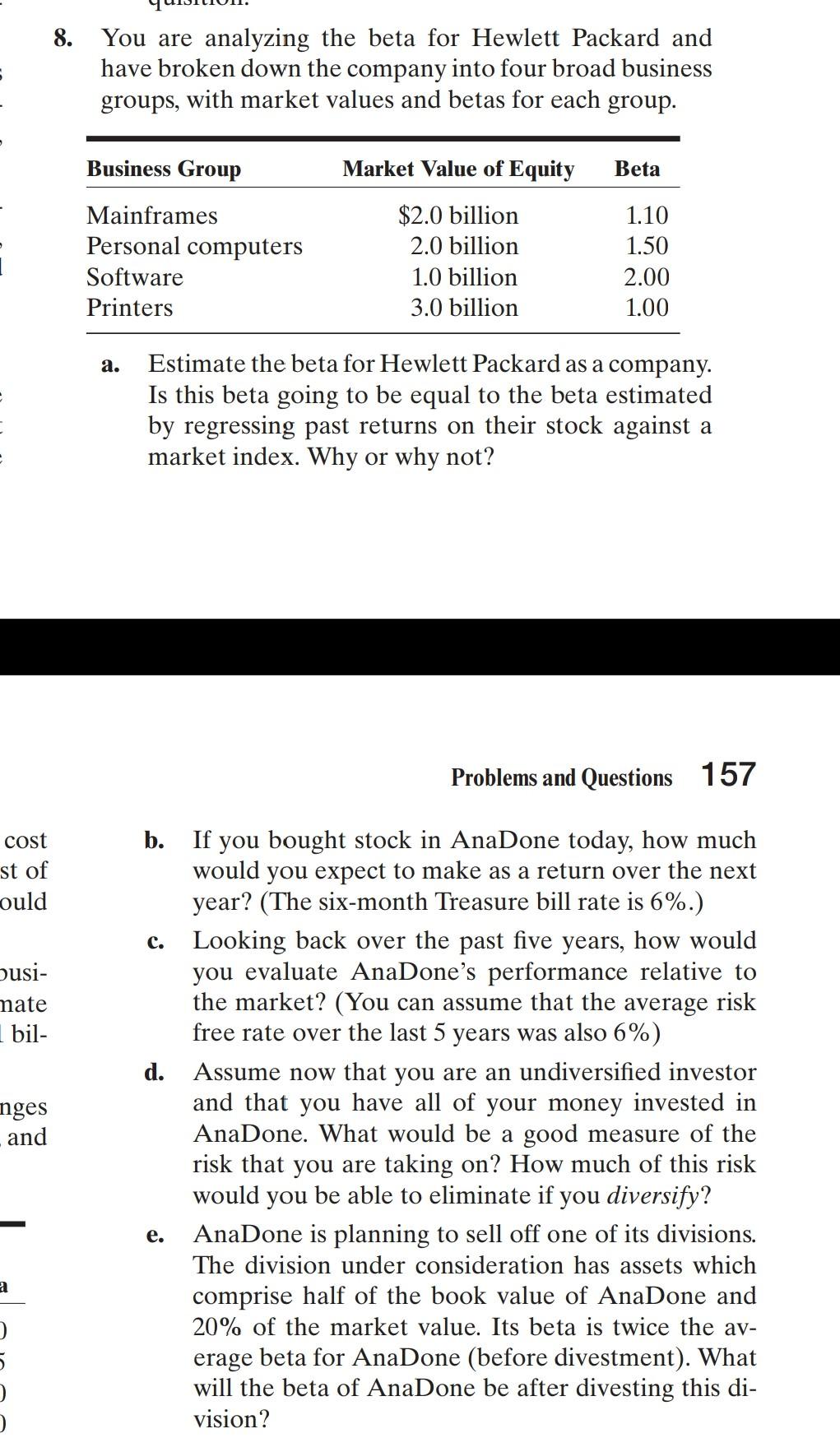

8. You are analyzing the beta for Hewlett Packard and have broken down the company into four broad business groups, with market values and betas

8. You are analyzing the beta for Hewlett Packard and have broken down the company into four broad business groups, with market values and betas for each group. Business Group Market Value of Equity Beta Mainframes Personal computers Software Printers $2.0 billion 2.0 billion 1.0 billion 3.0 billion 1.10 1.50 2.00 1.00 a. Estimate the beta for Hewlett Packard as a company. Is this beta going to be equal to the beta estimated by regressing past returns on their stock against a market index. Why or why not? Problems and Questions 157 cost st of ould busi- mate bil- nges and b. If you bought stock in AnaDone today, how much would you expect to make as a return over the next year? (The six-month Treasure bill rate is 6%.) c. Looking back over the past five years, how would you evaluate AnaDone's performance relative to the market? (You can assume that the average risk free rate over the last 5 years was also 6%) 5 d. Assume now that you are an undiversified investor and that you have all of your money invested in AnaDone. What would be a good measure of the risk that you are taking on? How much of this risk would you be able to eliminate if you diversify? AnaDone is planning to sell off one of its divisions. The division under consideration has assets which comprise half of the book value of AnaDone and 20% of the market value. Its beta is twice the av- erage beta for AnaDone (before divestment). What will the beta of AnaDone be after divesting this di- vision? e. a 5 8. You are analyzing the beta for Hewlett Packard and have broken down the company into four broad business groups, with market values and betas for each group. Business Group Market Value of Equity Beta Mainframes Personal computers Software Printers $2.0 billion 2.0 billion 1.0 billion 3.0 billion 1.10 1.50 2.00 1.00 a. Estimate the beta for Hewlett Packard as a company. Is this beta going to be equal to the beta estimated by regressing past returns on their stock against a market index. Why or why not? Problems and Questions 157 cost st of ould busi- mate bil- nges and b. If you bought stock in AnaDone today, how much would you expect to make as a return over the next year? (The six-month Treasure bill rate is 6%.) c. Looking back over the past five years, how would you evaluate AnaDone's performance relative to the market? (You can assume that the average risk free rate over the last 5 years was also 6%) 5 d. Assume now that you are an undiversified investor and that you have all of your money invested in AnaDone. What would be a good measure of the risk that you are taking on? How much of this risk would you be able to eliminate if you diversify? AnaDone is planning to sell off one of its divisions. The division under consideration has assets which comprise half of the book value of AnaDone and 20% of the market value. Its beta is twice the av- erage beta for AnaDone (before divestment). What will the beta of AnaDone be after divesting this di- vision? e. a 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started