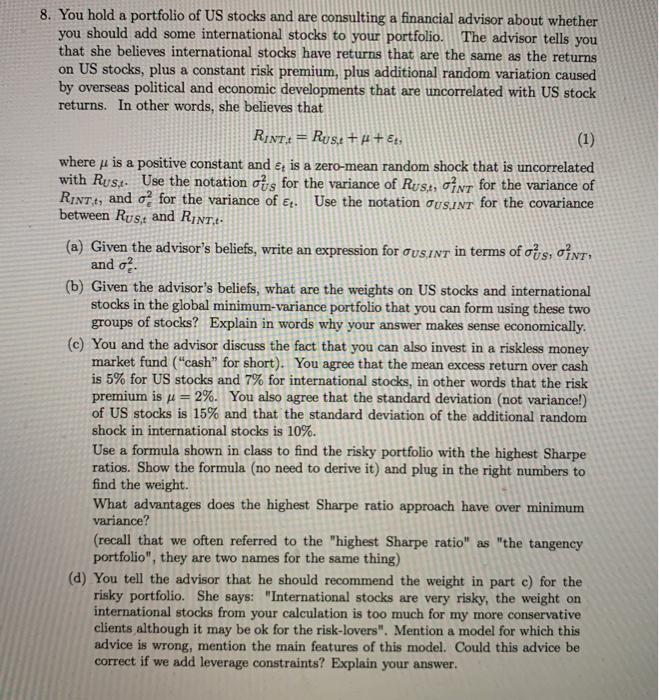

8. You hold a portfolio of US stocks and are consulting a financial advisor about whether you should add some international stocks to your portfolio. The advisor tells you that she believes international stocks have returns that are the same as the returns on US stocks, plus a constant risk premium, plus additional random variation caused by overseas political and economic developments that are uncorrelated with US stock returns. In other words, she believes that Rint: = Ruse + H+ E, (1) where is a positive constant and is a zero-mean random shock that is uncorrelated with Rust. Use the notation ous for the variance of Rust, oint for the variance of RINT, and o for the variance of Et. Use the notation usint for the covariance between Rust and RINT.t- (a) Given the advisor's beliefs, write an expression for OUsint in terms of oys, oint, and o (b) Given the advisor's beliefs, what are the weights on US stocks and international stocks in the global minimum-variance portfolio that you can form using these two groups of stocks? Explain in words why your answer makes sense economically. (c) You and the advisor discuss the fact that you can also invest in a riskless money market fund ("cash" for short). You agree that the mean excess return over cash is 5% for US stocks and 7% for international stocks, in other words that the risk premium is = 2%. You also agree that the standard deviation (not variance!) of US stocks is 15% and that the standard deviation of the additional random shock in international stocks is 10%. Use a formula shown in class to find the risky portfolio with the highest Sharpe ratios. Show the formula (no need to derive it) and plug in the right numbers to find the weight. What advantages does the highest Sharpe ratio approach have over minimum variance? (recall that we often referred to the "highest Sharpe ratio" as "the tangency portfolio", they are two names for the same thing) (d) You tell the advisor that he should recommend the weight in part e) for the risky portfolio. She says: "International stocks are very risky, the weight on international stocks from your calculation is too much for my more conservative clients although it may be ok for the risk-lovers". Mention a model for which this advice is wrong, mention the main features of this model. Could this advice be correct if we add leverage constraints? Explain your answer. 8. You hold a portfolio of US stocks and are consulting a financial advisor about whether you should add some international stocks to your portfolio. The advisor tells you that she believes international stocks have returns that are the same as the returns on US stocks, plus a constant risk premium, plus additional random variation caused by overseas political and economic developments that are uncorrelated with US stock returns. In other words, she believes that Rint: = Ruse + H+ E, (1) where is a positive constant and is a zero-mean random shock that is uncorrelated with Rust. Use the notation ous for the variance of Rust, oint for the variance of RINT, and o for the variance of Et. Use the notation usint for the covariance between Rust and RINT.t- (a) Given the advisor's beliefs, write an expression for OUsint in terms of oys, oint, and o (b) Given the advisor's beliefs, what are the weights on US stocks and international stocks in the global minimum-variance portfolio that you can form using these two groups of stocks? Explain in words why your answer makes sense economically. (c) You and the advisor discuss the fact that you can also invest in a riskless money market fund ("cash" for short). You agree that the mean excess return over cash is 5% for US stocks and 7% for international stocks, in other words that the risk premium is = 2%. You also agree that the standard deviation (not variance!) of US stocks is 15% and that the standard deviation of the additional random shock in international stocks is 10%. Use a formula shown in class to find the risky portfolio with the highest Sharpe ratios. Show the formula (no need to derive it) and plug in the right numbers to find the weight. What advantages does the highest Sharpe ratio approach have over minimum variance? (recall that we often referred to the "highest Sharpe ratio" as "the tangency portfolio", they are two names for the same thing) (d) You tell the advisor that he should recommend the weight in part e) for the risky portfolio. She says: "International stocks are very risky, the weight on international stocks from your calculation is too much for my more conservative clients although it may be ok for the risk-lovers". Mention a model for which this advice is wrong, mention the main features of this model. Could this advice be correct if we add leverage constraints? Explain your