Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. You want to endow a chair in the Finance Department in the UIC CBA. This will require you to fund a fellowship that pays

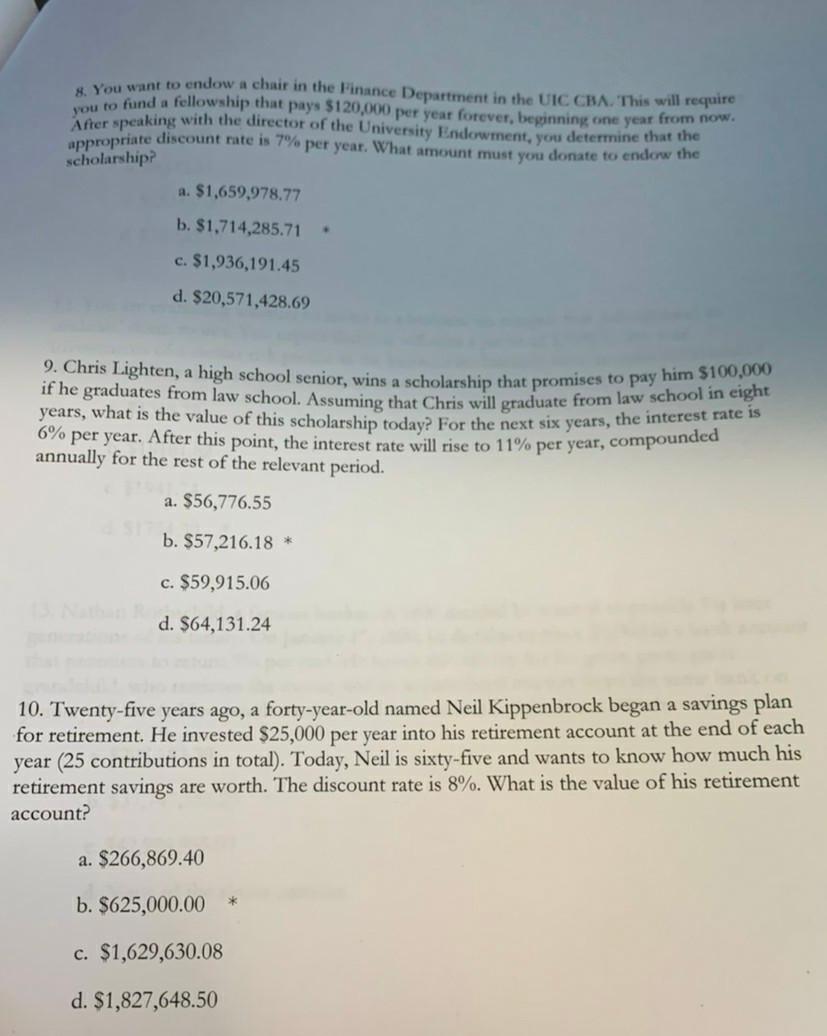

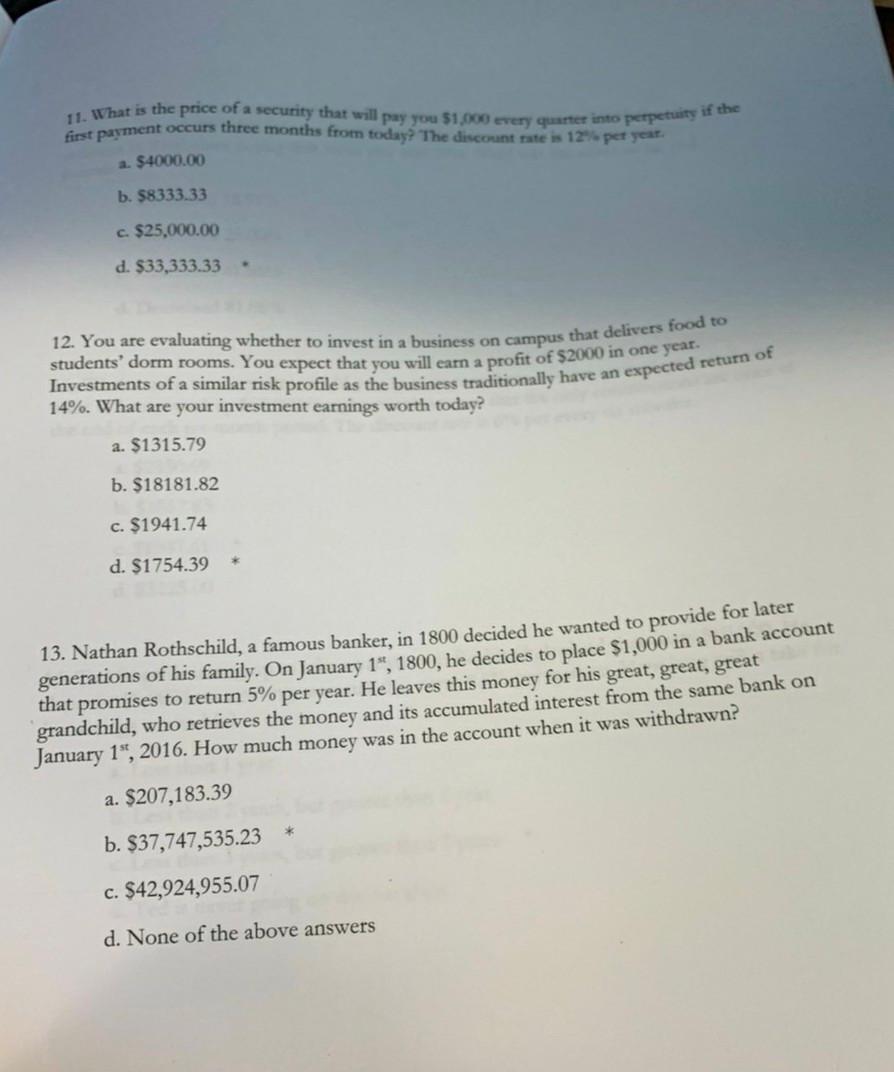

8. You want to endow a chair in the Finance Department in the UIC CBA. This will require you to fund a fellowship that pays $120,000 per year forever, beginning one year from now. After speaking with the director of the University Endowment, you determine that the appropriate discount rate is 7% per year. What amount must you donate to endow the scholarship? a. $1,659,978.77 b. $1,714,285,71 c. $1,936,191.45 . d. $20,571,428.69 9. Chris Lighten, a high school senior, wins a scholarship that promises to pay him $100.000 if he graduates from law school. Assuming that Chris will graduate from law school in eight years, what is the value of this scholarship today? For the next six years, the interest rate is 6% per year. After this point, the interest rate will rise to 11% per year, compounded annually for the rest of the relevant period. a. $56,776.55 b. $57,216.18 * c. $59,915.06 d. $64,131.24 10. Twenty-five years ago, a forty-year-old named Neil Kippenbrock began a savings plan for retirement. He invested $25,000 per year into his retirement account at the end of each year (25 contributions in total). Today, Neil is sixty-five and wants to know how much his retirement savings are worth. The discount rate is 8%. What is the value of his retirement account? a. $266,869.40 b. $625,000.00 c. $1,629,630.08 d. $1,827,648.50 11. What is the price of a security that will pay you 51.000 every quarter into perpetuty if the first payment occurs three months from today? The discount rate is 12% per year. a $4000.00 b. $8333.33 c. $25,000.00 d. $33,333.33 - students' dorm rooms. You expect that you will earn a profit of $2000 in one year, 12. You are evaluating whether to invest in a business on campus that delivers food to Investments of a similar risk profile as the business traditionally have an expected return of 14%. What are your investment earnings worth today? a. $1315.79 b. $18181.82 c. $1941.74 d. $1754.39 13. Nathan Rothschild, a famous banker, in 1800 decided he wanted to provide for later generations of his family. On January 1", 1800, he decides to place $1,000 in a bank account that promises to return 5% per year. He leaves this money for his great, great, great grandchild, who retrieves the money and its accumulated interest from the same bank on January 1", 2016. How much money was in the account when it was withdrawn? a. $207,183.39 b. $37,747,535.23 c. $42,924,955.07 d. None of the above answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started