Answered step by step

Verified Expert Solution

Question

1 Approved Answer

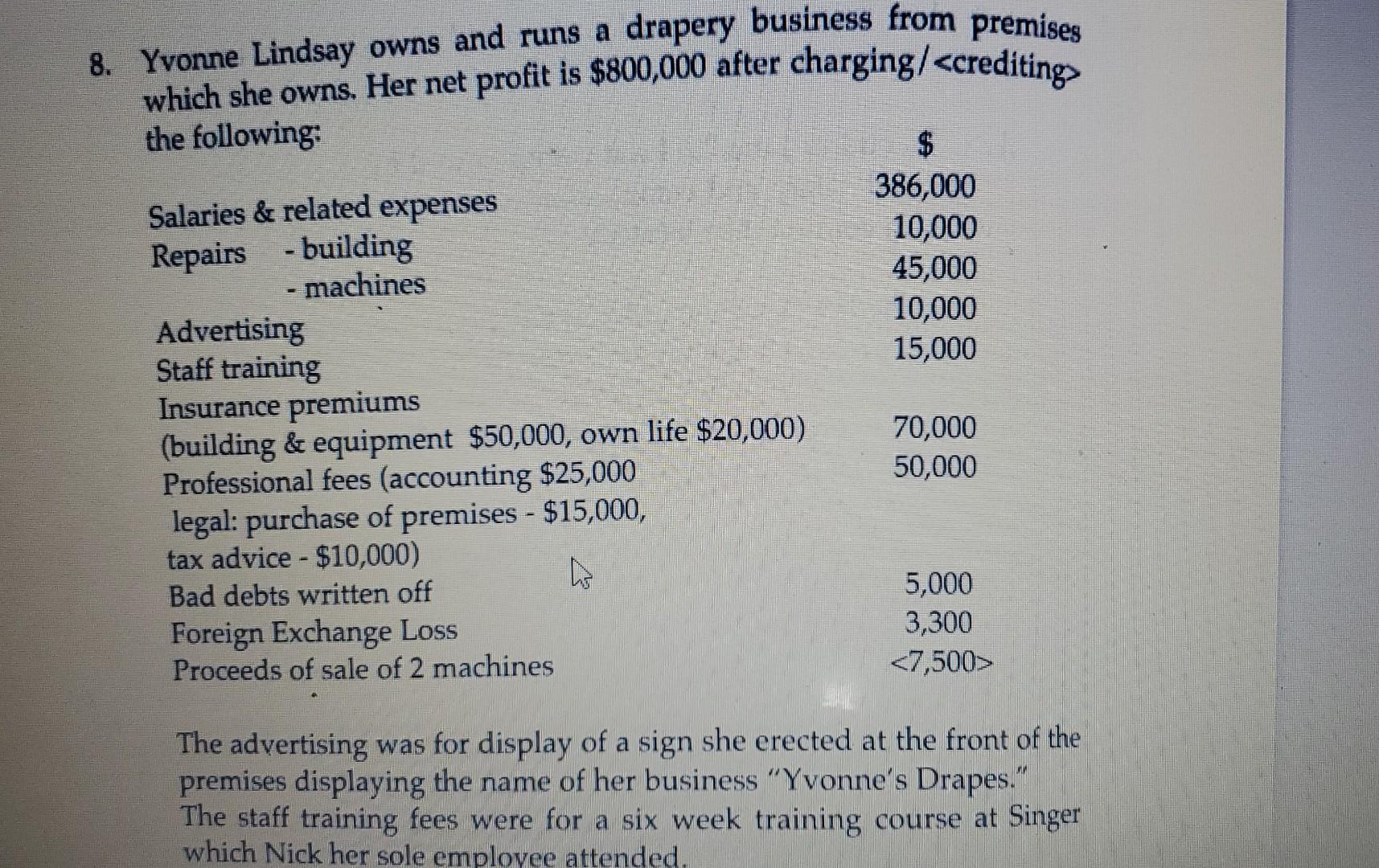

8. Yvonne Lindsay owns and runs a drapery business from premises which she owns. Her net profit is $800,000 after charging/> The advertising was for

8. Yvonne Lindsay owns and runs a drapery business from premises which she owns. Her net profit is $800,000 after charging/> The advertising was for display of a sign she erected at the front of the premises displaying the name of her business "Yvonne's Drapes." The staff training fees were for a six week training course at Singer which Nick her sole employee attended. The advertising was for d/splay of a sign she erected at the front of the premises displaying the name of her business "Yvonne's Drapes." The staff training fees were for a six week training course at Singer which Nick her sole employee attended. The foreign exchange losses were linked to the importation of machines late in the previous year and the increased cost of paying the debt due to the devaluation of the Jamaican dollar in the early months of the current year. Advise Miss Lindsay on the tax implications of each of the above items. 8. Yvonne Lindsay owns and runs a drapery business from premises which she owns. Her net profit is $800,000 after charging/> The advertising was for display of a sign she erected at the front of the premises displaying the name of her business "Yvonne's Drapes." The staff training fees were for a six week training course at Singer which Nick her sole employee attended. The advertising was for d/splay of a sign she erected at the front of the premises displaying the name of her business "Yvonne's Drapes." The staff training fees were for a six week training course at Singer which Nick her sole employee attended. The foreign exchange losses were linked to the importation of machines late in the previous year and the increased cost of paying the debt due to the devaluation of the Jamaican dollar in the early months of the current year. Advise Miss Lindsay on the tax implications of each of the above items

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started