Answered step by step

Verified Expert Solution

Question

1 Approved Answer

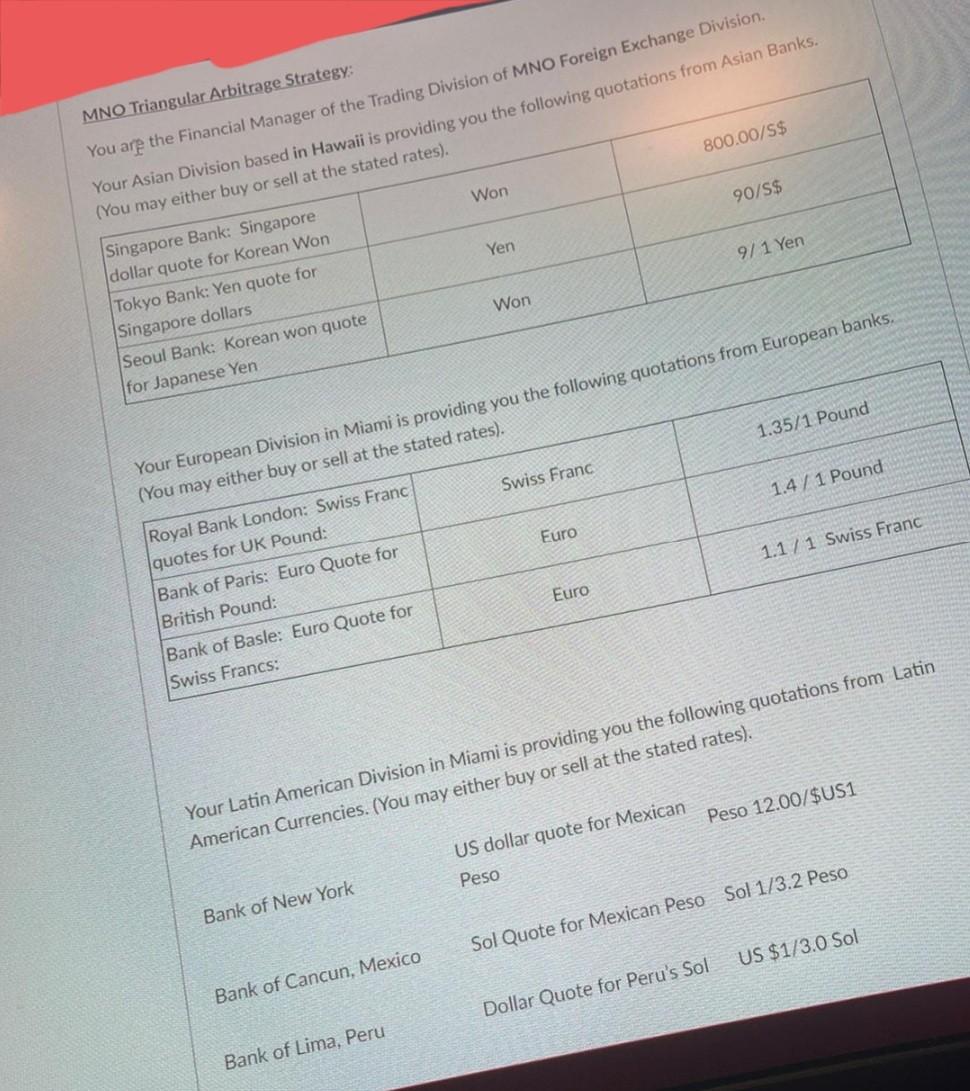

800.00/S$ MNO Triangular Arbitrage Strategy: You are the Financial Manager of the Trading Division of MNO Foreign Exchange Division Your Asian Division based in Hawaii

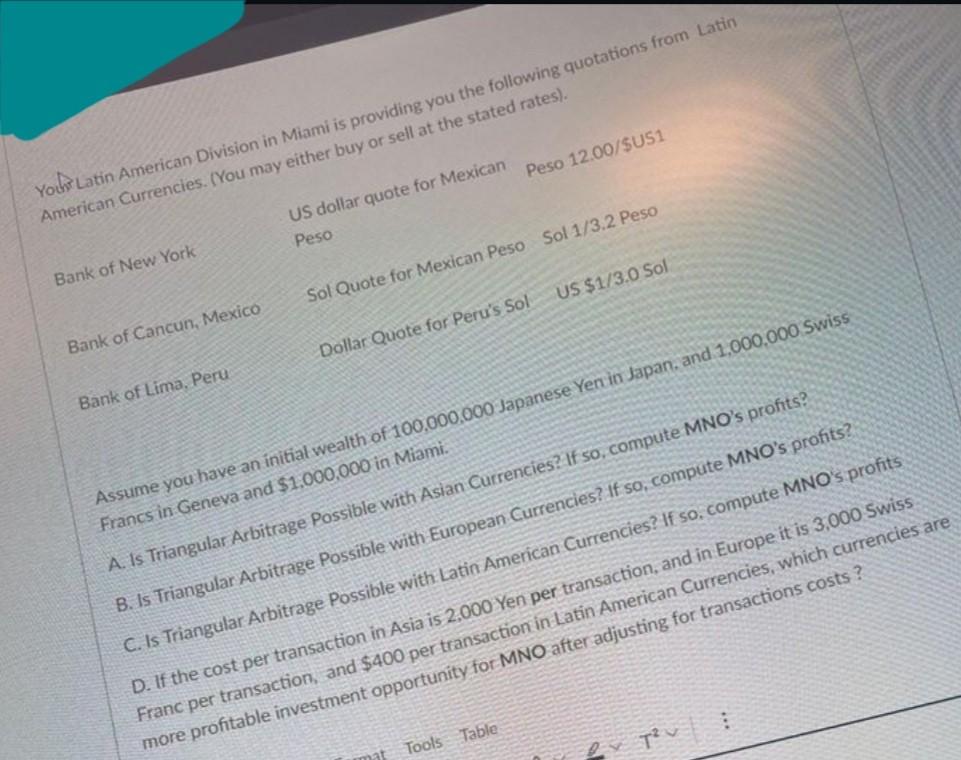

800.00/S$ MNO Triangular Arbitrage Strategy: You are the Financial Manager of the Trading Division of MNO Foreign Exchange Division Your Asian Division based in Hawaii is providing you the following quotations from Asian Banks. (You may either buy or sell at the stated rates). Won 90/S$ Yen 9/ 1 Yen Won Singapore Bank: Singapore dollar quote for Korean Won Tokyo Bank: Yen quote for Singapore dollars Seoul Bank: Korean won quote for Japanese Yen 1.35/1 Pound Your European Division in Miami is providing you the following quotations from European banks, (You may either buy or sell at the stated rates). Swiss Franc 1.4 / 1 Pound Euro 1.1/1 Swiss Franc Euro Royal Bank London: Swiss Franc quotes for UK Pound: Bank of Paris: Euro Quote for British Pound: Bank of Basle: Euro Quote for Swiss Francs: Peso 12.00/$US1 Your Latin American Division in Miami is providing you the following quotations from Latin American Currencies. (You may either buy or sell at the stated rates). US dollar quote for Mexican Peso Bank of New York Sol Quote for Mexican Peso Sol 1/3.2 Peso US $1/3.0 Sol Bank of Cancun, Mexico Dollar Quote for Peru's Sol Bank of Lima, Peru Peso 12.00/SU51 Yohr Latin American Division in Miami is providing you the following quotations from Latin American Currencies. (You may either buy or sell at the stated rates). US dollar quote for Mexican Peso Bank of New York Sol Quote for Mexican Peso Sol 1/3.2 Peso US $1/3.0 Sol Bank of Cancun, Mexico Dollar Quote for Peru's Sol Bank of Lima, Peru Assume you have an initial wealth of 100,000,000 Japanese Yen in Japan, and 1,000,000 Swiss Francs in Geneva and $1,000,000 in Miami. A. Is Triangular Arbitrage Possible with Asian Currencies? If so, compute MNO's profits? B. Is Triangular Arbitrage Possible with European Currencies? If so, compute MNO's profits? C. Is Triangular Arbitrage Possible with Latin American Currencies? If so, compute MNO's profits D. If the cost per transaction in Asia is 2,000 Yen per transaction, and in Europe it is 3,000 Swiss Franc per transaction, and $400 per transaction in Latin American Currencies, which currencies are more profitable investment opportunity for MNO after adjusting for transactions costs? Tools Table v Tv 800.00/S$ MNO Triangular Arbitrage Strategy: You are the Financial Manager of the Trading Division of MNO Foreign Exchange Division Your Asian Division based in Hawaii is providing you the following quotations from Asian Banks. (You may either buy or sell at the stated rates). Won 90/S$ Yen 9/ 1 Yen Won Singapore Bank: Singapore dollar quote for Korean Won Tokyo Bank: Yen quote for Singapore dollars Seoul Bank: Korean won quote for Japanese Yen 1.35/1 Pound Your European Division in Miami is providing you the following quotations from European banks, (You may either buy or sell at the stated rates). Swiss Franc 1.4 / 1 Pound Euro 1.1/1 Swiss Franc Euro Royal Bank London: Swiss Franc quotes for UK Pound: Bank of Paris: Euro Quote for British Pound: Bank of Basle: Euro Quote for Swiss Francs: Peso 12.00/$US1 Your Latin American Division in Miami is providing you the following quotations from Latin American Currencies. (You may either buy or sell at the stated rates). US dollar quote for Mexican Peso Bank of New York Sol Quote for Mexican Peso Sol 1/3.2 Peso US $1/3.0 Sol Bank of Cancun, Mexico Dollar Quote for Peru's Sol Bank of Lima, Peru Peso 12.00/SU51 Yohr Latin American Division in Miami is providing you the following quotations from Latin American Currencies. (You may either buy or sell at the stated rates). US dollar quote for Mexican Peso Bank of New York Sol Quote for Mexican Peso Sol 1/3.2 Peso US $1/3.0 Sol Bank of Cancun, Mexico Dollar Quote for Peru's Sol Bank of Lima, Peru Assume you have an initial wealth of 100,000,000 Japanese Yen in Japan, and 1,000,000 Swiss Francs in Geneva and $1,000,000 in Miami. A. Is Triangular Arbitrage Possible with Asian Currencies? If so, compute MNO's profits? B. Is Triangular Arbitrage Possible with European Currencies? If so, compute MNO's profits? C. Is Triangular Arbitrage Possible with Latin American Currencies? If so, compute MNO's profits D. If the cost per transaction in Asia is 2,000 Yen per transaction, and in Europe it is 3,000 Swiss Franc per transaction, and $400 per transaction in Latin American Currencies, which currencies are more profitable investment opportunity for MNO after adjusting for transactions costs? Tools Table v Tv

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started