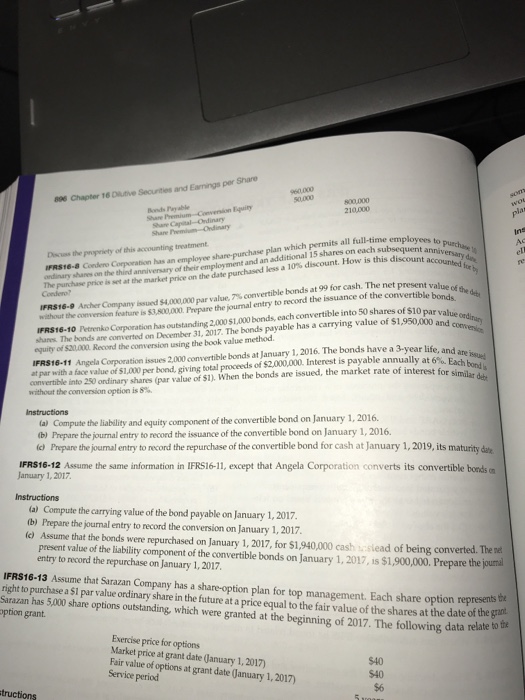

806 Chapter 16 Diutive Securities and Earnings per Share BendPayable Share Premium Coversion Equity 210,000 Share Capital-Ordinary ordinary shanes on the third anniversary of their employment and an additional 15 shares on each subsequent a Che punha e price is set at the market price on the date purchased less a 10% discount. How is this discont ac u enay anniversary Discuss the propriety of this accounting treatment IFRS18-8 Condero Corporation has an employee share-purchase plan which permits all full-time employeesto present value of the de convertible bonds at 99 for cash. The net convertible bonde the iFRS16-9 Ancher Company issued $40000 par value, r value ordinary without the IFRS16-10 Petrenko Corporation shanes. The bonds are converted on December 31, 2017. The bonds payable has a carrying value of $1,950,000d equity of $20,.000. Recond the conversion using the book value method. conversion feature is $3,800,000. Prepare the journal entry to record the issuance of the has outstanding 2,000$1,000 bonds, each convertible into 50 shares of s10 a par with a face value of Si ooper bend giving t talp eeds of S200000. Interest is payable annually at 6B convertible into 250 ondinary shares (par value of $1). When the bonds are issued, the market rate of interest for si without the conversion option is 8% -u, similar deb IFRS16-11 Angela Corporation issues 2,000 convertible bonds at January 1, 2016. The bonds have a 3-year life, and Instructions ity and equity component of the convertible bond on January 1, 2016 a) Compute the liabil b) Prepare the journal entry to record the issuance of the convertible bond on January 1, 2016. cl Prepare the journal entry to record the repurchase of the convertible bond for cash at January 1, 2019, its maturity dute IFRS18-12 Asume the same information in IFRS16-11, except that Angela Corporation converts its convertible bonds January 1, 2017 a) Compute the carrying value of the bond payable on January 1, 2017 b) Prepare the jounal entry to record the conversion on January 1, 2017, io Assume that the bonds were repurchased on January 1, 2017, for $1,940,000 cash scslead of being converted. The ne present value of the liability component of the convertible bonds on January 1, 2017, is $1,900,000. Prepare the jourmi entry to record the repurchase on January 1, 2017 IFRS16-13 Assume that Sarazan Company has a share-option plan for top management. Each share option represents be right to purchase a S1 par value ordinary share in the future at a price equal to the fair value of the shares at the date of the ga Sarazan has 5,000 share options outstanding, which were granted at the ption grant beginning of 2017. The following data relate Exercise price for options Market price at grant date January 1, 2017) Fair value of options at grant date January 1, 2017) Service period $40 $40 $6 tructions