Answered step by step

Verified Expert Solution

Question

1 Approved Answer

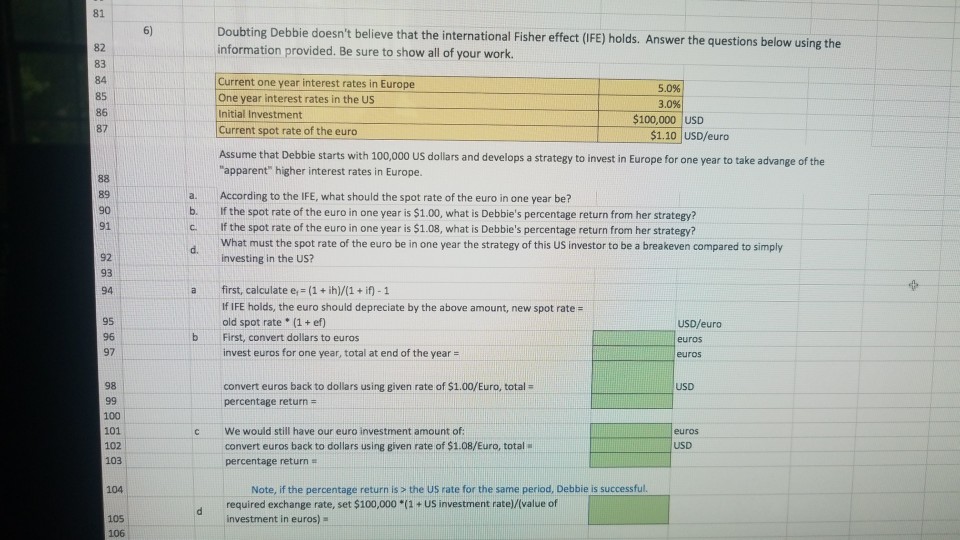

81 Doubting Debbie doesn't believe that the international Fisher effect (IFE) holds. Answer the questions below using the information provided. Be sure to show all

81 Doubting Debbie doesn't believe that the international Fisher effect (IFE) holds. Answer the questions below using the information provided. Be sure to show all of your work. 82 83 84 85 86 Current one year interest rates in Europe One year interest rates in the US Initial Investment Current spot rate of the euro 5.0% 3.0% $100,000 USD $1.10 USD/euro Assume that Debbie starts with 100,000 uS dollars and develops a strategy to invest in Europe for one year to take advange of the "apparent higher interest rates in Europe 89 90 91 a. b. c. According to the IFE, what should the spot rate of the euro in one year be? If the spot rate of the euro in one year is $1.00, what is Debbie's percentage return from her strategy? If the spot rate of the euro in one year is $1.08, what is Debbie's percentage return from her strategy? What must the spot rate of the euro be in one year the strategy of this US investor to be a breakeven compared to simply investing in the US? 92 93 94 a first, calculate e (1 + ih)/(1 if) -1 95 96 97 If IFE holds, the euro should depreciate by the above amount, new spot rate- old spot rate (1+ ef) First, convert dollars to euros invest euros for one year, total at end of the year USD/euro b euros 98 convert euros back to dollars using given rate of $1.00/Euro, total percentage return USD 100 101 c We would still have our euro investment amount of: convert euros back to dollars using given rate of $1.08/Euro, total USD 103 percentage return # Note, if the percentage return is the US rate for the same period, Debbie is successful. required exchange rate, set $100,000 "(1 + US investment rate)/(value of investment in euros) 105 106

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started