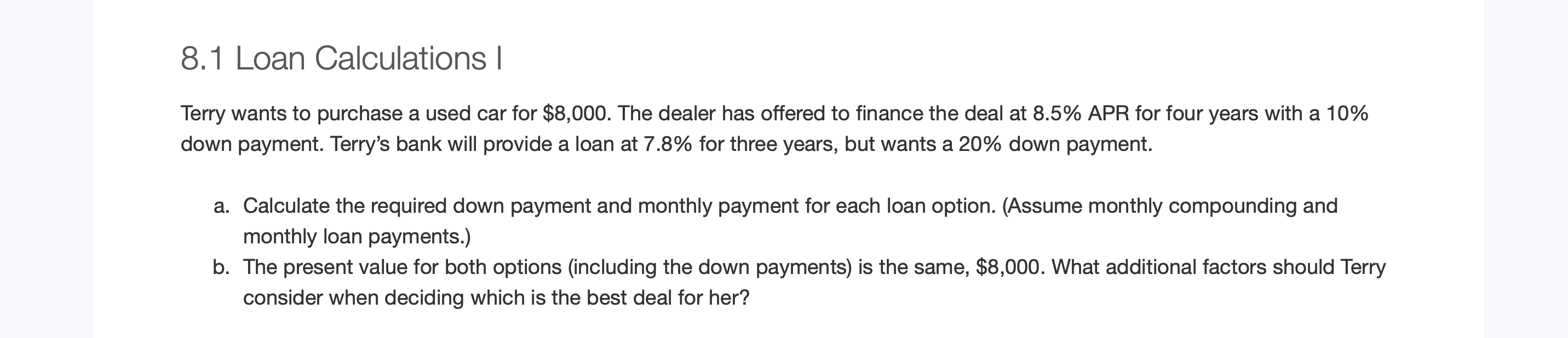

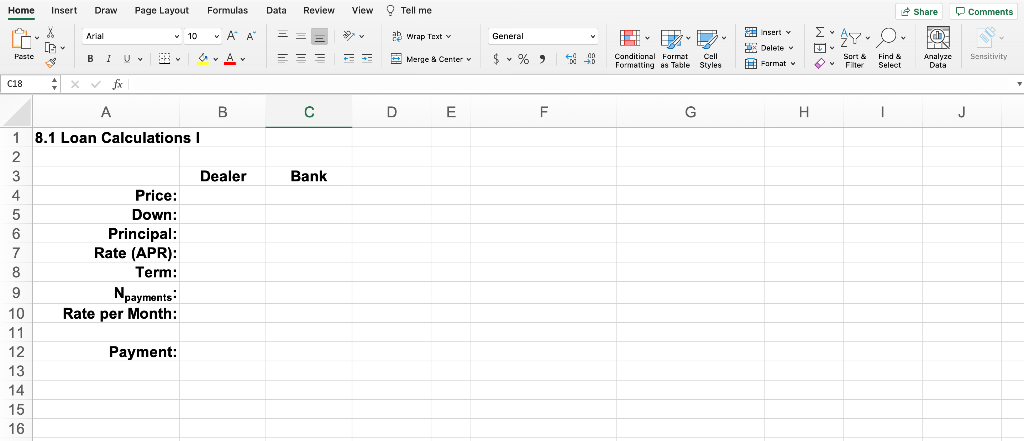

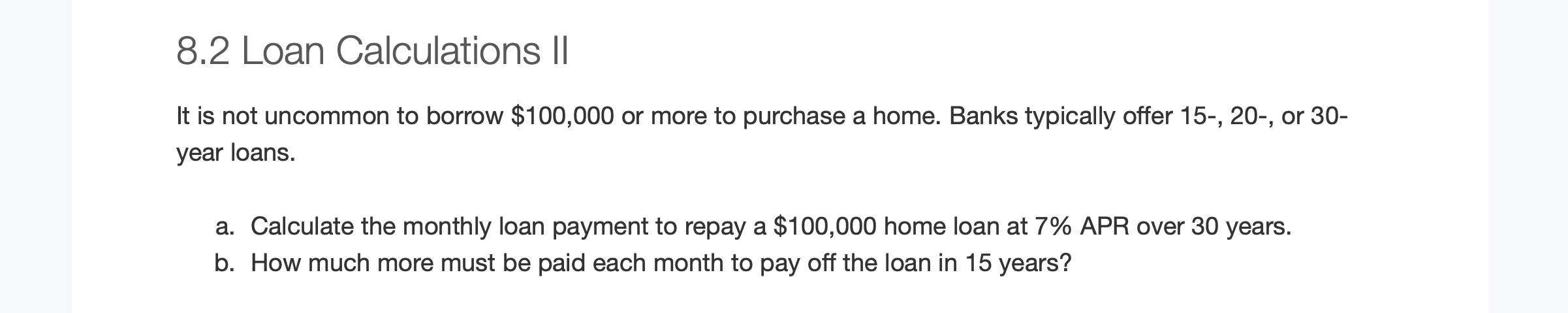

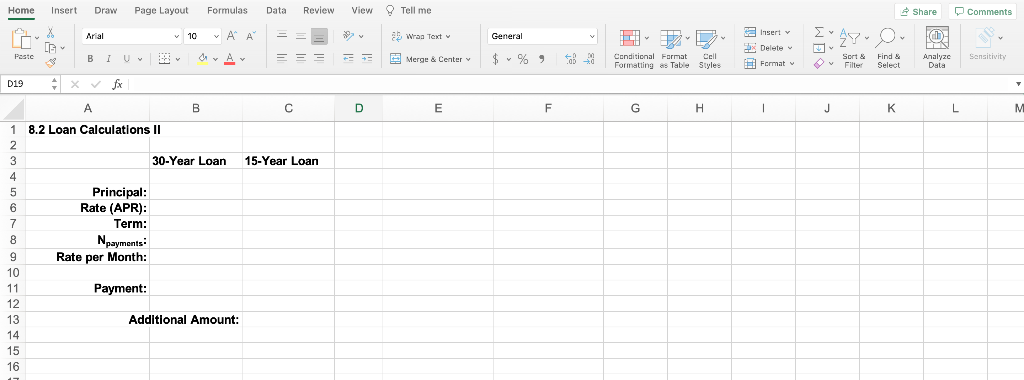

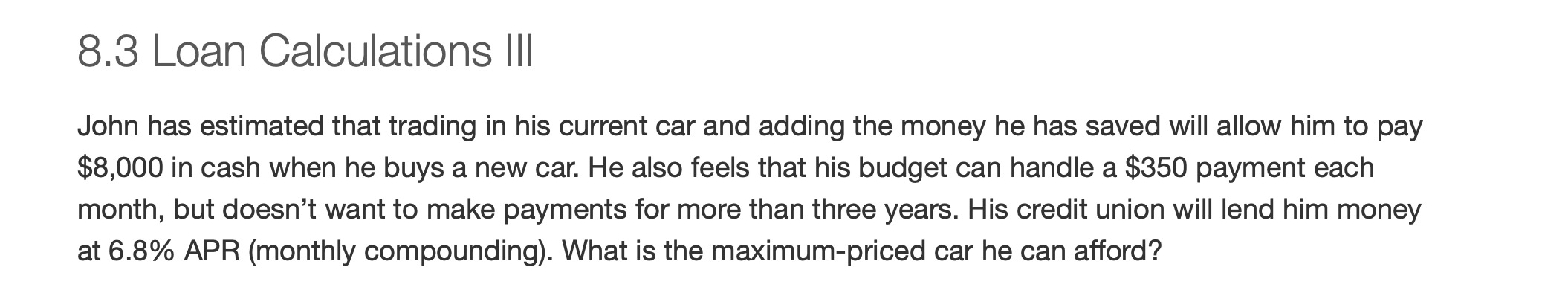

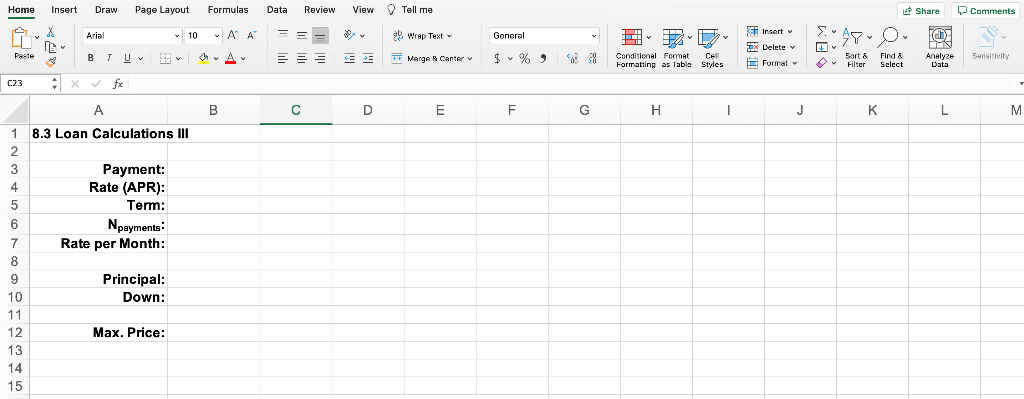

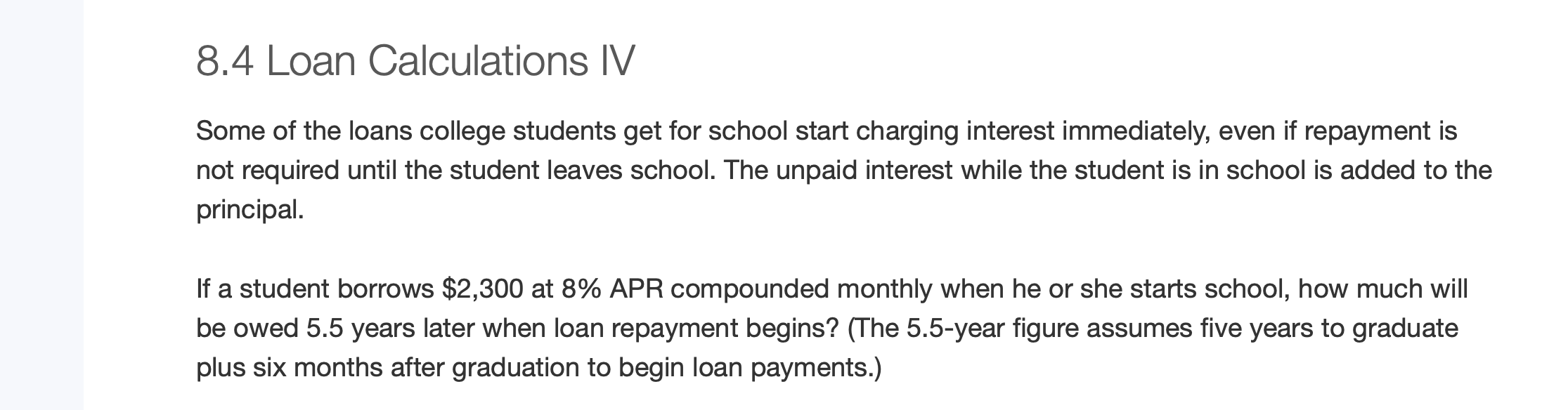

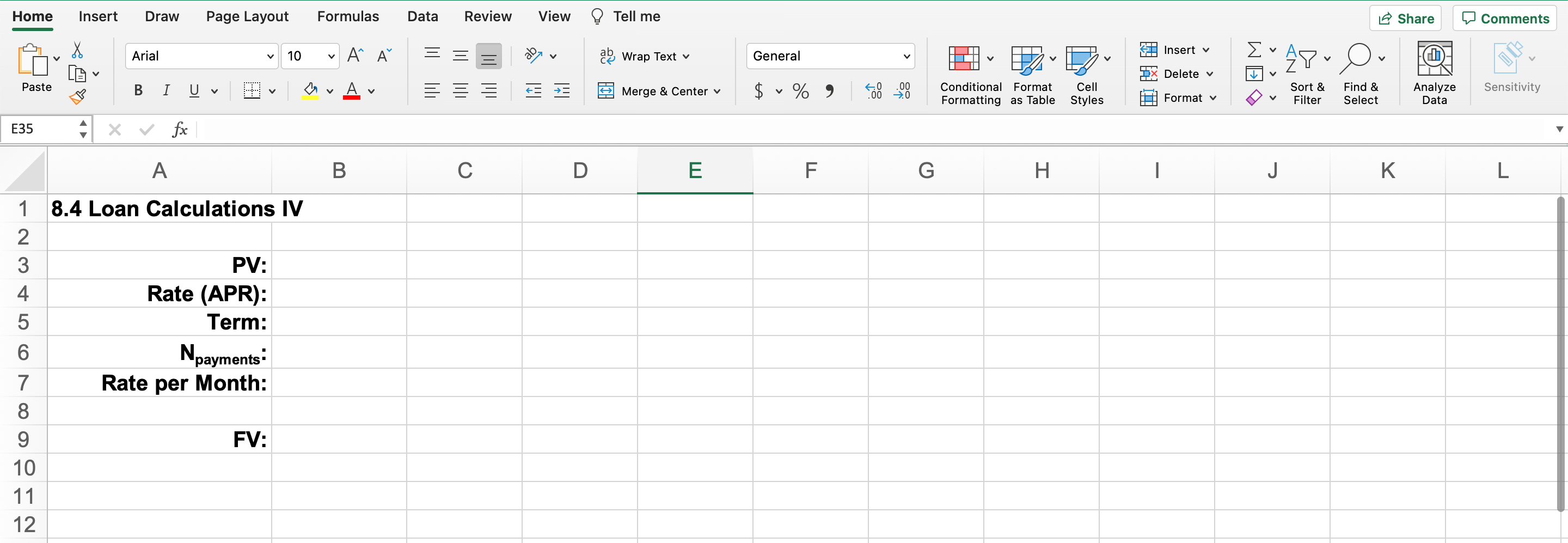

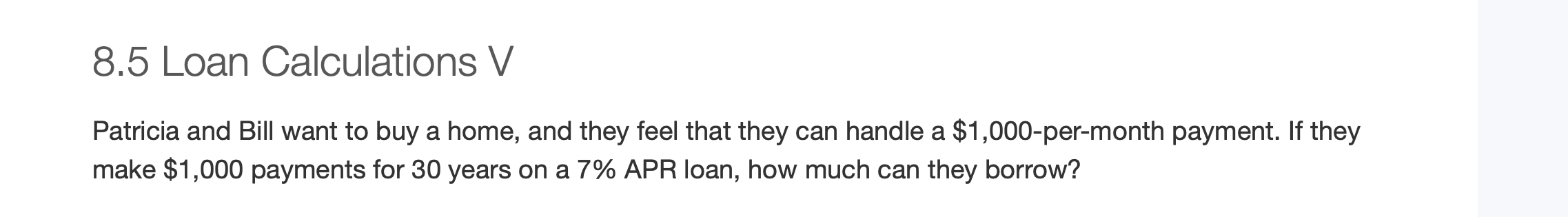

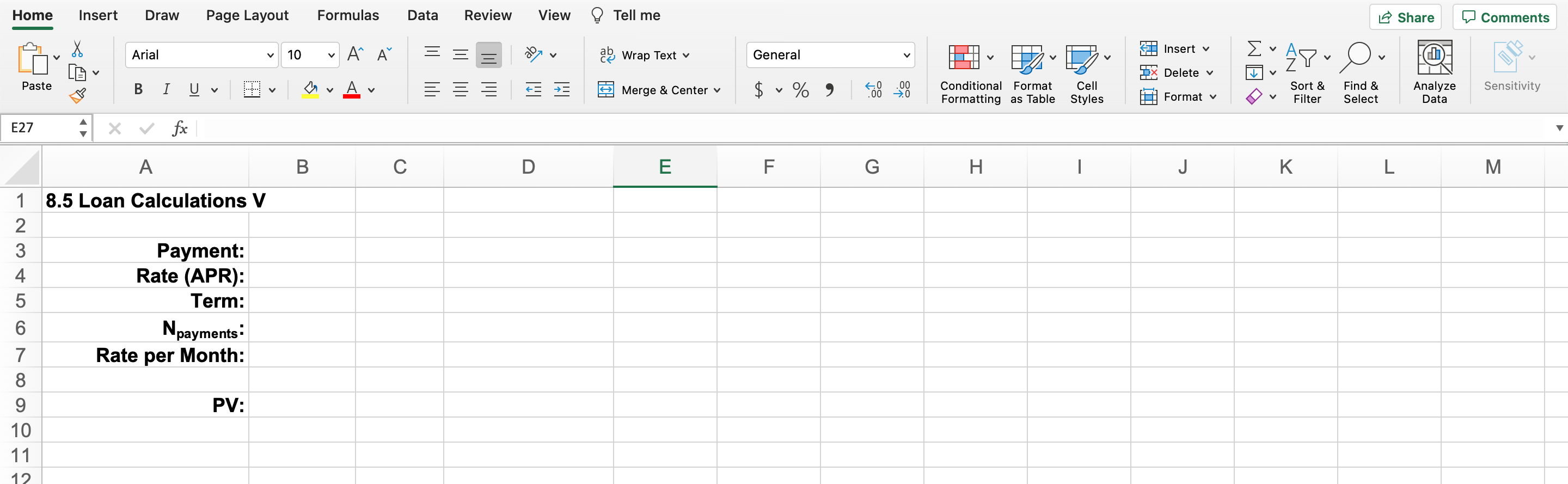

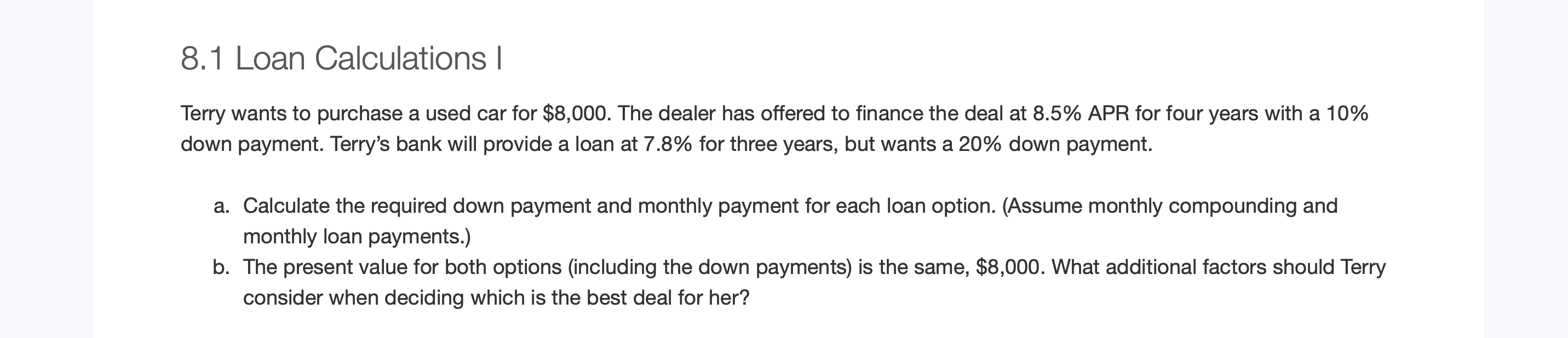

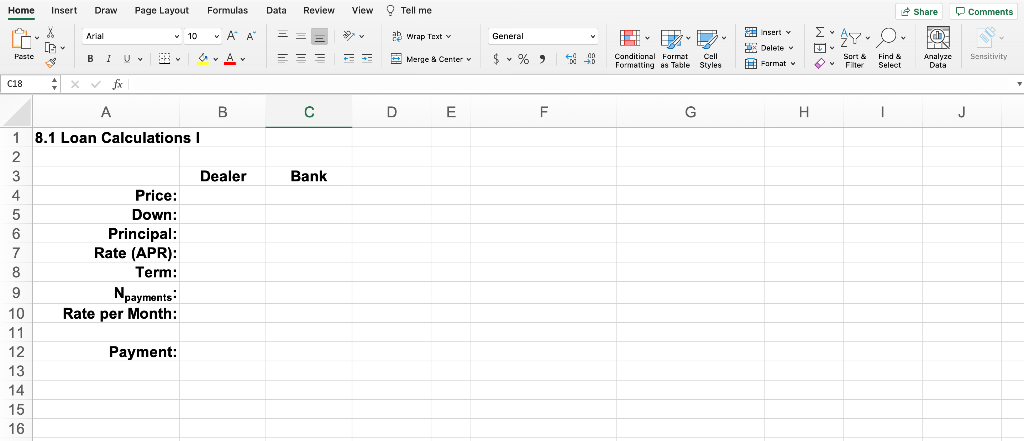

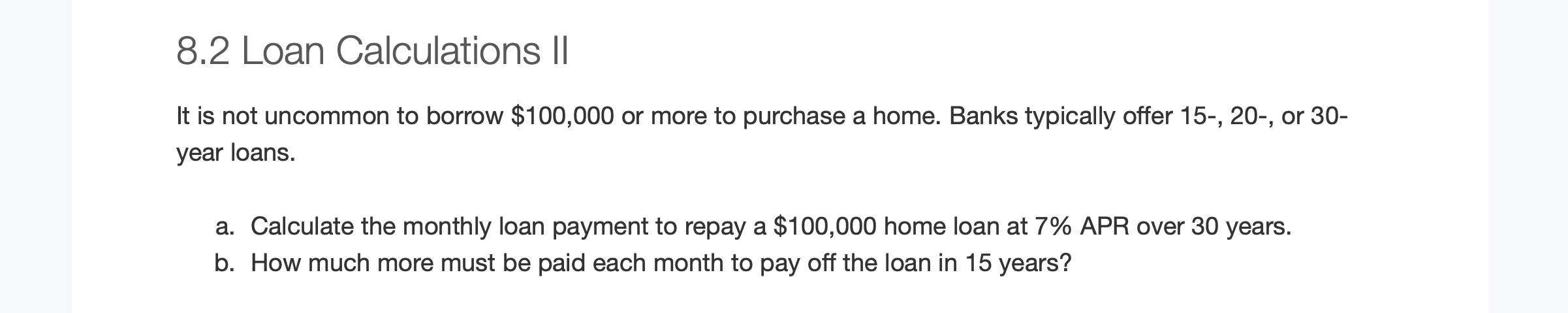

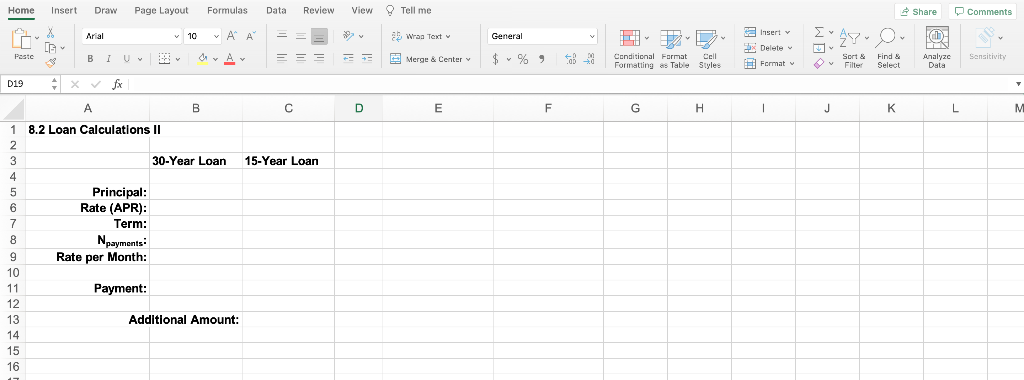

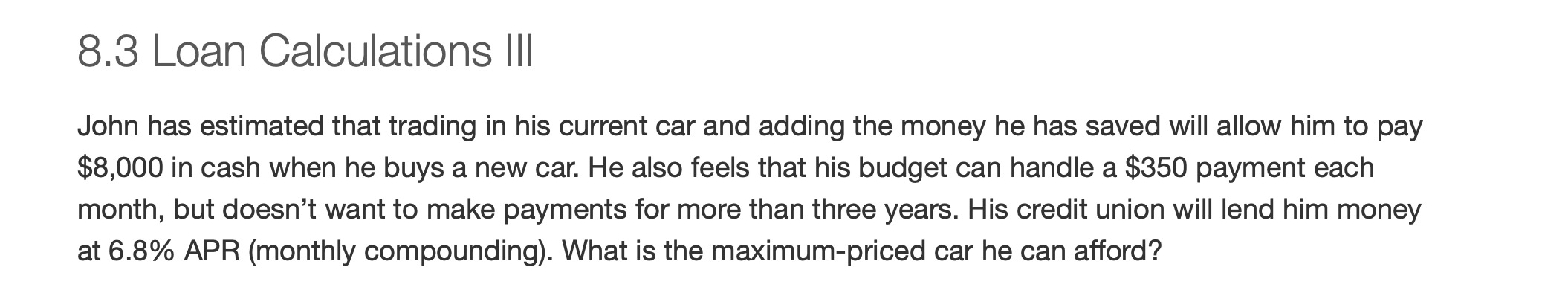

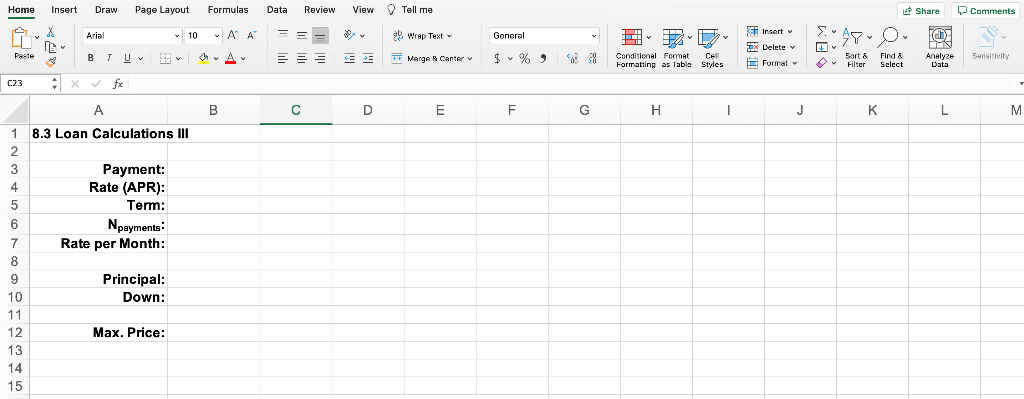

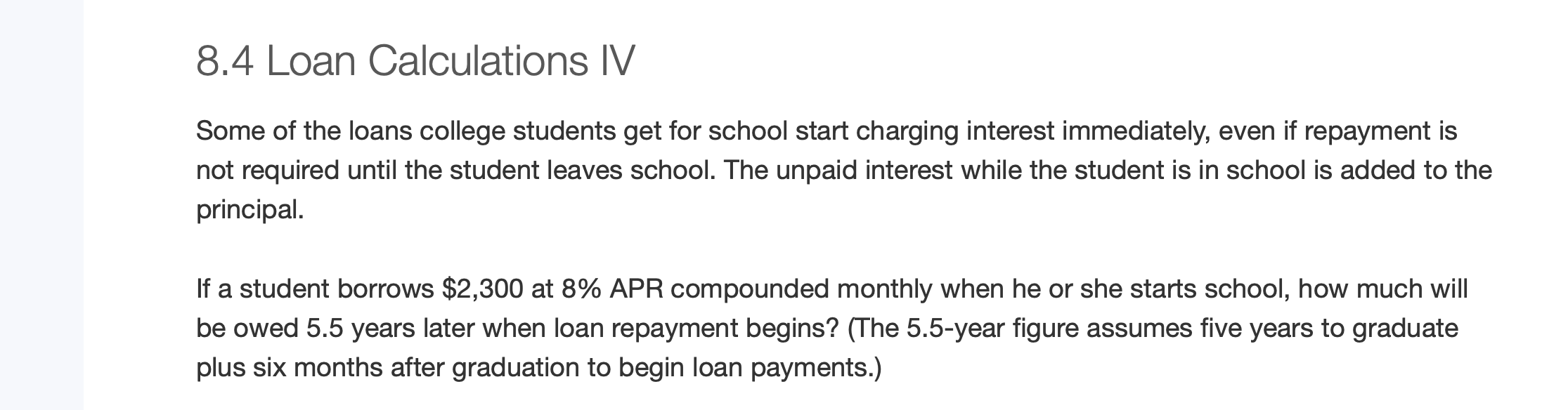

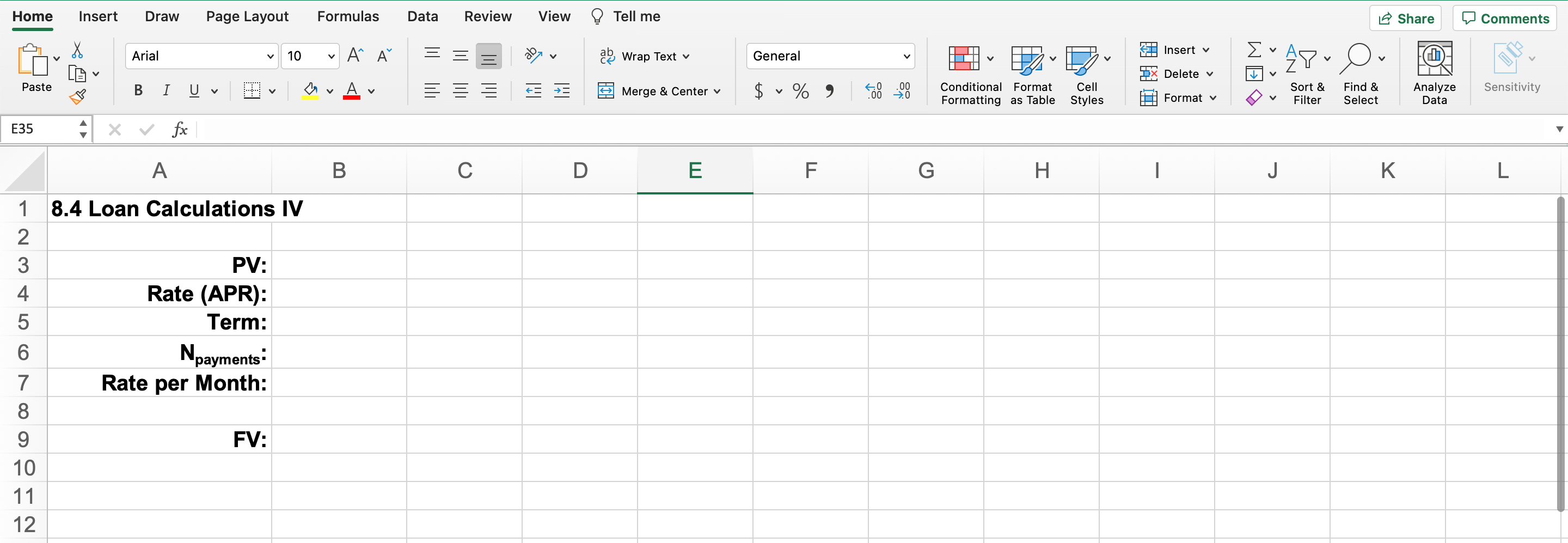

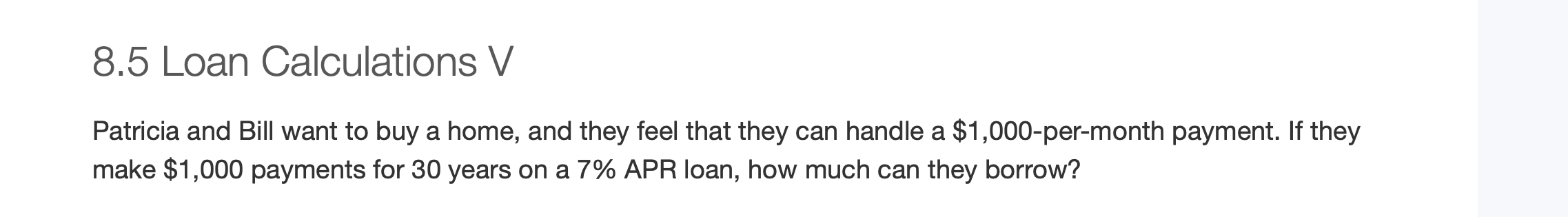

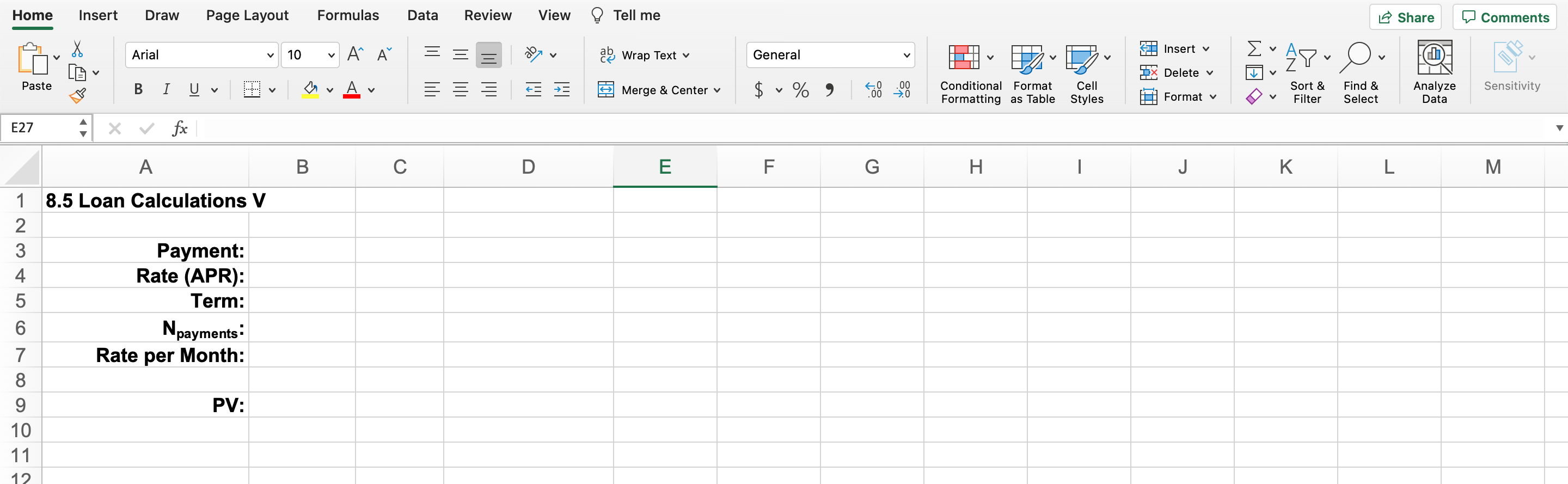

8.1 Loan Calculations | Terry wants to purchase a used car for $8,000. The dealer has offered to finance the deal at 8.5% APR for four years with a 10% down payment. Terry's bank will provide a loan at 7.8% for three years, but wants a 20% down payment. a. Calculate the required down payment and monthly payment for each loan option. (Assume monthly compounding and monthly loan payments.) b. The present value for both options (including the down payments) is the same, $8,000. What additional factors should Terry consider when deciding which is the best deal for her? Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X Arial 10 VA A v Insert ab Wrap Text General DX Delete WS Paste B 1 BIU A Y an D Merge & Center Call Sensitivity Conditional Format Formatting as Table Styles Sort & Filter Format Find & Select Analyze Data C18 x fx B D E F G H 1 J Dealer Bank A 1 8.1 Loan Calculations 2 3 4 Price: 5 Down: 6 Principal: 7 Rate (APR): 8 Term: 9 Npayments: 10 Rate per Month: 11. 12 Payment: 13 14 15 16 8.2 Loan Calculations Il It is not uncommon to borrow $100,000 or more to purchase a home. Banks typically offer 15-, 20-, or 30- year loans. a. Calculate the monthly loan payment to repay a $100,000 home loan at 7% APR over 30 years. b. How much more must be paid each month to pay off the loan in 15 years? Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X TE Arial v 10 v Insert v a 2 Wraa Text General F AYO Delete W66 Paste B I U V CA Merge & Center % 9 Conditional Format Cell Formatting as Table Styles Sort & Filter Format Find & Select Sensitivity Analyze Data 019 + x X A B D E F G H H 1 J K L M 1 8.2 Loan Calculations II 2 3 30-Year Loan 15-Year Loan 4 5 Principal: 6 Rate (APR): 7 Term: 8 g Npayments: 9 a 9 Rate per Month: 10 11 Payment: 12 13 Additional Amount: 14 15 16 8.3 Loan Calculations III John has estimated that trading in his current car and adding the money he has saved will allow him to pay $8,000 in cash when he buys a new car. He also feels that his budget can handle a $350 payment each month, but doesn't want to make payments for more than three years. His credit union will lend him money at 6.8% APR (monthly compounding). What is the maximum-priced car he can afford? Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Arial 10 VA A ab Wrap Text General my d) Y EN. Insert * Delete v Format Paste BTU MA = = Marge Canter $ % V Sensitivity Conditional Format Formatting as tabla Styles Sort & 2 Filter Find & Select Analyze Data C23 fx A B D E F G H 1 J K L M M 8.3 Loan Calculations III Payment: Rate (APR): Term: Npayments: Rate per Month: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Principal: Down: Max. Price: 8.4 Loan Calculations IV Some of the loans college students get for school start charging interest immediately, even if repayment is not required until the student leaves school. The unpaid interest while the student is in school is added to the principal. If a student borrows $2,300 at 8% APR compounded monthly when he or she starts school, how much will be owed 5.5 years later when loan repayment begins? (The 5.5-year figure assumes five years to graduate plus six months after graduation to begin loan payments.) Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X Insert v Arial V 10 V Ai ab Wrap Textv General V II III OM o Delete v V Paste V V ma . V ll ili Merge & Center v IM $ v % ) .00 >0 Conditional Format Formatting as Table Cell Styles Sensitivity Sort & Filter Format v Find & Select Analyze Data V E35 fx A B D E F G H . 1 J K L L 8.4 Loan Calculations IV 1 2 3 4 5 PV: Rate (APR): Term: Npayments: Rate per Month: 6 7 8 9 10 11 12 FV: 8.5 Loan Calculations V Patricia and Bill want to buy a home, and they feel that they can handle a $1,000-per-month payment. If they make $1,000 payments for 30 years on a 7% APR loan, how much can they borrow? Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X V Insert v Arial . Ai M v 10 ab ako Wrap Textv General V AY Delete v V Paste 60 U V V : V Merge & Center v V $ v % 9 Sensitivity .00 20 V Conditional Format Formatting as Table Cell Styles Sort & Filter Format v Find & Select Analyze Data V E27 fx A B D E F G . I J K L M 1 8.5 Loan Calculations V 2 3 Payment: 4 Rate (APR): 5 Term: 6 Npayments: 7 Rate per Month: 8 9 PV: 10 11 12