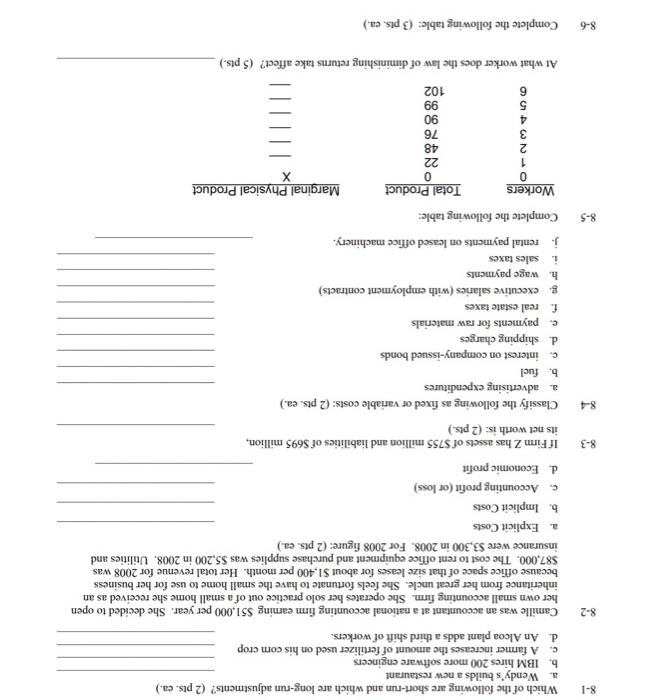

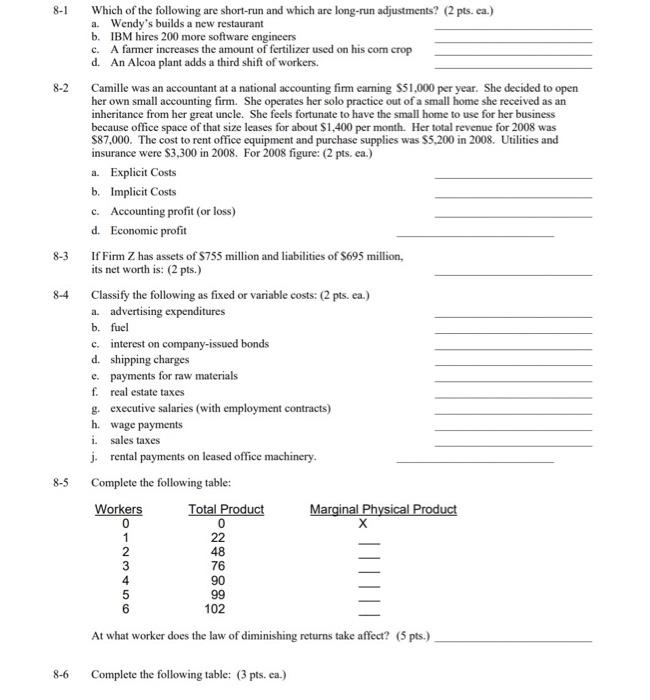

8-1 Which of the following are short-run and which are long-run adjustments? (2 pts. ea.) a. Wendy's builds a new restaurant b. IBM hires 200 more software engineers c. A farmer increases the amount of fertilizer used on his com crop d. An Alcoa plant adds a third shift of workers. 8-2 Camille was an accountant at a national accounting firm earning $51.000 per year. She decided to open her own small accounting firm. She operates her solo practice out of a small home she received as an inheritance from her great uncle. She feels fortunate to have the small home to use for her business because office space of that size leases for about $1.400 per month. Her total revenue for 2008 was $87,000. The cost to rent office equipment and purchase supplies was $5,200 in 2008. Utilities and insurance were $3,300 in 2008. For 2008 figure: (2 pts. ea.) a. Explicit Costs b. Implicit Costs Accounting profit (or loss) d. Economic profit If Firm Z has assets of $755 million and liabilities of $695 million, its net worth is: (2 pts.) 8-3 8-4 Classify the following as fixed or variable costs: (2 pts. ea.) a. advertising expenditures b. fuel c. interest on company-issued bonds d. shipping charges e payments for raw materials f. real estate taxes g. executive salaries (with employment contracts) h wage payments i. sales taxes j. rental payments on leased office machinery. 8-5 Complete the following table: Total Product Marginal Physical Product X Workers 0 1 2 3 0 22 48 76 OU AWN 90 99 102 At what worker does the law of diminishing returns take affect? (5 pts.) 8-6 Complete the following table: (3 pts.ca.) 8-1 8-2 Which of the following are short-run and which are long-run adjustments? (2 pts. ca.) a. Wendy's builds a new restaurant b. IBM hires 200 more software engineers c. A farmer increases the amount of fertilizer used on his com crop d. An Alcoa plant adds a third shift of workers. Camille was an accountant at a national accounting fimm earning $51,000 per year. She decided to open her own small accounting firm. She operates her solo practice out of a small home she received as an inheritance from her great uncle. She feels fortunate to have the small home to use for her business because office space of that size leases for about $1,400 per month. Her total revenue for 2008 was $87,000. The cost to rent office equipment and purchase supplies was $5,200 in 2008. Utilities and insurance were $3.300 in 2008. For 2008 figure: (2 pts.ea.) a. Explicit Costs b. Implicit Costs c. Accounting profit (or loss) d. Economic profit 8-3 If Fimm Z has assets of S755 million and liabilities of $695 million, its net worth is: (2 pts.) 8-4 Classify the following as fixed or variable costs: (2 pts.ca.) a. advertising expenditures b. fuel c. interest on company-issued bonds d. shipping charges c. payments for raw materials f. real estate taxes g executive salaries (with employment contracts) h. wage payments i. sales taxes j. rental payments on leased office machinery. 8-5 Complete the following table: Total Product 0 Marginal Physical Product X Workers 0 1 2 3 4 5 6 22 48 76 90 99 102 At what worker does the law of diminishing returns take affect? (5 pts.) 8-6 Complete the following table: (3 pts.ca.)