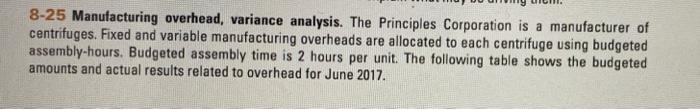

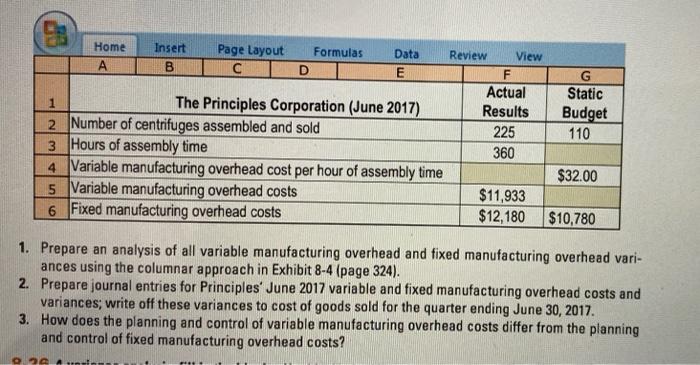

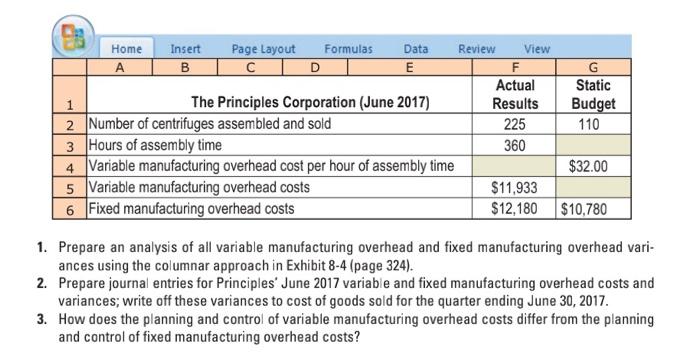

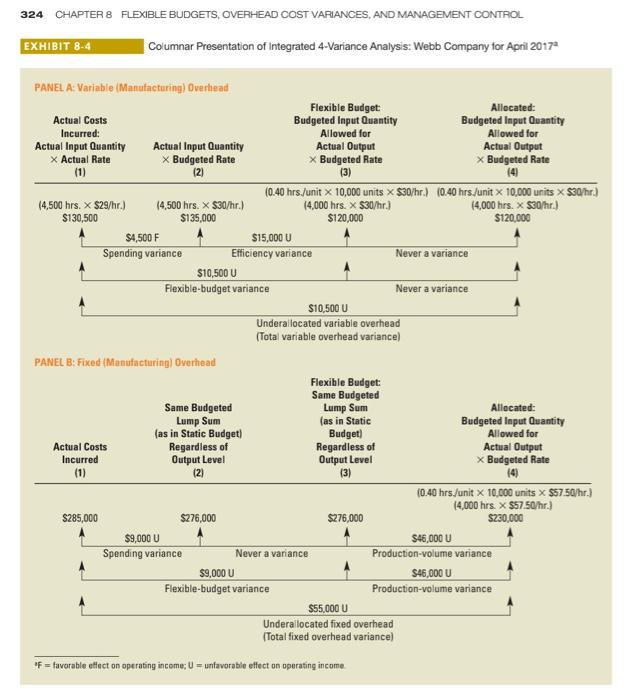

8-25 Manufacturing overhead, variance analysis. The Principles Corporation is a manufacturer of centrifuges. Fixed and variable manufacturing overheads are allocated to each centrifuge using budgeted assembly-hours. Budgeted assembly time is 2 hours per unit. The following table shows the budgeted amounts and actual results related to overhead for June 2017. Home Insert Page Layout Formulas Data Review View B D E F G Actual Static 1 The Principles Corporation (June 2017) Results Budget 2 Number of centrifuges assembled and sold 225 110 3 Hours of assembly time 360 4 Variable manufacturing overhead cost per hour of assembly time $32.00 5 Variable manufacturing overhead costs $11,933 6 Fixed manufacturing overhead costs $12,180 $10,780 1. Prepare an analysis of all variable manufacturing overhead and fixed manufacturing overhead vari- ances using the columnar approach in Exhibit 8-4 (page 324). 2. Prepare journal entries for Principles' June 2017 variable and fixed manufacturing overhead costs and variances; write off these variances to cost of goods sold for the quarter ending June 30, 2017. 3. How does the planning and control of variable manufacturing overhead costs differ from the planning and control of fixed manufacturing overhead costs? O2 324 CHAPTER 8 FLEXBLE BUDGETS, OVERHEAD COST VARIANCES, AND MANAGEMENT CONTROL EXHIBIT 8.4 Columnar Presentation of Integrated 4-Variance Analysis: Webb Company for April 2017 PANEL A: Variabla (Manufacturing) Overhand Flexible Budget Allocated: Actual Costs Budgeted Input Quantity Budgeted Input Quantity Incurred: Allowed for Allowed for Actual Input Quantity Actual Input Quantity Actual Output Actual Output x Actual Rato x Budgeted Rate x Budgeted Rate X Budgeted Rate (1) (2) (3) (4) 10.40 hrs/unit x 10,000 units X $30/hr) 10.40 hrs/unit x 10,000 units X $30/hr) (4,500 hrs. X $29/ht) 14,500 hrs. X $30/hr) 14,000 hrs. X 530/hr) (4,000 hrs. X 530/hr) $130,500 $135,000 $120,000 $120,000 $4,500 F $15,000 U Spending variance Efficiency variance Never a variance $10,500 U Flexible-budget variance Never a variance $10,500 U Underallocated variable overhead (Total variable overhead variance) PANEL B: Fixed (Manufacturing) Overhead Flexible Budget Same Budgeted Same Budgeted Lump Sum Allocated: Lump Sum (as in Static Budgeted Input Quantity (as in Static Budget) Budget) Allowed for Actual Costs Regardless of Regardless of Actual Output Incurred Output Level Output Level x Budgeted Rate (1) (2) (3) (4) 10:40 hrs/unit x 10,000 units X $5750/hr.) 14,000 hrs. X $5750/hr.) $285,000 $275,000 $276,000 $230,000 $9,000 U $46,000 U Spending variance Never a variance Production volume variance $9,000 U $46,000 U Flexible-budget variance Production-volume variance $55,000 Under allocated fixed overhead (Total fixed overhead variance) F = favorable effect on operating income; U = unfavorable effect on operating income 8-25 Manufacturing overhead, variance analysis. The Principles Corporation is a manufacturer of centrifuges. Fixed and variable manufacturing overheads are allocated to each centrifuge using budgeted assembly-hours. Budgeted assembly time is 2 hours per unit. The following table shows the budgeted amounts and actual results related to overhead for June 2017. Home Insert Page Layout Formulas Data Review View A B D E F G Actual Static 1 The Principles Corporation (June 2017) Results Budget 2 Number of centrifuges assembled and sold 225 110 3 Hours of assembly time 360 4 Variable manufacturing overhead cost per hour of assembly time $32.00 5 Variable manufacturing overhead costs $11.933 6 Fixed manufacturing overhead costs $12,180 $10,780 1. Prepare an analysis of all variable manufacturing overhead and fixed manufacturing overhead vari- ances using the columnar approach in Exhibit 8-4 (page 324). 2. Prepare journal entries for Principles' June 2017 variable and fixed manufacturing overhead costs and variances; write off these variances to cost of goods sold for the quarter ending June 30, 2017. 3. How does the planning and control of variable manufacturing overhead costs differ from the planning and control of fixed manufacturing overhead costs? 324 CHAPTER 8 FLEXIBLE BUDGETS, OVERHEAD COST VARIANCES, AND MANAGEMENT CONTROL EXHIBIT 8-4 Columnar Presentation of Integrated 4-Variance Analysis: Webb Company for April 2017 PANEL A: Variable (Manufacturing) Overhead Flexible Budget Allocated Actual Costs Budgeted Input Quantity Budgeted Input Quantity Incurred: Allowed for Allowed for Actual Input Quantity Actual Input Quantity Actual Output Actual Output X Actual Rate X Budgeted Rate * Budgeted Rate * Budgeted Rate (1) (2) (3) (0.40 hrs./unit x 10,000 units X $30/hr.) 10.40 hrs./unit x 10,000 units X 530/hr.) (4,500 hrs. X $29/hr.) (4.500 hrs. * $30/hr.) (4,000 hrs. * $30/hr.) (4,000 hrs. X 530/hr.) $130,500 $135,000 $120,000 $120,000 $4,500 F $15,000 U Spending variance Efficiency variance Never a variance $10,500U Flexible-budget variance Never a variance $10,500U Undera located variable overhead (Total variable overhead variance) PANEL B: Fixed (Manufacturing) Overhead Flexible Budget: Same Budgeted Same Budgeted Lump Sum Allocated: Lump Sum (as in Static Budgeted Input Quantity (as in Static Budget Budget) Allowed for Actual Costs Regardless of Regardless of Actual Output Incurred Output Level Output Level x Budgeted Rate (1) (2) (3) 10.40 hrs./unit x 10,000 units X $57.50/hr.) (4,000 hrs. * $57.50/hr. $285,000 $276,000 $275,000 S230,000 $9,000 U $45,000 Spending variance Never a variance Production-volume variance $9,000 U $46,000 Flexible-budget variance Production-volume variance $55.000 U Underal located fixed overhead Total fixed overhead variance) "F= favorable effect on operating income; U = unfavorable effect on operating income