8.3 B (a and b)must use info from 8.2b to complete

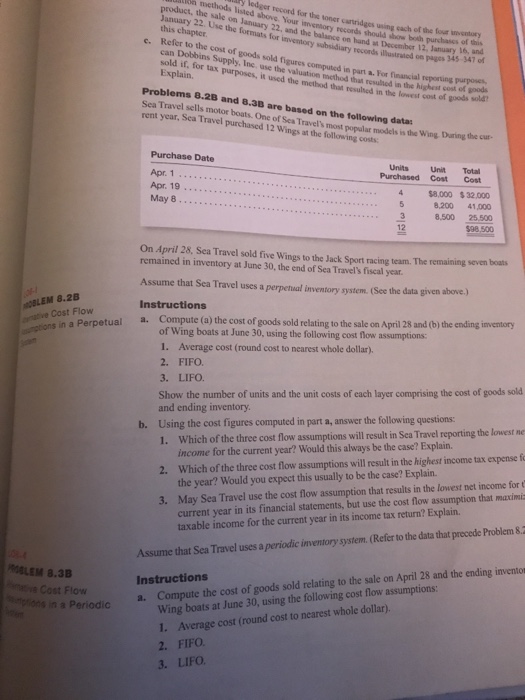

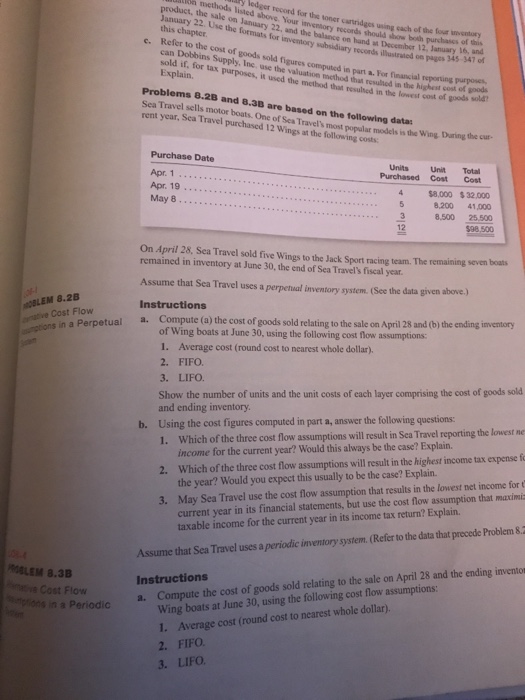

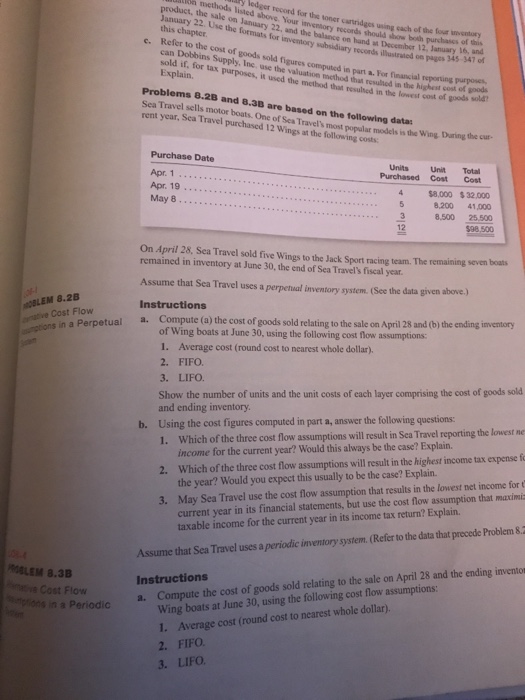

product, the sale on January 22, and the balance o January 22. Use the formats for inventory subsidiary rocords this chapter on methods listed above. Your inventory rocords should hoe y ledger record for the toner cartridges using cach of the fosur inventory both purchasss of this on hand at December 12 January 16, and illustrated on pages 345-347 of computed in part a. For financial reporting purposes c. Refer to the cost of goods sold figures can Dobbins Supply, Inc sold if, for tax purposes, it used the method that resulbed in for tat valuation method that resulhod in the highest cost of goods the lowest cost of goods soilda Problems 8.2B and 8.3 Sea Travel sells motor boats. One of Sea Travel's most popular models is the Wing Daring the cur- rent year, Sea Travel purchased 12 Wings at the following cost B are based on the following datas Purchase Date Units Unit Total Purchased CostCost Apr. 1 Apr. 19 May 8 4 $8,000 $32,000 5 8,200 41,000 8,500 25,500 98,500 On April 28, Sea Travel sold five Wings to the Jack Sport racing team. The remaining seven boats remained in inventory at June 30, the end of Sea Travel's fiscal year. Assume that Sea Travel uses a perpetual inventory system. (See the data given above.) Instructions BLEM 8.28 Cost Flow n a Perpetual a. Compute (a) the cost of goods sold relating to the sale on April 28 and (b) the ending inventory of Wing boats at June 30, using the following cost flow assumptions: 1. Average cost (round cost to nearest whole dollar), 2. FIFO. 3. LIFO. Show the number of units and the unit costs of each layer comprising the cost of goods sold and ending inventory Which of the three cost flow assumptions will result in Sea Travel reporting the lowest ne income for the current year? Would this always be the case? Explain. Which of the three cost flow assumptions will result in the highest income tax expense f the year? Would you expect this usually to be the case? Explain. May Sea Travel use the cost flow assumption that results in the lowest net income for t current year in its financial statements, but use the cost flow assumption that maximi taxable income for the current year in its income tax return? Explain. b. Using the cost figures computed in part a, answer the following questions: 1. 2. 3. Assume that Sea Travel uses a periodic inventory system (Refer to the data that precede Problem 82 LEM 8.3B Wing boats at June 30, using the following cost flow assumptions: 1. Average cost (round cost to nearest whole dollar). 2. FIFO 3. LIFO Instructions Cost Flow in a Periodic a. Compute the cost of goods sold relating to the sale on April 28 and the ending inventon