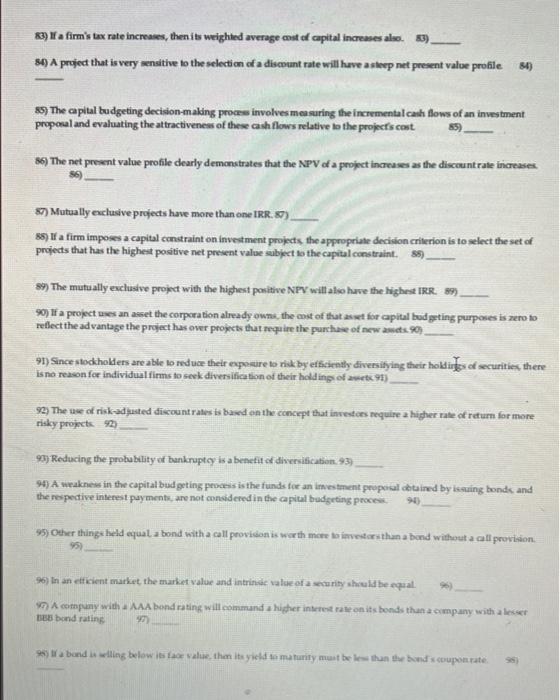

83) Na firm's tax rate increases, then its weighted average cost of capital increases als 3). 84) A project that is very sensitive to the selection of a discount rate will have asleep net present value profile 85) The capital budgeting decision-making proces involves measuring the incremental cash flows of an investment propoul and evaluating the attractiveness of these cash flows relative to the projects cost 85) 89) The net present value profile dearly demonstrates that the NPV dla project increases as the discount rate increases 87) Mutually exclusive projects have more than one IRR. ) 88) If a firm imposes a capital constraint on investment projects the appropriate decision criterion is to select the set of projects that has the highest positive net present value subject to the capital constraint. 85) 89) The mutually exclusive project with the highest positive NPV will also have the highest IRR. 89) 90) If a project was an asset the corporation already own, the cost of that asset for capital budgeting purposes is zero to reflect the advantage the project has over projects that require the purchase of new amets 90) 91) Since stockholders are able to reduce their experture to risk by efficiently diversifying their holdings of securities there is no reason for individual firms to seek diversification of their holdings of webc93) 92) The use of risk-adjusted discount rates is based on the concept that investors require a higher rate of return for more risky projects 92 93) Reducing the probability of bankruptcy is a benefit of diversification.93) 917 A weakness in the capital budgeting process is the funds for an imestment proposal chained by issuing bonds and the respective interest payments are not considered in the capital budgeting process 95) Other thinge held equal a bond with a call provision is worth more to investasthan a bond without a call provision 96) in an efficient market the market value and intrinsic value of a murity should be equal. 9) A company with AA bond rating will command a higher interest rate on its bonds than a company with a lesser e band rating 90 a band swelling below is a value then it yield to maturity must be less than the band's coupon rate SS