Answered step by step

Verified Expert Solution

Question

1 Approved Answer

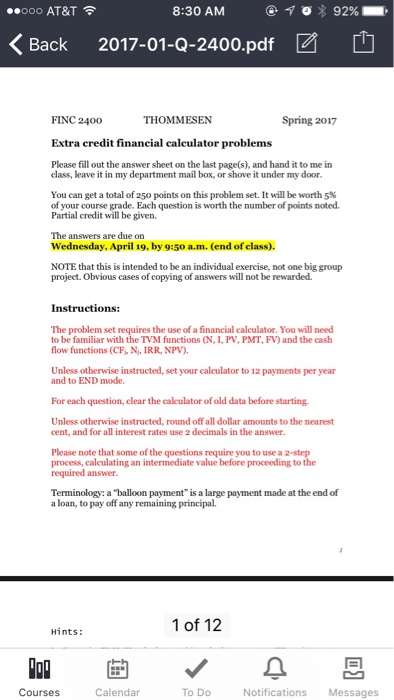

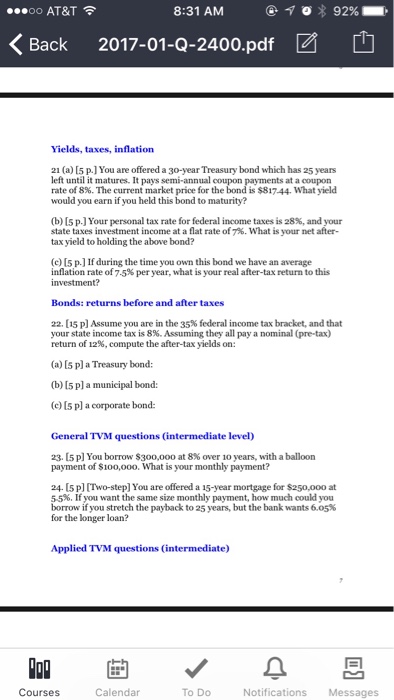

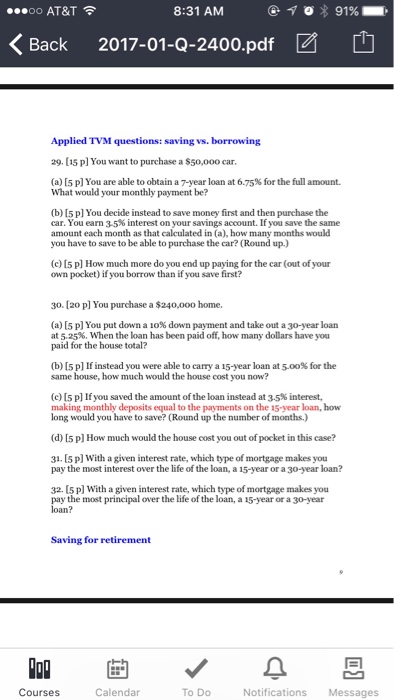

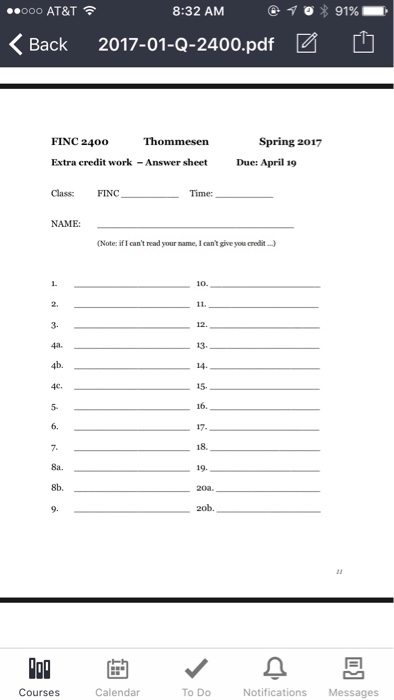

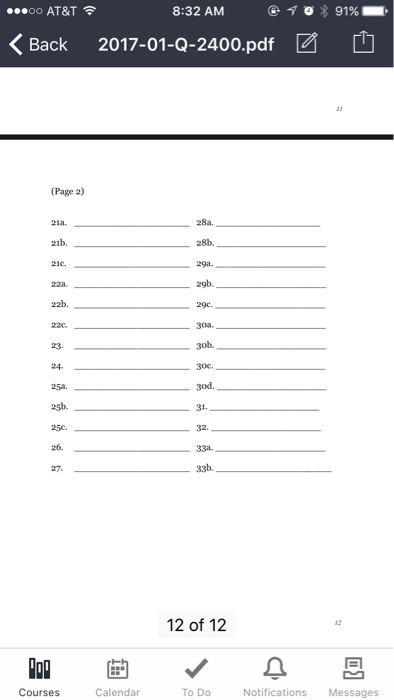

8:30 AM 7 o 92% ooo AT&T K Back 2017-01-Q-2400.pdf FINC 2400 THOMMESEN Spring 2017 Extra credit financial calculator problems Please fill out the answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started