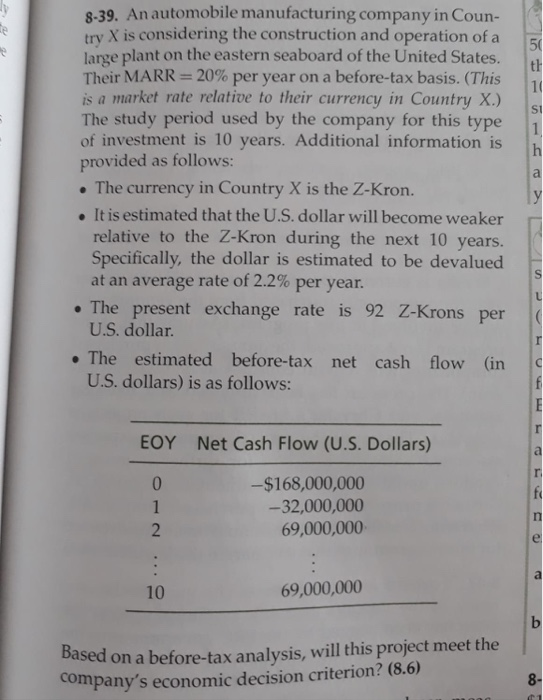

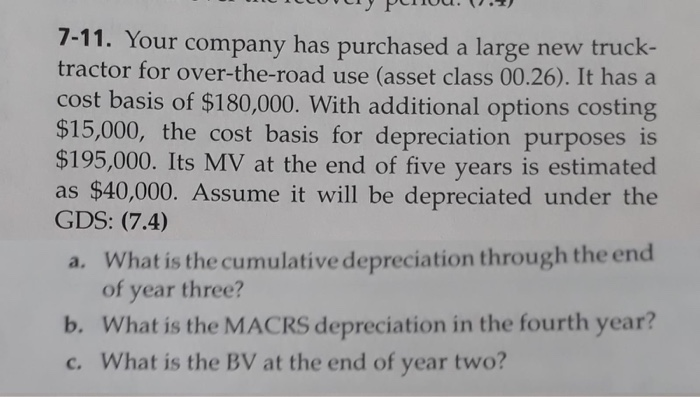

8-39. An automobile manufacturing company in Coun try X is considering the construction and operation of a large plant on the eastern seaboard of the United States. Their MARR = 20% per year on a before-tax basis. (This is a market rate relative to their currency in Country X.) The study period used by the company for this type of investment is 10 years. Additional information is provided as follows: 50 St . The currency in Country X is the Z-Kron. . It is estimated that the U.S. dollar will become weaker relative to the Z-Kron during the next 10 years. Specifically, the dollar is estimated to be devalued at an average rate of 2.2% per year. . The present exchange rate is 92 Z-Krons per U.S. dollar. . The estimated before-tax net cash flow (in U.S. dollars) is as follows: EOY Net Cash Flow (U.S. Dollars) -$168,000,000 32,000,000 69,000,000 69,000,000 10 based on a before-tax analysis, will this project meet the company's economic decision criterion? (8.6) 7-11. Your company has purchased a large new truck tractor for over-the-road use (asset class 00.26). It has a cost basis of $180,000. With additional options costing $15,000, the cost basis for depreciation purposes is $195,000. Its MV at the end of five years is estimated as $40,000. Assume it will be depreciated under the GDS: (7.4) What is the cumulative depreciation through the end of year three? What is the MACRS depreciation in the fourth year? What is the BV at the end of year two? a. b. c. 8-39. An automobile manufacturing company in Coun try X is considering the construction and operation of a large plant on the eastern seaboard of the United States. Their MARR = 20% per year on a before-tax basis. (This is a market rate relative to their currency in Country X.) The study period used by the company for this type of investment is 10 years. Additional information is provided as follows: 50 St . The currency in Country X is the Z-Kron. . It is estimated that the U.S. dollar will become weaker relative to the Z-Kron during the next 10 years. Specifically, the dollar is estimated to be devalued at an average rate of 2.2% per year. . The present exchange rate is 92 Z-Krons per U.S. dollar. . The estimated before-tax net cash flow (in U.S. dollars) is as follows: EOY Net Cash Flow (U.S. Dollars) -$168,000,000 32,000,000 69,000,000 69,000,000 10 based on a before-tax analysis, will this project meet the company's economic decision criterion? (8.6) 7-11. Your company has purchased a large new truck tractor for over-the-road use (asset class 00.26). It has a cost basis of $180,000. With additional options costing $15,000, the cost basis for depreciation purposes is $195,000. Its MV at the end of five years is estimated as $40,000. Assume it will be depreciated under the GDS: (7.4) What is the cumulative depreciation through the end of year three? What is the MACRS depreciation in the fourth year? What is the BV at the end of year two? a. b. c