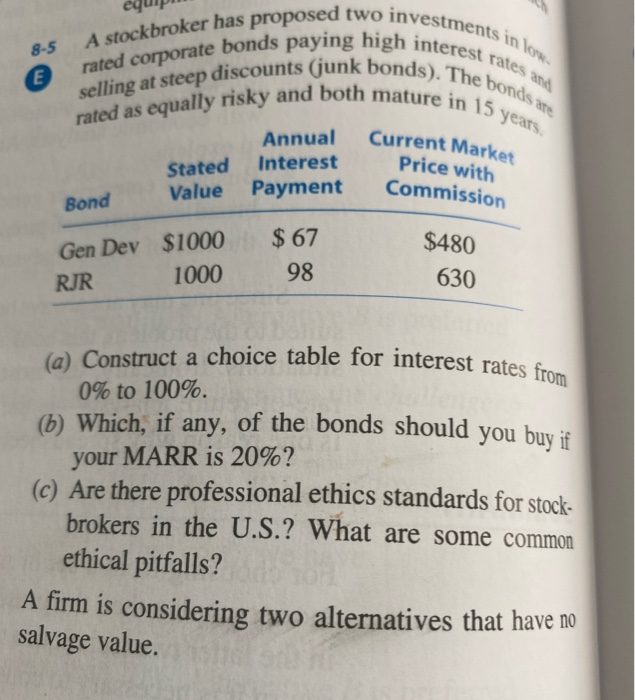

Question: 8-5 (E Stated Value Current Market Price with Commission Bond Gen Dev $1000 RJR 1000 rated corporate bonds paying high interest rates and A stockbroker

8-5 (E Stated Value Current Market Price with Commission Bond Gen Dev $1000 RJR 1000 rated corporate bonds paying high interest rates and A stockbroker has proposed two investments in low rated as equally risky and both mature in 15 years. selling at steep discounts (junk bonds). The bonds a (a) Construct a choice table for interest rates from Annual Interest Payment $ 67 $480 98 630 0% to 100%. (6) Which, if any, of the bonds should you buy if your MARR is 20%? (c) Are there professional ethics standards for stock- brokers in the U.S.? What are some common ethical pitfalls? A firm is considering two alternatives that have no salvage value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts