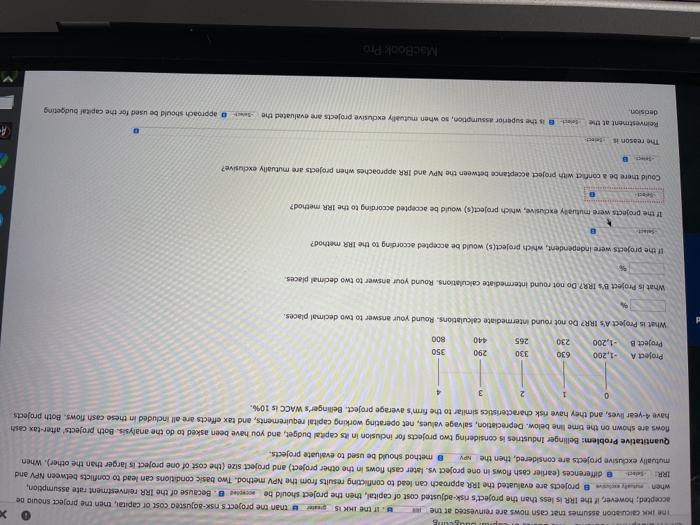

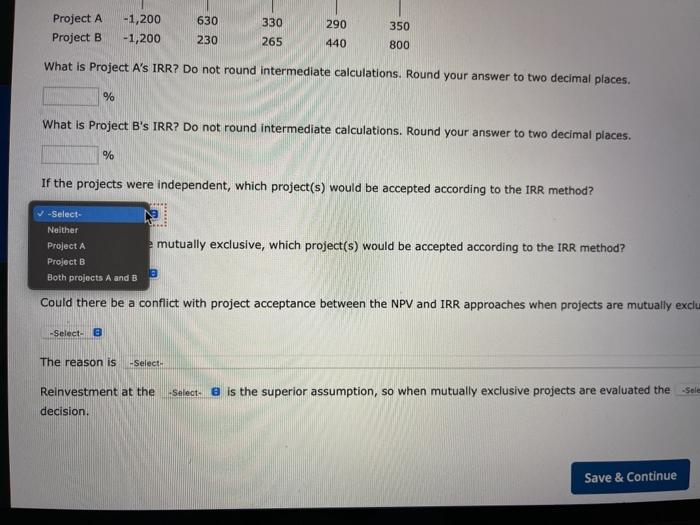

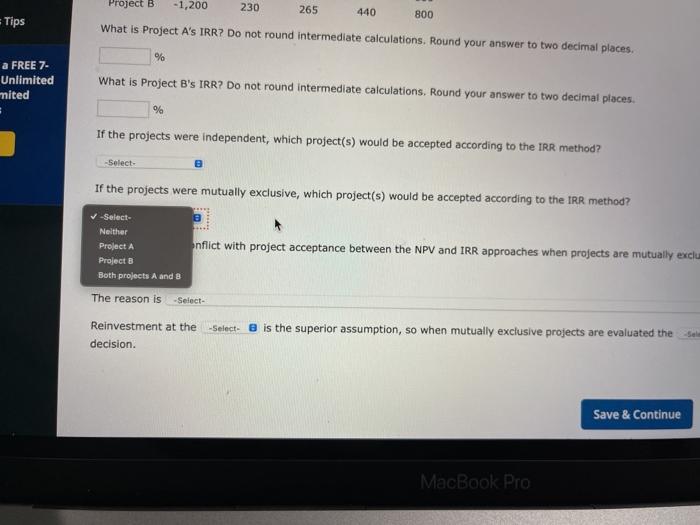

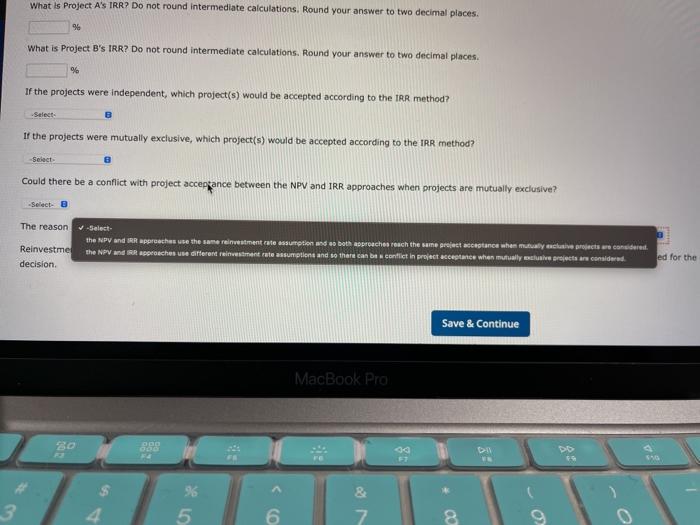

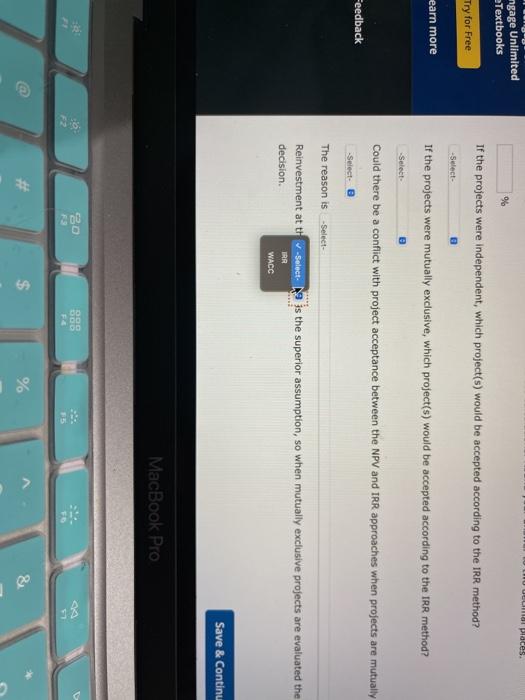

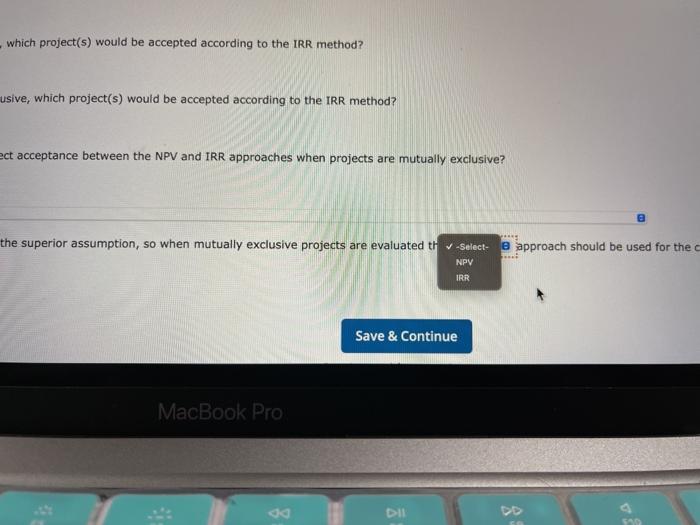

8.5 IKK Caiction assumes that casniows are reinvested at the 8. Ir the IKK 15 than the projects Isk-adjusted cost of capital, then the project should be accepted; however, if the IRR is less than the project's risk-adjusted cost of capital, then the project should be wote 8 Because of the IRR reinvestment rate assumption, when projects are evaluated the IRR approach can lead to conflicting results from the NPV method. Two basic conditions can lead to conflicts between NPV and IRR et B differences (earlier cash flows in one project vs. later cash flows in the other project) and project size (the cost of one project is larger than the other). When mutually exclusive projects are considered, then the NPV method should be used to evaluate projects. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the timeline below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 10%. 0 2 3 4 Project A Project B -1,200 -1,200 630 330 255 230 290 440 350 800 What is Project A's IRR? Do not round Intermediate calculations. Round your answer to two decimal places. What is Project B'S TRR? Do not round Intermediate calculations. Round your answer to two decimal places If the projects were independent, which project(s) would be accepted according to the IRR method? If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method? Could there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutually exclusive? The reason is Reinvestment at the decision w is the superior assumption, so when mutually exclusive projects are evaluated the Se approach should be used for the capital budgeting MacBook Pro 330 Project A Project B -1,200 -1,200 630 230 290 440 350 800 265 What is Project A's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % If the projects were independent, which project(s) would be accepted according to the IRR method? -Select- Neither Project A mutually exclusive, which project(s) would be accepted according to the IRR method? Project B Both projects A and B Could there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutually exclu -Select- The reason is -Select -Select- e is the superior assumption, so when mutually exclusive projects are evaluated the Sele Reinvestment at the decision, Save & Continue Project B -1,200 230 265 440 800 = Tips What is Project A's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % a FREE 7. Unlimited nited What is Project B's IRR? Do not round intermediate calculations, Round your answer to two decimal places. % If the projects were independent, which project(s) would be accepted according to the IRR method? -Select- B If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method? Select Neither Project A Project B Both projects A and 8 onflict with project acceptance between the NPV and IRR approaches when projects are mutually exclu -Select- The reason is Reinvestment at the -Select- is the superior assumption, so when mutually exclusive projects are evaluated the decision. Save & Continue MacBook Pro What is Project A'S IRR? Do not round intermediate calculations, Round your answer to two decimal places. 96 What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % If the projects were independent, which project(s) would be accepted according to the IRR method? Select B If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method? Select Could there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutually exclusive? -Select- The reason -Select- the NPV and RR approaches use the same reinvestment rate assumption and so both approaches reach the same project acceptance when muually exclusive projects are considered Reinvestme the NPV and approaches use different reinvestment rate asumption and so there can be conflict in project acceptance when mutually alive arts are considered decision ed for the Save & Continue MacBook Pro 80 596 3 5 6 7 Uud places ngage Unlimited Textbooks % If the projects were independent, which project(s) would be accepted according to the IRR method? Try for Free -Select- earn more If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method? Select Could there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutually Feedback -Select- The reason is -Select- Reinvestment at tv-Select. Na is the superior assumption, so when mutually exclusive projects are evaluated the decision IRR WACC Save & Continu MacBook Pro 80 @ % & which project(s) would be accepted according to the IRR method? usive, which project(s) would be accepted according to the IRR method? ect acceptance between the NPV and IRR approaches when projects are mutually exclusive? the superior assumption, so when mutually exclusive projects are evaluated th -Select- le approach should be used for the NPV IRR Save & Continue MacBook Pro DI 8