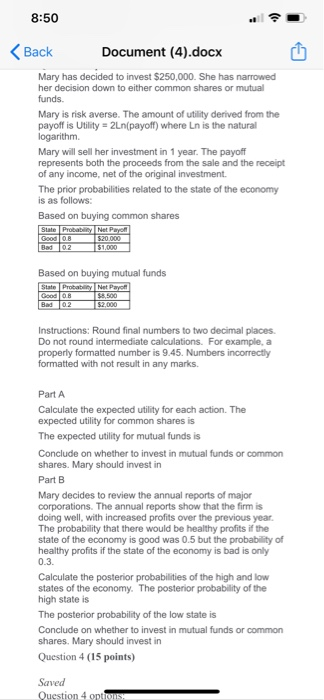

8:50 Back Document (4).docx Mary has decided to invest $250,000. She has narrowed her decision down to either common shares or mutual funds. Mary is risk averse. The amount of utility derived from the payoff is Utility = 2Ln(payoff) where Ln is the natural logarithm. Mary will sell her investment in 1 year. The payoff represents both the proceeds from the sale and the receipt of any income, net of the original investment. The prior probabilities related to the state of the economy is as follows: Based on buying common shares State Probability Net Payoff Good OU 520.000 Bad 02 51.000 Based on buying mutual funds State Probably Not Payot Good08 $8.500 Bad 02 $2.000 Instructions: Round final numbers to two decimal places. Do not round intermediate calculations. For example, a properly formatted number is 9.45. Numbers incorrectly formatted with not result in any marks. Part A Calculate the expected utility for each action. The expected utility for common shares is The expected utility for mutual funds is Conclude on whether to invest in mutual funds or common shares. Mary should invest in Part B Mary decides to review the annual reports of major corporations. The annual reports show that the firm is doing well, with increased profits over the previous year. The probability that there would be healthy profits if the state of the economy is good was 0.5 but the probability of healthy profits if the state of the economy is bad is only 0.3. Calculate the posterior probabilities of the high and low states of the economy. The posterior probability of the high state is The posterior probability of the low state is Conclude on whether to invest in mutual funds or common shares. Mary should invest in Question 4 (15 points) Saved Question 4 options 8:50 Back Document (4).docx Mary has decided to invest $250,000. She has narrowed her decision down to either common shares or mutual funds. Mary is risk averse. The amount of utility derived from the payoff is Utility = 2Ln(payoff) where Ln is the natural logarithm. Mary will sell her investment in 1 year. The payoff represents both the proceeds from the sale and the receipt of any income, net of the original investment. The prior probabilities related to the state of the economy is as follows: Based on buying common shares State Probability Net Payoff Good OU 520.000 Bad 02 51.000 Based on buying mutual funds State Probably Not Payot Good08 $8.500 Bad 02 $2.000 Instructions: Round final numbers to two decimal places. Do not round intermediate calculations. For example, a properly formatted number is 9.45. Numbers incorrectly formatted with not result in any marks. Part A Calculate the expected utility for each action. The expected utility for common shares is The expected utility for mutual funds is Conclude on whether to invest in mutual funds or common shares. Mary should invest in Part B Mary decides to review the annual reports of major corporations. The annual reports show that the firm is doing well, with increased profits over the previous year. The probability that there would be healthy profits if the state of the economy is good was 0.5 but the probability of healthy profits if the state of the economy is bad is only 0.3. Calculate the posterior probabilities of the high and low states of the economy. The posterior probability of the high state is The posterior probability of the low state is Conclude on whether to invest in mutual funds or common shares. Mary should invest in Question 4 (15 points) Saved Question 4 options