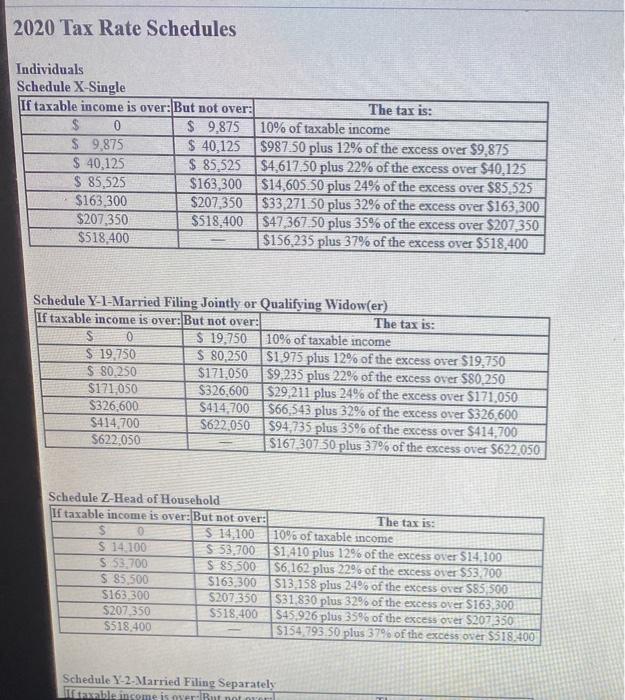

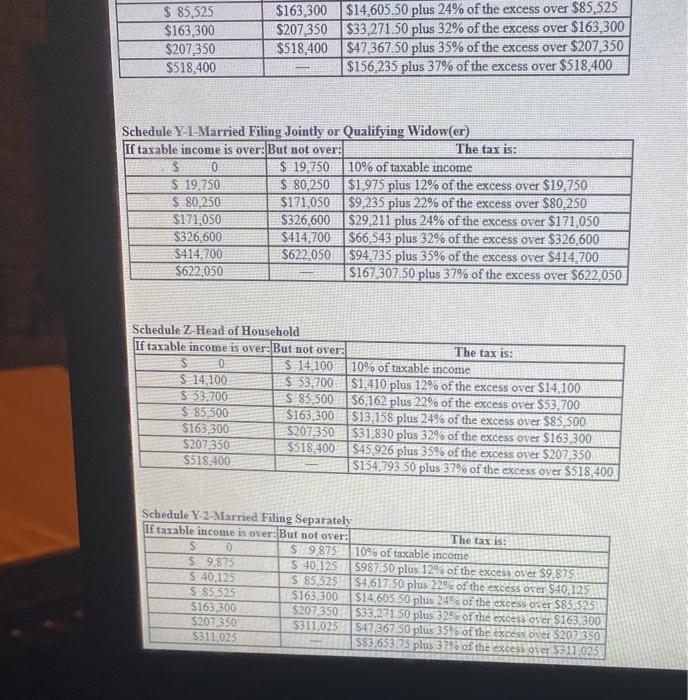

$ 85,525 $163,300 $207,350 $518,400 $163,300 $14,605.50 plus 24% of the excess over $85,525 $207,350 $33,271 50 plus 32% of the excess over $163,300 $518,400 $47,367.50 plus 35% of the excess over $207,350 $156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over:But not over: The tax is: 0 $ 19.750 10% of taxable income $ 19,750 $ 80,250 $1,975 plus 12% of the excess over $19.750 5.80.250 $171,050 $9,235 plus 22% of the excess over $80.250 $171,050 $326,600 $29,211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94.735 plus 35% of the excess over $414,700 $622,050 $167 307.50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: 0 $ 14,100 10% of taxable income S 14,100 $ 53.700 51.410 plus 12% of the excess over $14,100 $ 53,700 S 85,500 $6,162 plus 22% of the excess over $53.700 $ 85,500 $163,300 $13,158 plus 24% of the excess over $85.500 $163 300 $207,350 $31,830 plus 32% of the excess over $163 300 $207,350 $518.400$45,926 plus 35% of the excess over $207,350 $518,400 $154,793.50 plus 37% of the excess over $518,400 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: S 0 $9.875 10% of taxable income S 9.875 $ 40.125 598750 plus 129 of the excess over $9.875 $ 40.125 S SS 525 $4.617 50 plus 229 of the excess over $40.125 S 85.525 S163 300 $14,605 50 plus 24% of the excess over $83.525 S163,300 $207350 $33,271 50 plus 329 of the excess ostes S163 300 $207 350 5311,025 S47367 50 plus 35 of the excess over $207 350 S311.025 583.65325 plus 37% of the excess over $311025 $ 85,525 $163,300 $207,350 $518,400 $163,300 $14,605.50 plus 24% of the excess over $85,525 $207,350 $33,271 50 plus 32% of the excess over $163,300 $518,400 $47,367.50 plus 35% of the excess over $207,350 $156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over:But not over: The tax is: 0 $ 19.750 10% of taxable income $ 19,750 $ 80,250 $1,975 plus 12% of the excess over $19.750 5.80.250 $171,050 $9,235 plus 22% of the excess over $80.250 $171,050 $326,600 $29,211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94.735 plus 35% of the excess over $414,700 $622,050 $167 307.50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: 0 $ 14,100 10% of taxable income S 14,100 $ 53.700 51.410 plus 12% of the excess over $14,100 $ 53,700 S 85,500 $6,162 plus 22% of the excess over $53.700 $ 85,500 $163,300 $13,158 plus 24% of the excess over $85.500 $163 300 $207,350 $31,830 plus 32% of the excess over $163 300 $207,350 $518.400$45,926 plus 35% of the excess over $207,350 $518,400 $154,793.50 plus 37% of the excess over $518,400 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: S 0 $9.875 10% of taxable income S 9.875 $ 40.125 598750 plus 129 of the excess over $9.875 $ 40.125 S SS 525 $4.617 50 plus 229 of the excess over $40.125 S 85.525 S163 300 $14,605 50 plus 24% of the excess over $83.525 S163,300 $207350 $33,271 50 plus 329 of the excess ostes S163 300 $207 350 5311,025 S47367 50 plus 35 of the excess over $207 350 S311.025 583.65325 plus 37% of the excess over $311025