Answered step by step

Verified Expert Solution

Question

1 Approved Answer

+ 86% 8 20:02 Read Only - You can't save changes to t... 6. ABC Ltd. is a company that owns a pine tree plantation.

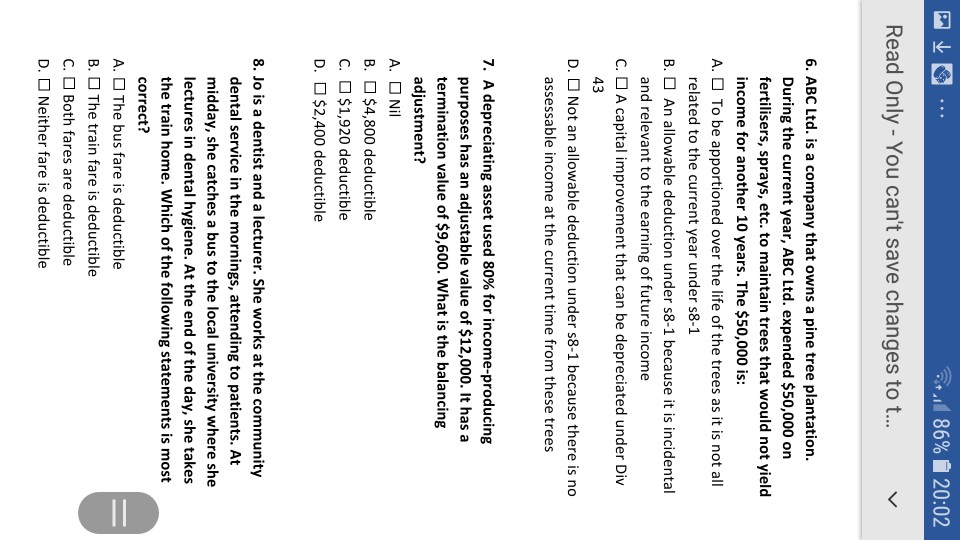

+ 86% 8 20:02 Read Only - You can't save changes to t... 6. ABC Ltd. is a company that owns a pine tree plantation. During the current year, ABC Ltd. expended $50,000 on fertilisers, sprays, etc. to maintain trees that would not yield income for another 10 years. The $50,000 is: A. O To be apportioned over the life of the trees as it is not all related to the current year under s8-1 B. O An allowable deduction under s8-1 because it is incidental and relevant to the earning of future income C. A capital improvement that can be depreciated under Div 43 D. O Not an allowable deduction under s8-1 because there is no assessable income at the current time from these trees 7. A depreciating asset used 80% for income-producing purposes has an adjustable value of $12,000. It has a termination value of $9,600. What is the balancing adjustment? A. Nil B. O $4,800 deductible C. $1,920 deductible D. $2,400 deductible 8. Jo is a dentist and a lecturer. She works at the community dental service in the mornings, attending to patients. At midday, she catches a bus to the local university where she lectures in dental hygiene. At the end of the day, she takes the train home. Which of the following statements is most correct? A. The bus fare is deductible B. The train fare is deductible C. O Both fares are deductible D. Neither fare is deductible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started