Answered step by step

Verified Expert Solution

Question

1 Approved Answer

87% 20:00 Read Only - You can't save changes to t... Question 2 If you answer question 2, please answer question 2(a) and (b) (a)

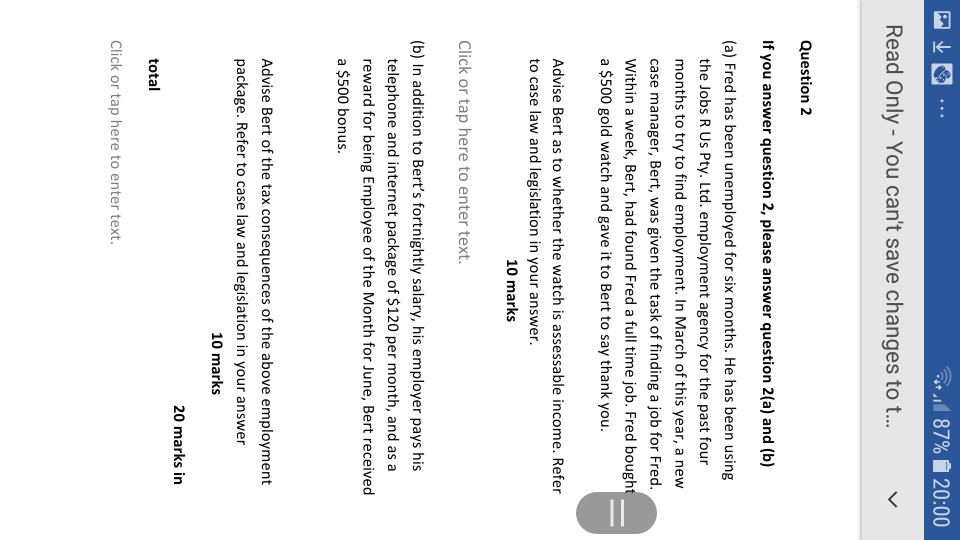

87% 20:00 Read Only - You can't save changes to t... Question 2 If you answer question 2, please answer question 2(a) and (b) (a) Fred has been unemployed for six months. He has been using the Jobs R Us Pty. Ltd. employment agency for the past four months to try to find employment. In March of this year, a new case manager, Bert, was given the task of finding a job for Fred. Within a week, Bert, had found Fred a full time job. Fred bought a $500 gold watch and gave it to Bert to say thank you. II Advise Bert as to whether the watch is assessable income. Refer to case law and legislation in your answer. 10 marks Click or tap here to enter text. (b) In addition to Bert's fortnightly salary, his employer pays his telephone and internet package of $120 per month, and as a reward for being Employee of the Month for June, Bert received a $500 bonus. Advise Bert of the tax consequences of the above employment package. Refer to case law and legislation in your answer 10 marks 20 marks in total Click or tap here to enter text. 87% 20:00 Read Only - You can't save changes to t... Question 2 If you answer question 2, please answer question 2(a) and (b) (a) Fred has been unemployed for six months. He has been using the Jobs R Us Pty. Ltd. employment agency for the past four months to try to find employment. In March of this year, a new case manager, Bert, was given the task of finding a job for Fred. Within a week, Bert, had found Fred a full time job. Fred bought a $500 gold watch and gave it to Bert to say thank you. II Advise Bert as to whether the watch is assessable income. Refer to case law and legislation in your answer. 10 marks Click or tap here to enter text. (b) In addition to Bert's fortnightly salary, his employer pays his telephone and internet package of $120 per month, and as a reward for being Employee of the Month for June, Bert received a $500 bonus. Advise Bert of the tax consequences of the above employment package. Refer to case law and legislation in your answer 10 marks 20 marks in total Click or tap here to enter text

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started