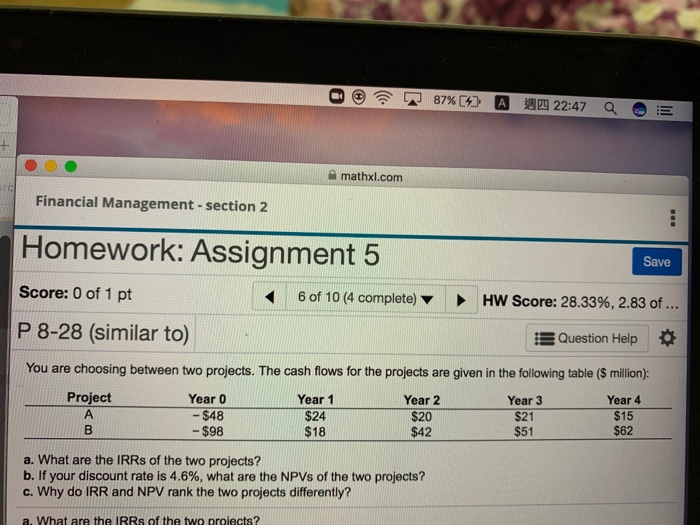

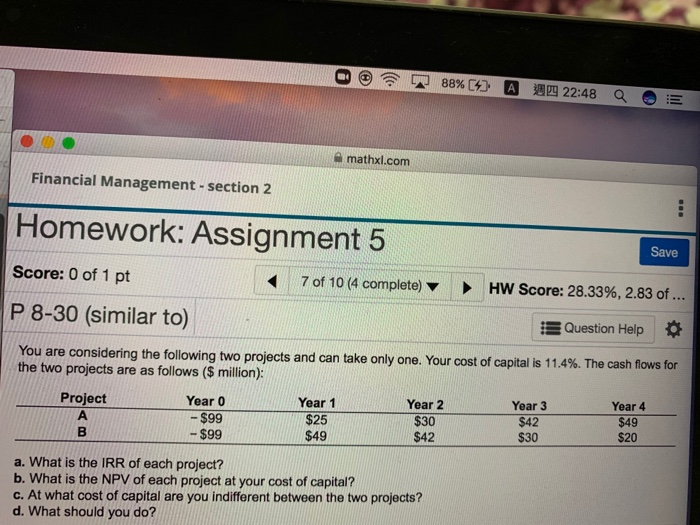

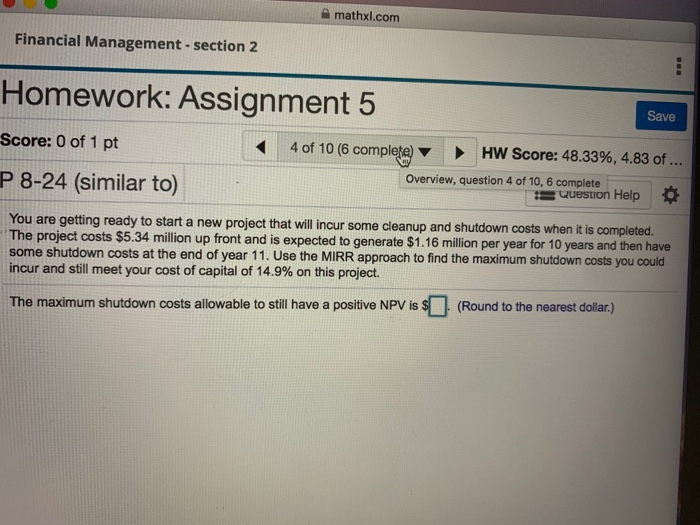

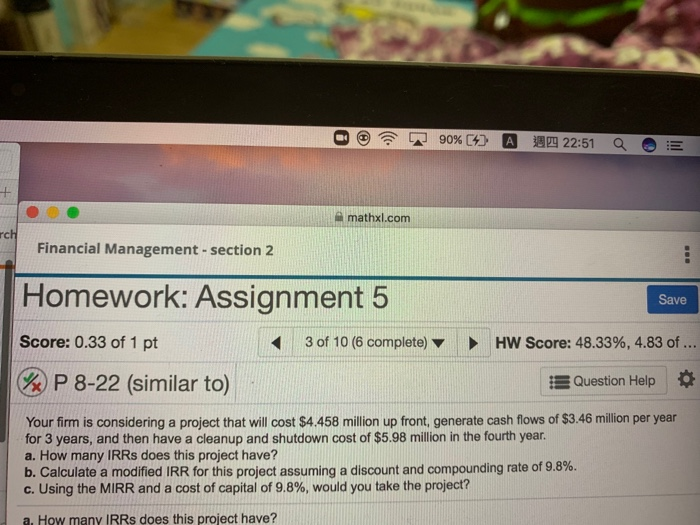

87%(%) A 29 22:47 Q E mathxl.com Financial Management - section 2 Save Homework: Assignment 5 Score: 0 of 1 pt 6 of 10 (4 complete) P 8-28 (similar to) HW Score: 28.33%, 2.83 of ... Question Help You are choosing between two projects. The cash flows for the projects are given in the following table ($ million): Project Year 0 Year 1 Year 2 -$48 $24 Year 3 $21 $51 Year 4 $15 $62 S98 $18 a. What are the IRRs of the two projects? b. If your discount rate is 4.6%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? a. What are the IRRs of the two proiects? @ 88%C43 A 29 22:48 Q E mathxl.com Financial Management - section 2 Save Homework: Assignment 5 Score: 0 of 1 pt 7 of 10 (4 complete) P 8-30 (similar to) HW Score: 28.33%, 2.83 of ... Question Help You are considering the following two projects and can take only one. Your cost of capital is 11.4%. The cash flows for the two projects are as follows ($ million): Project Year 0 - $99 Year 1 $25 $49 Year 2 $30 $42 Year 3 $42 $30 - $99 Year 4 $49 $20 a. What is the IRR of each project? b. What is the NPV of each project at your cost of capital? c. At what cost of capital are you indifferent between the two projects? d. What should you do? mathxl.com Financial Management - section 2 Homework: Assignment 5 Save Score: 0 of 1 pt P 8-24 (similar to) 4 of 10 (6 complete) HW Score: 48.33%, 4.83 of ... Overview, question 4 of 10,6 complete B Wuestion Help You are getting ready to start a new project that will incur some cleanup and shutdown costs when it is completed. The project costs $5.34 million up front and is expected to generate $1.16 million per year for 10 years and then have some shutdown costs at the end of year 11. Use the MIRR approach to find the maximum shutdown costs you could incur and still meet your cost of capital of 14.9% on this project. The maximum shutdown costs allowable to still have a positive NPV is $ (Round to the nearest dollar.) 90% [4] A 209 22:51 a E + mathxl.com Financial Management - section 2 Homework: Assignment 5 Save Score: 0.33 of 1 pt 3 of 10 (6 complete) HW Score: 48.33%, 4.83 of ... WP 8-22 (similar to) Question Help Your firm is considering a project that will cost $4.458 million up front, generate cash flows of $3.46 million per year for 3 years, and then have a cleanup and shutdown cost of $5.98 million in the fourth year. a. How many IRRs does this project have? b. Calculate a modified IRR for this project assuming a discount and compounding rate of 9.8%. c. Using the MIRR and a cost of capital of 9.8%, would you take the project? a. How many IRRs does this project have