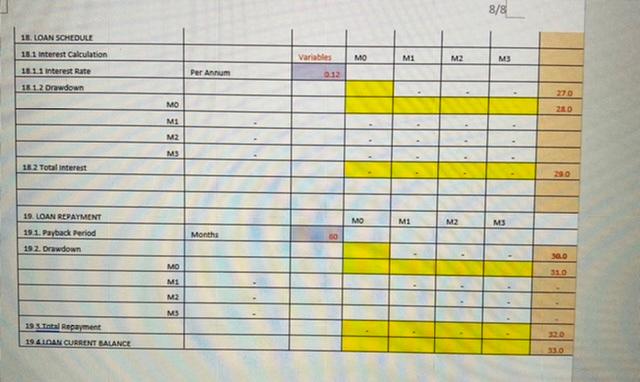

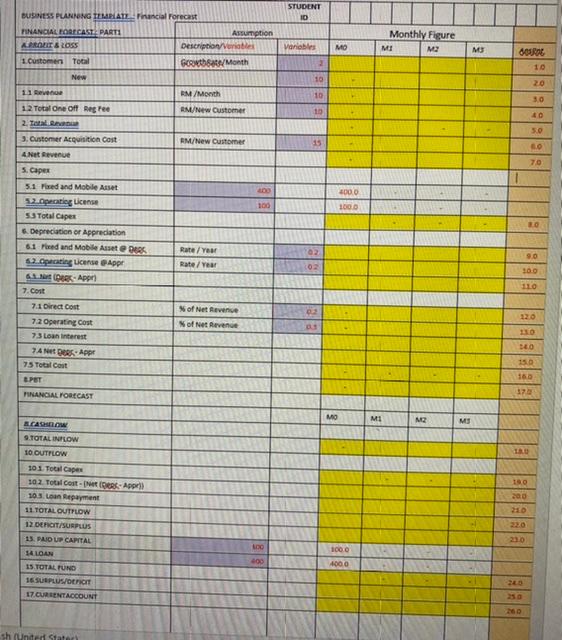

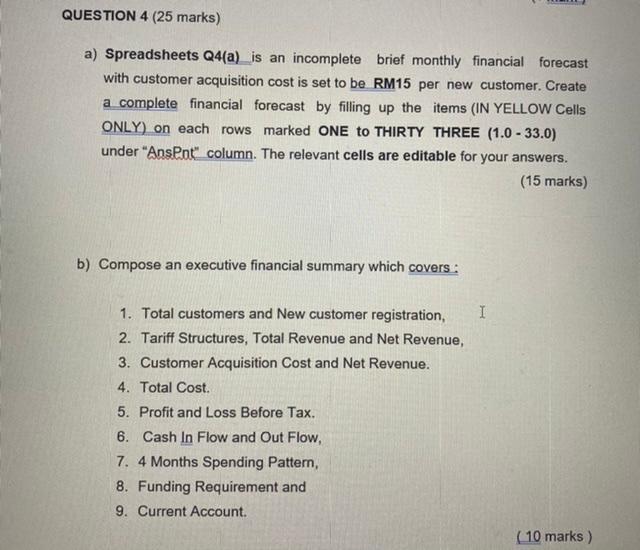

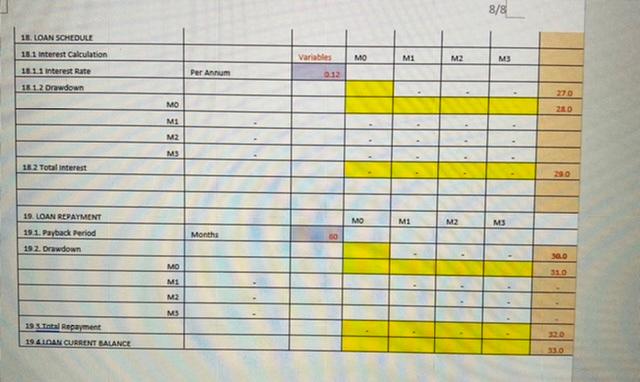

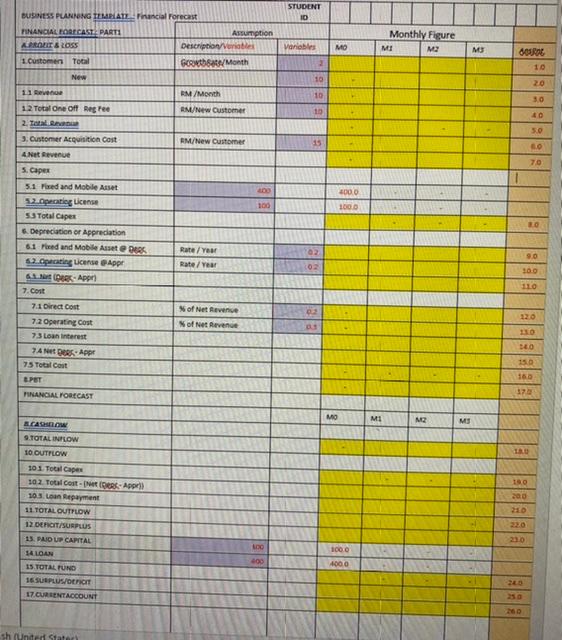

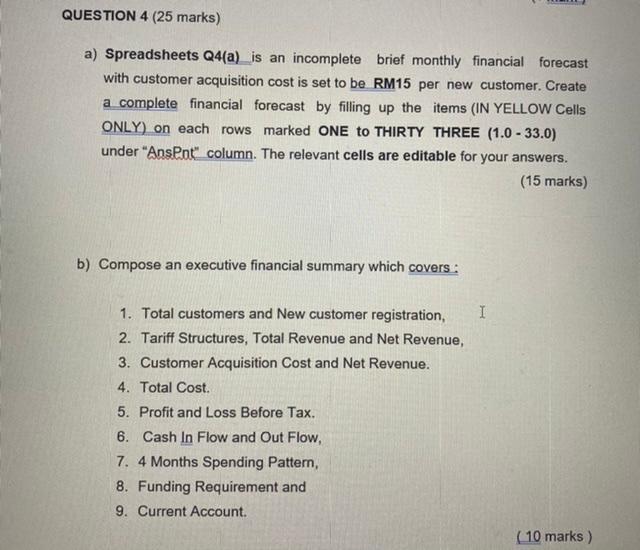

8/8 16. LOAN SCHEDULE 15. Interest Calculation MO MI M2 M Variables 0:12 18 11 Interest Rate Per Annum 18 12 Drawdown MO ME M2 M3 1 2 Total interest 19. LOAN REPAYMENT MO M1 M2 MS 19 1. Payback Period Months 192. Drawdown 30.0 MO 310 MI MZ MS 19 Total Repayment 1941NAN CURRENT BALANCE STUDENT 10 BUSINESS PLANNING TIME ATL. Financial Forecast PINANCIAL FORECAST. PARTI Assumption AEROU & Loss in thi HH Customer Total Gowthat/Month New Monthly Figure MI MU Variables MO M Gospa 10 20 11 Revue 10 AM /Month RM/New Customer 3.0 10 AM/New Customer 15 9191919 1000 1000 30 12 Total One Off Regree 2. Total 3. Customer Acquisition Cost 4 Net Revenue 5. Caper 5.1 Med and Mobile Asset 12. Opatieg License 53 Total Caper 6. Depreciation of Appreciation 61 Med and Mobile Asset DER 6.2.aparating License Appr 6.1. (OR Appr 7. Cost 7.1 Direct Cost 72 Operating cost 73 Loan interest 7AN BERS App 75 Total Cost EPET Rate / Year Rate / Year 90 02 110 of Net Revenue of Net Revenue DEO 15.0 FINANCIAL FORECAST 170 MO MI MZ ACADOW M 9.TOTAL INFLOW 10 OUTFLOW ISO 200 101. Total Cape 302. Total cost-e-April) 103. Lo Repayment 11. TOTAL OUTFLOW 12 DICIT/SURPLUS 15. PAID UP CAPITAL 230 14 LOAN 1000 200 15 TOTAL FUND 16 SURPLUS/DEFICIT 17. CURRENT ACCOUNT 260 sh (United States QUESTION 4 (25 marks) a) Spreadsheets Q4(a) is an incomplete brief monthly financial forecast with customer acquisition cost is set to be RM15 per new customer. Create a complete financial forecast by filling up the items (IN YELLOW Cells ONLY) on each rows marked ONE to THIRTY THREE (1.0 - 33.0) under "AnsPot" column. The relevant cells are editable for your answers. (15 marks) b) Compose an executive financial summary which covers : I 1. Total customers and New customer registration, 2. Tariff Structures, Total Revenue and Net Revenue, 3. Customer Acquisition Cost and Net Revenue. 4. Total Cost. 5. Profit and Loss Before Tax. 6. Cash Flow nd Out Flow, 7. 4 Months Spending Pattern, 8. Funding Requirement and 9. Current Account (10 marks) 8/8 16. LOAN SCHEDULE 15. Interest Calculation MO MI M2 M Variables 0:12 18 11 Interest Rate Per Annum 18 12 Drawdown MO ME M2 M3 1 2 Total interest 19. LOAN REPAYMENT MO M1 M2 MS 19 1. Payback Period Months 192. Drawdown 30.0 MO 310 MI MZ MS 19 Total Repayment 1941NAN CURRENT BALANCE STUDENT 10 BUSINESS PLANNING TIME ATL. Financial Forecast PINANCIAL FORECAST. PARTI Assumption AEROU & Loss in thi HH Customer Total Gowthat/Month New Monthly Figure MI MU Variables MO M Gospa 10 20 11 Revue 10 AM /Month RM/New Customer 3.0 10 AM/New Customer 15 9191919 1000 1000 30 12 Total One Off Regree 2. Total 3. Customer Acquisition Cost 4 Net Revenue 5. Caper 5.1 Med and Mobile Asset 12. Opatieg License 53 Total Caper 6. Depreciation of Appreciation 61 Med and Mobile Asset DER 6.2.aparating License Appr 6.1. (OR Appr 7. Cost 7.1 Direct Cost 72 Operating cost 73 Loan interest 7AN BERS App 75 Total Cost EPET Rate / Year Rate / Year 90 02 110 of Net Revenue of Net Revenue DEO 15.0 FINANCIAL FORECAST 170 MO MI MZ ACADOW M 9.TOTAL INFLOW 10 OUTFLOW ISO 200 101. Total Cape 302. Total cost-e-April) 103. Lo Repayment 11. TOTAL OUTFLOW 12 DICIT/SURPLUS 15. PAID UP CAPITAL 230 14 LOAN 1000 200 15 TOTAL FUND 16 SURPLUS/DEFICIT 17. CURRENT ACCOUNT 260 sh (United States QUESTION 4 (25 marks) a) Spreadsheets Q4(a) is an incomplete brief monthly financial forecast with customer acquisition cost is set to be RM15 per new customer. Create a complete financial forecast by filling up the items (IN YELLOW Cells ONLY) on each rows marked ONE to THIRTY THREE (1.0 - 33.0) under "AnsPot" column. The relevant cells are editable for your answers. (15 marks) b) Compose an executive financial summary which covers : I 1. Total customers and New customer registration, 2. Tariff Structures, Total Revenue and Net Revenue, 3. Customer Acquisition Cost and Net Revenue. 4. Total Cost. 5. Profit and Loss Before Tax. 6. Cash Flow nd Out Flow, 7. 4 Months Spending Pattern, 8. Funding Requirement and 9. Current Account (10 marks)