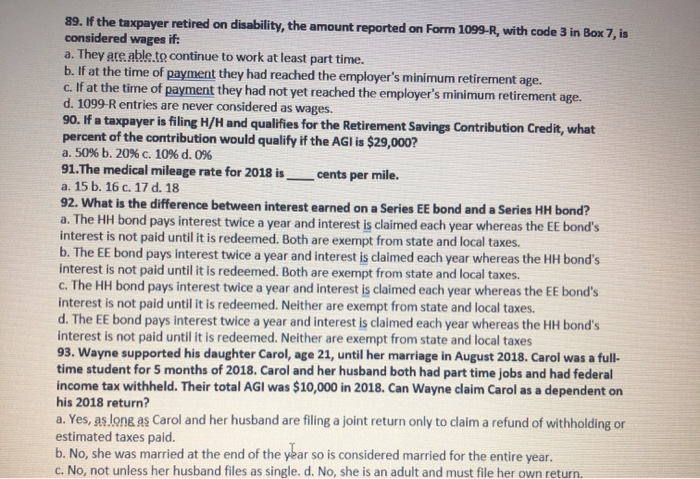

89. If the taxpayer retired on disability, the amount reported on Form 1099-R, with code 3 in Box 7, is considered wages if: a. They are able to continue to work at least part time. b. If at the time of payment they had reached the employer's minimum retirement age. c. If at the time of payment they had not yet reached the employer's minimum retirement age. d. 1099-R entries are never considered as wages. 90. If a taxpayer is filing H/H and qualifies for the Retirement Savings Contribution Credit, what percent of the contribution would qualify if the AGI is $29,000? a. 50% b. 20% c. 10% d. 0% 91. The medical mileage rate for 2018 is_cents per mile. a. 15 b. 16 c. 17 d. 18 92. What is the difference between interest earned on a Series EE bond and a Series HH bond? a. The HH bond pays interest twice a year and interest is claimed each year whereas the EE bond's interest is not paid until it is redeemed. Both are exempt from state and local taxes. b. The EE bond pays interest twice a year and interest is claimed each year whereas the HH bond's interest is not paid until it is redeemed. Both are exempt from state and local taxes. c. The HH bond pays interest twice a year and interest is claimed each year whereas the EE bond's interest is not paid until it is redeemed. Neither are exempt from state and local taxes. d. The EE bond pays interest twice a year and interest is claimed each year whereas the HH bond's interest is not paid until it is redeemed. Neither are exempt from state and local taxes 93. Wayne supported his daughter Carol, age 21, until her marriage in August 2018. Carol was a full time student for 5 months of 2018. Carol and her husband both had part time jobs and had federal income tax withheld. Their total AGI was $10,000 in 2018. Can Wayne claim Carol as a dependent on his 2018 return? a. Yes, as long as Carol and her husband are filing a joint return only to claim a refund of withholding or estimated taxes paid. b. No, she was married at the end of the year so is considered married for the entire year. c. No, not unless her husband files as single. d. No, she is an adult and must file her own return