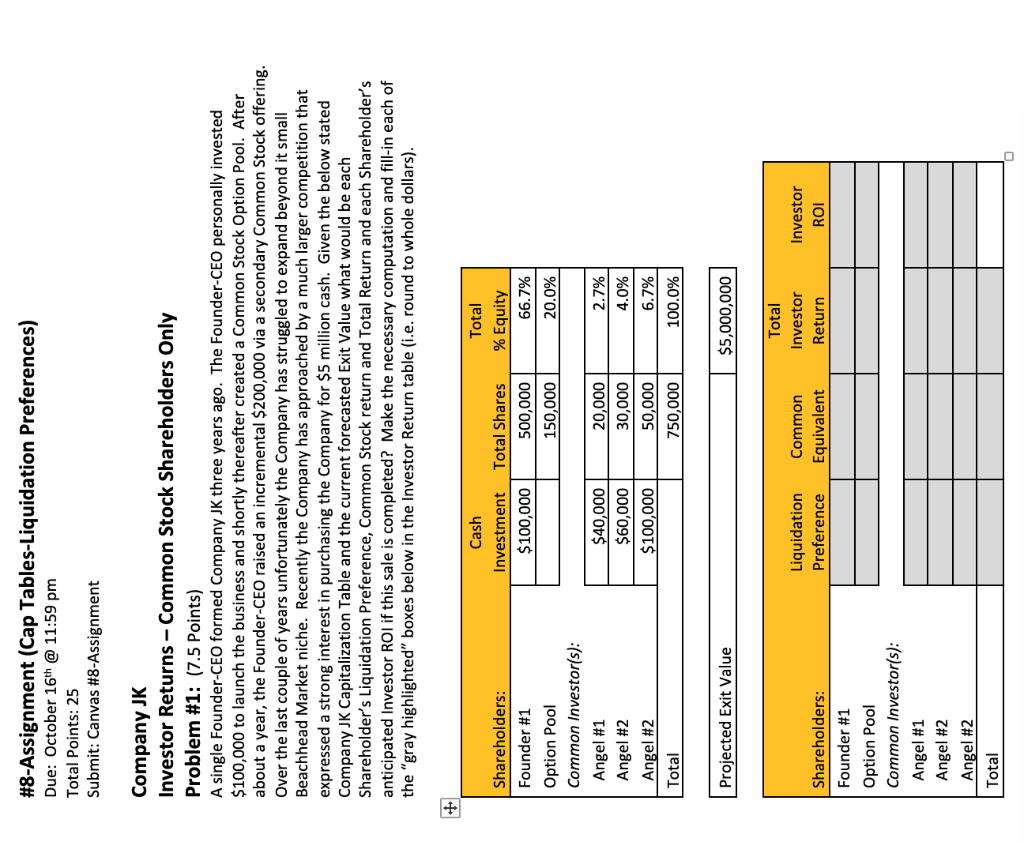

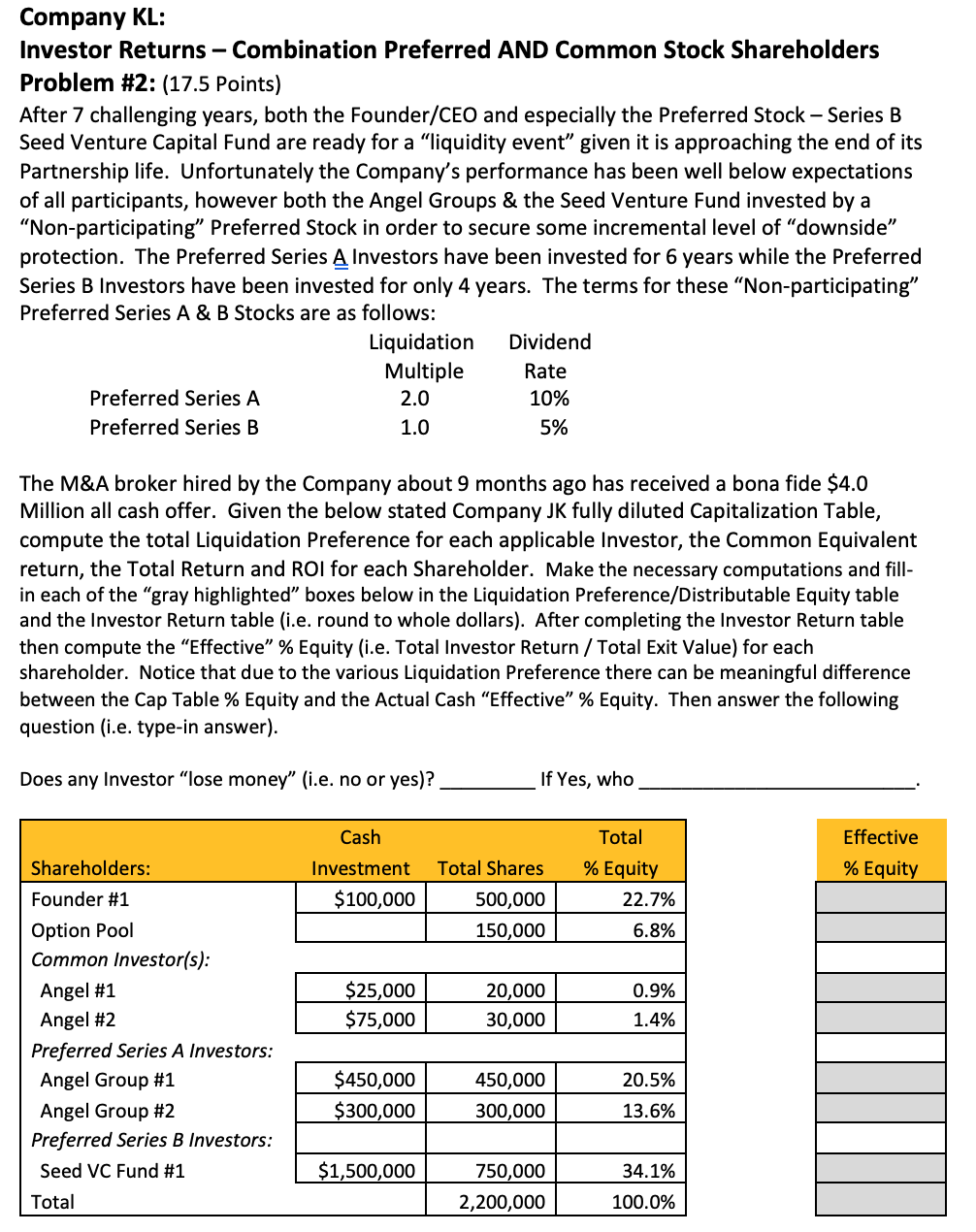

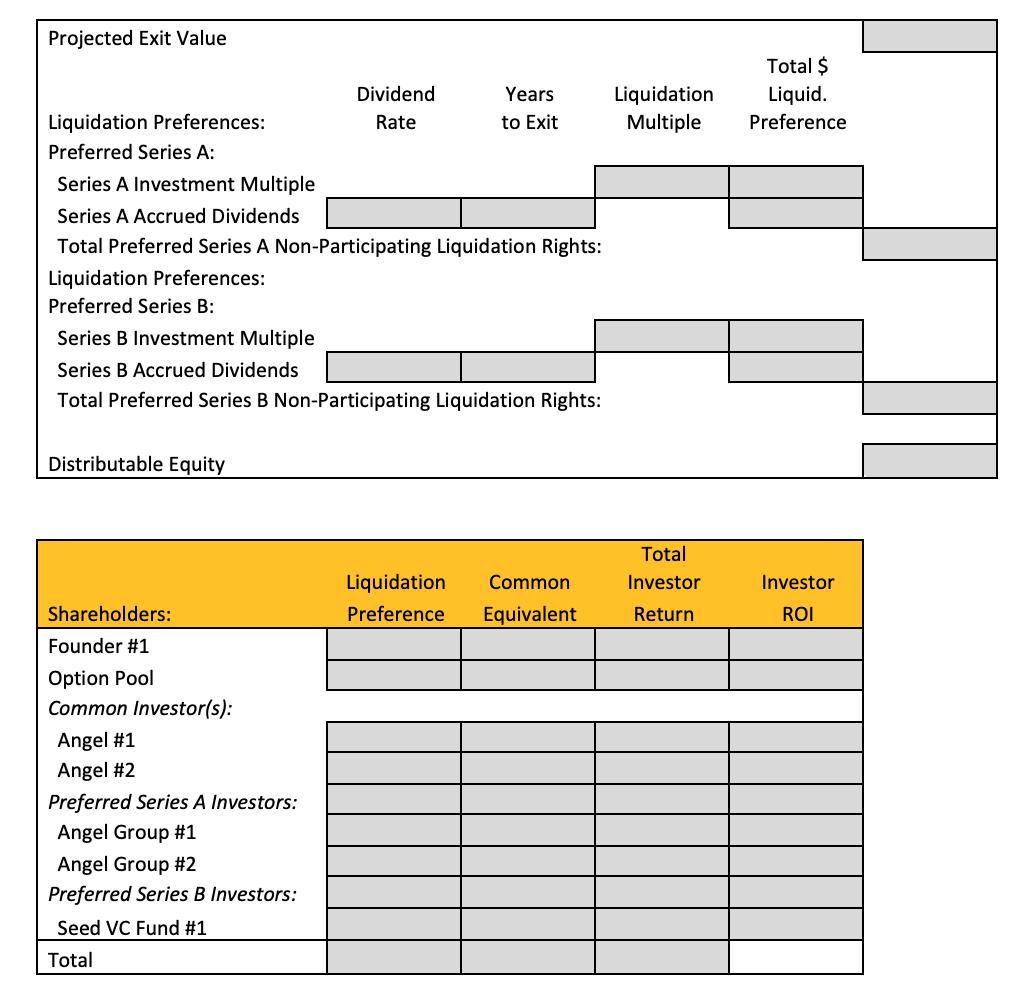

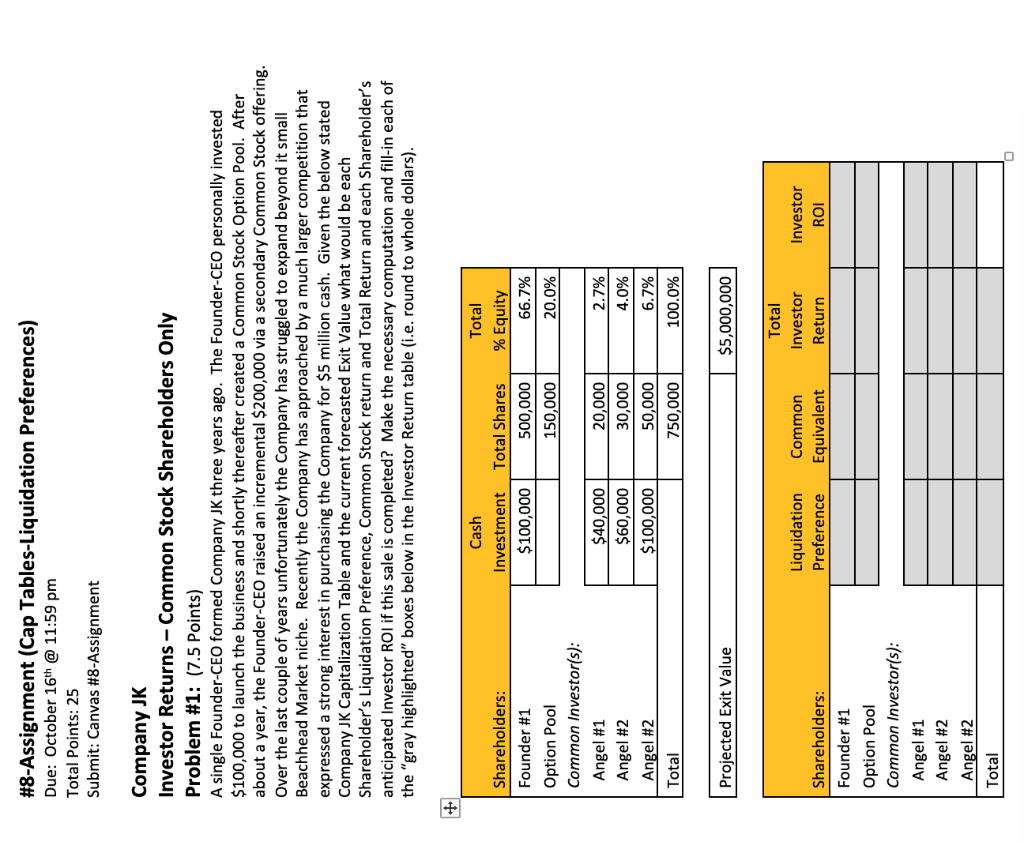

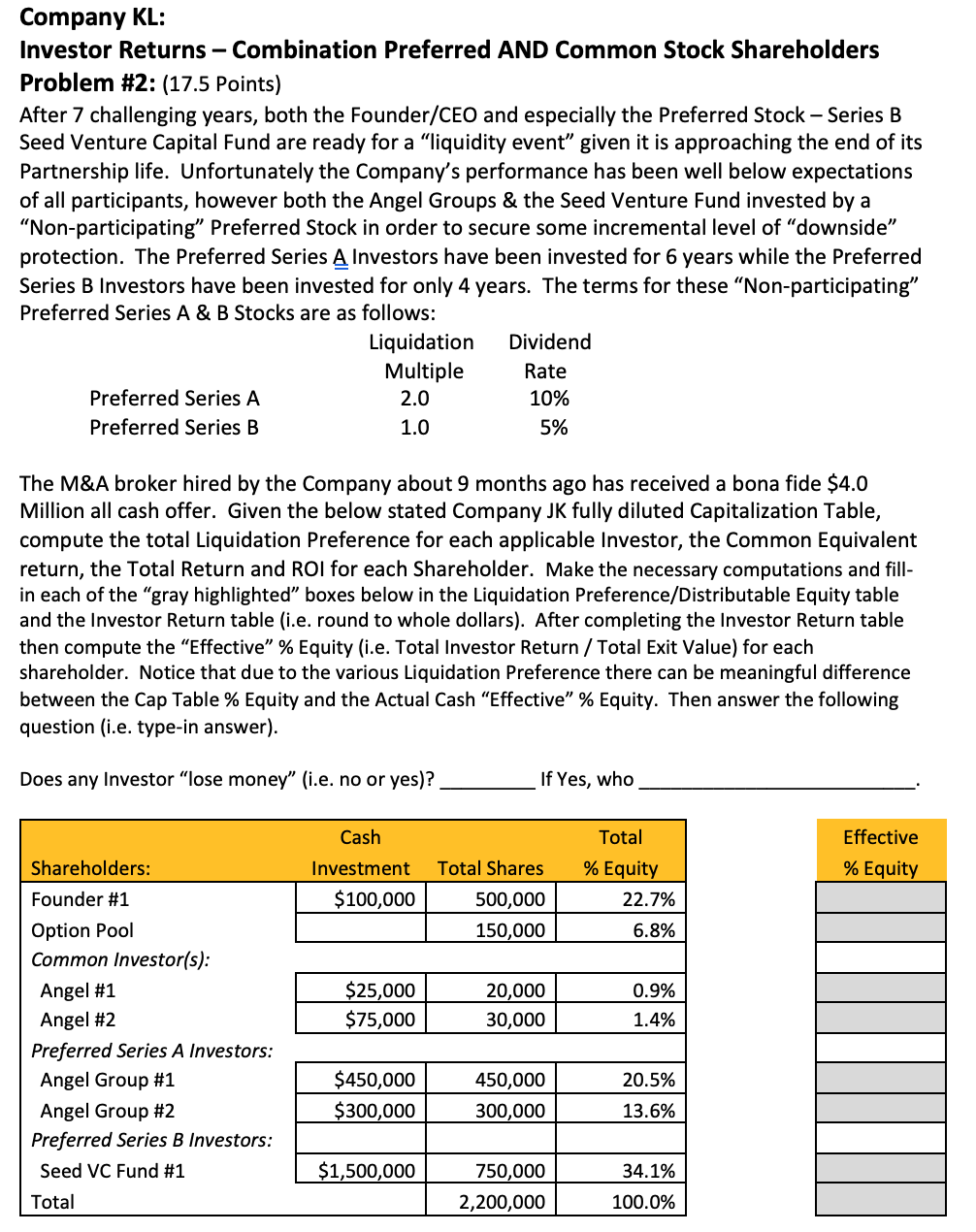

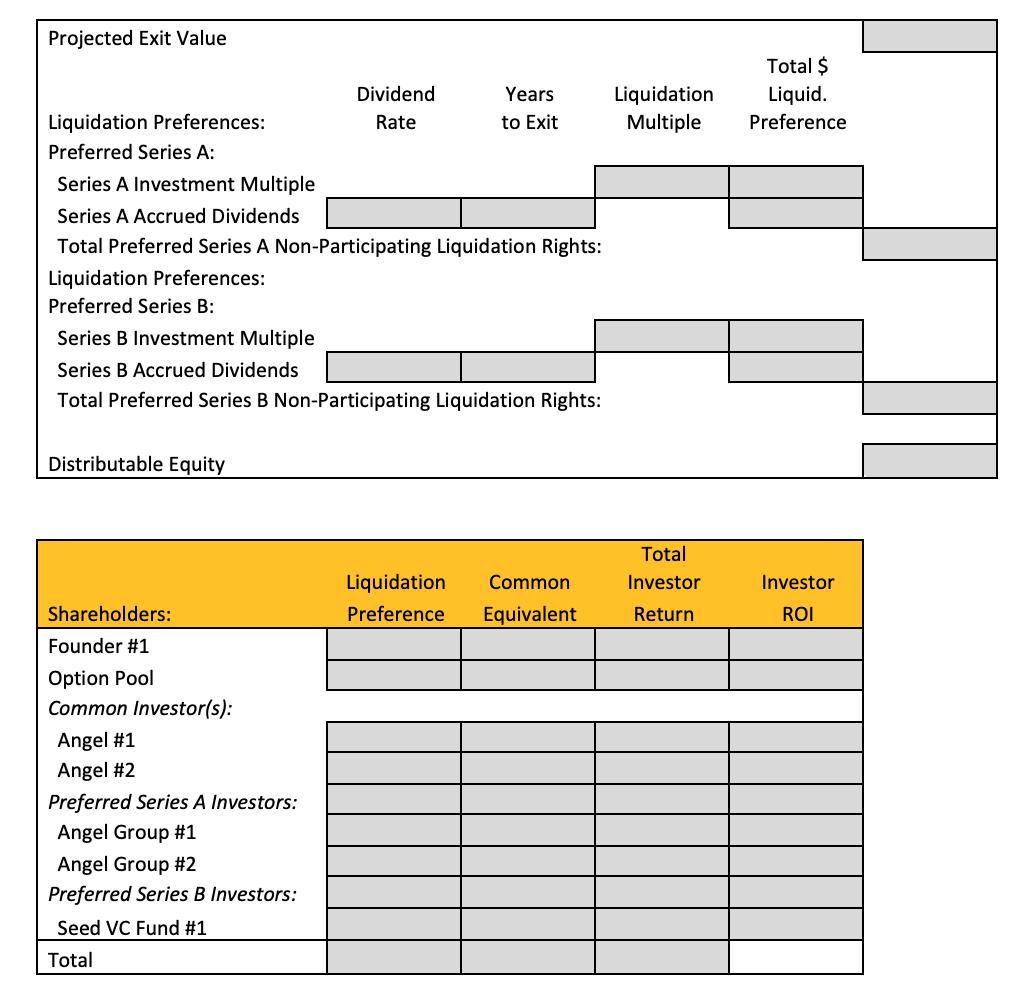

#8-Assignment (Cap Tables-Liquidation Preferences) Due: October 16th @ 11:59 pm Total Points: 25 Submit: Canvas #8-Assignment Company JK Investor Returns - Common Stock Shareholders Only Problem #1: (7.5 Points) A single Founder-CEO formed Company JK three years ago. The Founder-CEO personally invested $100,000 to launch the business and shortly thereafter created a Common Stock Option Pool. After about a year, the Founder-CEO raised an incremental $200,000 via a secondary Common Stock offering. Over the last couple of years unfortunately the Company has struggled to expand beyond it small Beachhead Market niche. Recently the Company has approached by a much larger competition that expressed a strong interest in purchasing the Company for $5 million cash. Given the below stated Company JK Capitalization Table and the current forecasted Exit Value what would be each Shareholder's Liquidation Preference, Common Stock return and Total Return and each Shareholder's anticipated Investor ROI if this sale is completed? Make the necessary computation and fill-in each of the "gray highlighted" boxes below in the Investor Return table (i.e. round to whole dollars). Company KL: Investor Returns - Combination Preferred AND Common Stock Shareholders Problem #2: (17.5 Points) After 7 challenging years, both the Founder/CEO and especially the Preferred Stock-Series B Seed Venture Capital Fund are ready for a "liquidity event" given it is approaching the end of its Partnership life. Unfortunately the Company's performance has been well below expectations of all participants, however both the Angel Groups \& the Seed Venture Fund invested by a "Non-participating" Preferred Stock in order to secure some incremental level of "downside" protection. The Preferred Series A Investors have been invested for 6 years while the Preferred Series B Investors have been invested for only 4 years. The terms for these "Non-participating" Preferred Series A \& B Stocks are as follows: The M\&A broker hired by the Company about 9 months ago has received a bona fide $4.0 Million all cash offer. Given the below stated Company JK fully diluted Capitalization Table, compute the total Liquidation Preference for each applicable Investor, the Common Equivalent return, the Total Return and ROI for each Shareholder. Make the necessary computations and fillin each of the "gray highlighted" boxes below in the Liquidation Preference/Distributable Equity table and the Investor Return table (i.e. round to whole dollars). After completing the Investor Return table then compute the "Effective" \% Equity (i.e. Total Investor Return / Total Exit Value) for each shareholder. Notice that due to the various Liquidation Preference there can be meaningful difference between the Cap Table \% Equity and the Actual Cash "Effective" \% Equity. Then answer the following question (i.e. type-in answer). #8-Assignment (Cap Tables-Liquidation Preferences) Due: October 16th @ 11:59 pm Total Points: 25 Submit: Canvas #8-Assignment Company JK Investor Returns - Common Stock Shareholders Only Problem #1: (7.5 Points) A single Founder-CEO formed Company JK three years ago. The Founder-CEO personally invested $100,000 to launch the business and shortly thereafter created a Common Stock Option Pool. After about a year, the Founder-CEO raised an incremental $200,000 via a secondary Common Stock offering. Over the last couple of years unfortunately the Company has struggled to expand beyond it small Beachhead Market niche. Recently the Company has approached by a much larger competition that expressed a strong interest in purchasing the Company for $5 million cash. Given the below stated Company JK Capitalization Table and the current forecasted Exit Value what would be each Shareholder's Liquidation Preference, Common Stock return and Total Return and each Shareholder's anticipated Investor ROI if this sale is completed? Make the necessary computation and fill-in each of the "gray highlighted" boxes below in the Investor Return table (i.e. round to whole dollars). Company KL: Investor Returns - Combination Preferred AND Common Stock Shareholders Problem #2: (17.5 Points) After 7 challenging years, both the Founder/CEO and especially the Preferred Stock-Series B Seed Venture Capital Fund are ready for a "liquidity event" given it is approaching the end of its Partnership life. Unfortunately the Company's performance has been well below expectations of all participants, however both the Angel Groups \& the Seed Venture Fund invested by a "Non-participating" Preferred Stock in order to secure some incremental level of "downside" protection. The Preferred Series A Investors have been invested for 6 years while the Preferred Series B Investors have been invested for only 4 years. The terms for these "Non-participating" Preferred Series A \& B Stocks are as follows: The M\&A broker hired by the Company about 9 months ago has received a bona fide $4.0 Million all cash offer. Given the below stated Company JK fully diluted Capitalization Table, compute the total Liquidation Preference for each applicable Investor, the Common Equivalent return, the Total Return and ROI for each Shareholder. Make the necessary computations and fillin each of the "gray highlighted" boxes below in the Liquidation Preference/Distributable Equity table and the Investor Return table (i.e. round to whole dollars). After completing the Investor Return table then compute the "Effective" \% Equity (i.e. Total Investor Return / Total Exit Value) for each shareholder. Notice that due to the various Liquidation Preference there can be meaningful difference between the Cap Table \% Equity and the Actual Cash "Effective" \% Equity. Then answer the following question (i.e. type-in answer)