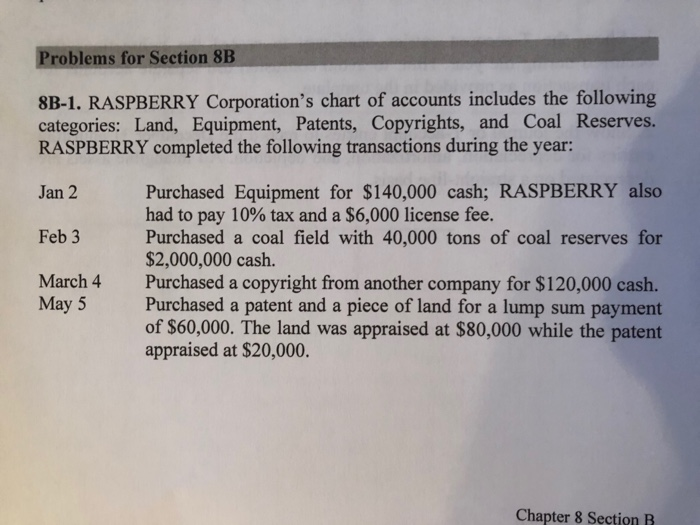

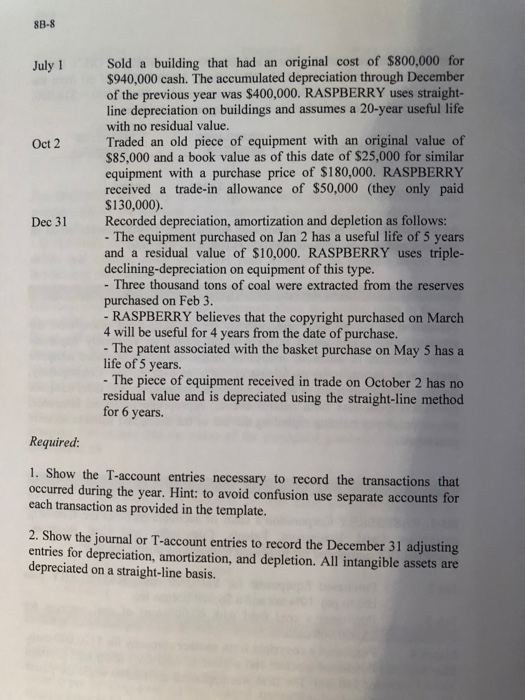

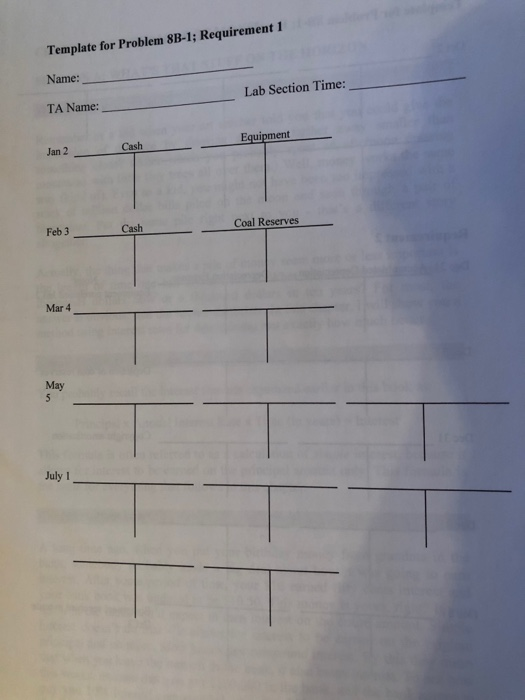

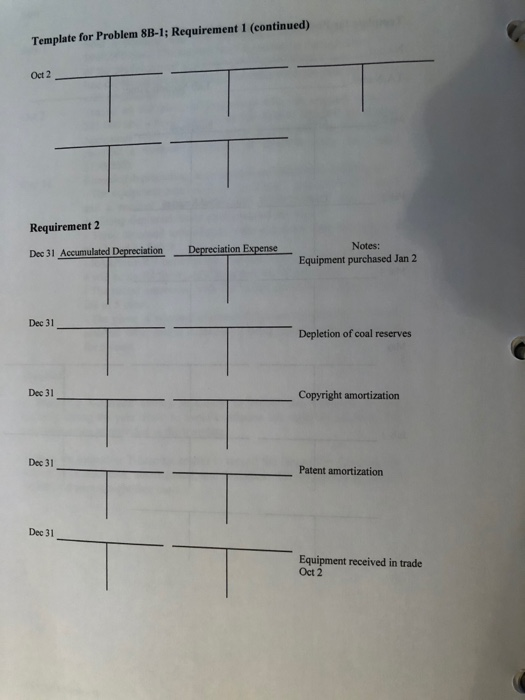

8B-8 Sold a building that had an original cost of $800,000 for $940,000 cash. The accumulated depreciation through December of the previous year was $400,000. RASPBERRY uses straight- line depreciation on buildings and assumes a 20-year useful life with no residual value. Traded an old piece of equipment with an original value of $85,000 and a book value as of this date of $25,000 for similar equipment with a purchase price of $180,000. RASPBERRY received a trade-in allowance of $50,000 (they only paid $130,000). Recorded depreciation, amortization and depletion as follows: - The equipment purchased on Jan 2 has a useful life of 5 years and a residual value of $10,000. RASPBERRY uses triple- declining-depreciation on equipment of this type. - Three thousand tons of coal were extracted from the reserves purchased on Feb 3. - RASPBERRY believes that the copyright purchased on March 4 will be useful for 4 years from the date of purchase. - The patent associated with the basket purchase on May 5 has a life of 5 years. - The piece of equipment received in trade on October 2 has no residual value and is depreciated using the straight-line method for 6 years. July1 Oct 2 Dec 31 Required: 1. Show the T-account entries necessary to record the transactions that occurred during the year. Hint: to avoid confusion use separate accounts for each transaction as provided in the template. 2. Show the journal or T-account entries to record the December 31 adjusting entries for depreciation, amortization, and depletion. All intangible assets are depreciated on a straight-line basis. Template for Problem 8B-1; Requirement 1 Name: Lab Section Time: TA Name: Equipment Cash Jan 2 Feb 3 Coal Reserves Cash Mar 4 May 5 July 1 Template for Problem 8B-1; Requirement 1 (continued) Oct 2 Requirement 2 Notes: Depreciation Expense Dec 31 Accumulated Depreciation Equipment purchased Jan 2 Dec 31 Depletion of coal reserves Dec 31 Copyright amortization Dec 31 Patent amortization Dec 31 Equipment received in trade Oct 2 8B-8 Sold a building that had an original cost of $800,000 for $940,000 cash. The accumulated depreciation through December of the previous year was $400,000. RASPBERRY uses straight- line depreciation on buildings and assumes a 20-year useful life with no residual value. Traded an old piece of equipment with an original value of $85,000 and a book value as of this date of $25,000 for similar equipment with a purchase price of $180,000. RASPBERRY received a trade-in allowance of $50,000 (they only paid $130,000). Recorded depreciation, amortization and depletion as follows: - The equipment purchased on Jan 2 has a useful life of 5 years and a residual value of $10,000. RASPBERRY uses triple- declining-depreciation on equipment of this type. - Three thousand tons of coal were extracted from the reserves purchased on Feb 3. - RASPBERRY believes that the copyright purchased on March 4 will be useful for 4 years from the date of purchase. - The patent associated with the basket purchase on May 5 has a life of 5 years. - The piece of equipment received in trade on October 2 has no residual value and is depreciated using the straight-line method for 6 years. July1 Oct 2 Dec 31 Required: 1. Show the T-account entries necessary to record the transactions that occurred during the year. Hint: to avoid confusion use separate accounts for each transaction as provided in the template. 2. Show the journal or T-account entries to record the December 31 adjusting entries for depreciation, amortization, and depletion. All intangible assets are depreciated on a straight-line basis. Template for Problem 8B-1; Requirement 1 Name: Lab Section Time: TA Name: Equipment Cash Jan 2 Feb 3 Coal Reserves Cash Mar 4 May 5 July 1 Template for Problem 8B-1; Requirement 1 (continued) Oct 2 Requirement 2 Notes: Depreciation Expense Dec 31 Accumulated Depreciation Equipment purchased Jan 2 Dec 31 Depletion of coal reserves Dec 31 Copyright amortization Dec 31 Patent amortization Dec 31 Equipment received in trade Oct 2