Question

8.-Congress is considering legislation to implement a tax on CO 2 emissions.You have been hired as a consultant by the Aluminum Producers Association (APA) to

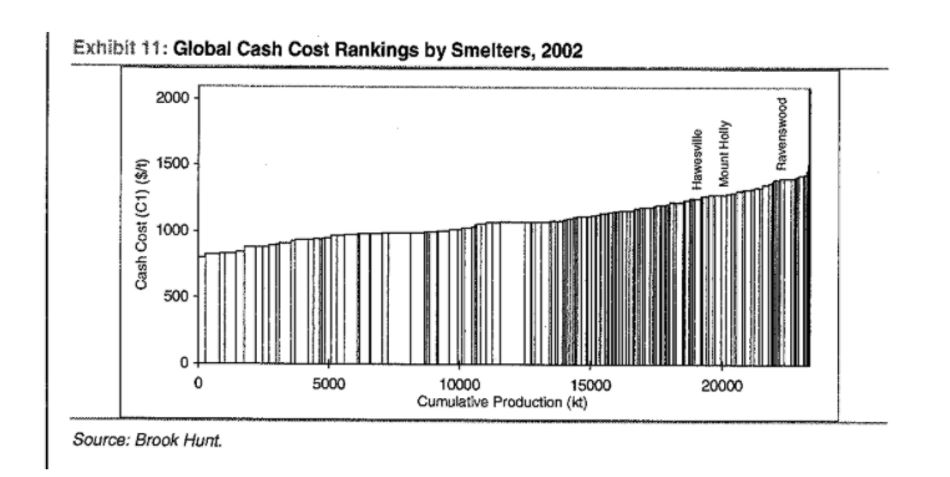

8.-Congress is considering legislation to implement a tax on CO2emissions.You have been hired as a consultant by the Aluminum Producers Association (APA) to help them figure out which of several approaches under consideration would be best for aluminum smelters .Approximately 7 tons ofCO2are emitted for each ton of aluminum produced.The three approaches under consideration are:

1.A system in which firms would be required to purchase a license for each ton of CO2There would be a fixed number of licenses available which would cap the amount of CO2emissions (the Cap Level).The price of the licenses would be determined in an auction.A few targeted industries deemed essential to national security (including aluminum smelters) would be allocated licenses for free.The licenses would be tradable so that if a company in a targeted industry chose to produce at a level that resulted in more emissions than its allocation, the company could purchase more licenses from other companies that received an allocation but chose not to use them.

2.A tax of $25 on each ton of CO2emitted for all CO2emitters in the country . The $25 level for the tax was chosen because it is expected to bring emissions down to the Cap Level.

3.A fixed tax on each smelter (or other emitter) equal to $25 times however many tons of CO2were emitted by that smelter in last year (2019).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started