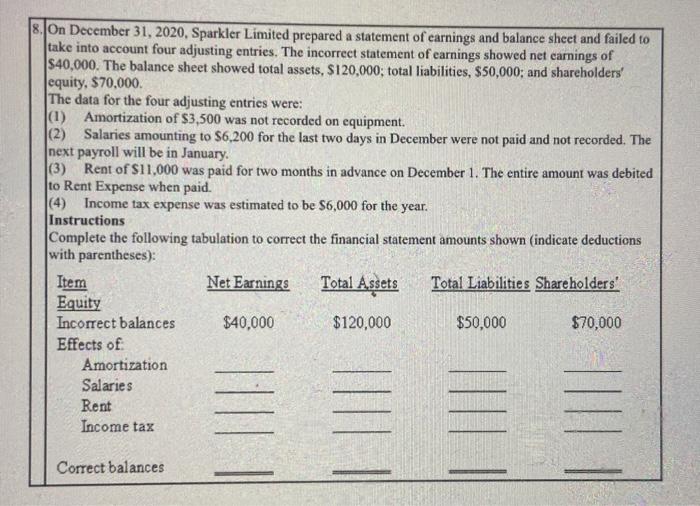

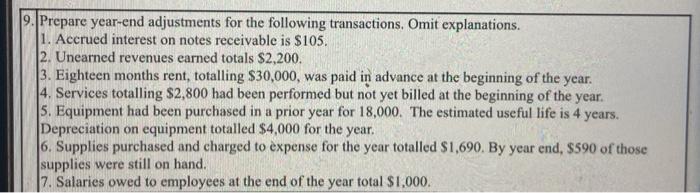

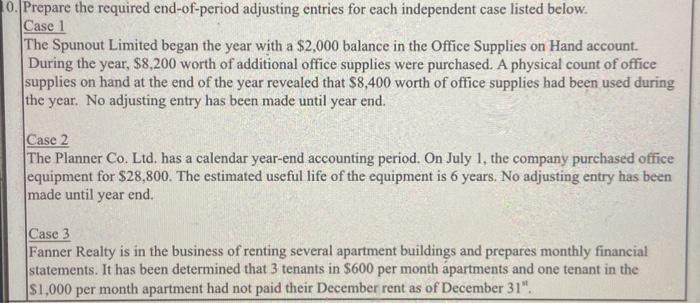

8.JOn December 31, 2020, Sparkler Limited prepared a statement of earnings and balance sheet and failed to take into account four adjusting entries. The incorrect statement of earnings showed net carnings of $40,000. The balance sheet showed total assets, $120,000; total liabilities, $50,000; and shareholders' equity, $70,000 The data for the four adjusting entries were: (1) Amortization of $3,500 was not recorded on equipment. (2) Salaries amounting to $6,200 for the last two days in December were not paid and not recorded. The next payroll will be in January (3) Rent of $11,000 was paid for two months in advance on December 1. The entire amount was debited to Rent Expense when paid. (4) Income tax expense was estimated to be $6,000 for the year. Instructions Complete the following tabulation to correct the financial statement amounts shown (indicate deductions with parentheses): Item Net Earnings Total Assets Total Liabilities Shareholders' Equity Incorrect balances $40,000 $120,000 $50,000 $70,000 Effects of Amortization Salaries Rent Income tax | ITAL Correct balances 9. Prepare year-end adjustments for the following transactions. Omit explanations. 1. Accrued interest on notes receivable is $105. 2. Unearned revenues earned totals $2,200. 3. Eighteen months rent, totalling $30,000, was paid in advance at the beginning of the year. 4. Services totalling $2,800 had been performed but not yet billed at the beginning of the year. 5. Equipment had been purchased in a prior year for 18,000. The estimated useful life is 4 years. Depreciation on equipment totalled $4,000 for the year. 6. Supplies purchased and charged to expense for the year totalled $1,690. By year end, $590 of those supplies were still on hand. 17. Salaries owed to employees at the end of the year total $1,000. 10. Prepare the required end-of-period adjusting entries for each independent case listed below. Case 1 The Spunout Limited began the year with a $2,000 balance in the Office Supplies on Hand account During the year, $8,200 worth of additional office supplies were purchased. A physical count of office supplies on hand at the end of the year revealed that $8,400 worth of office supplies had been used during the year. No adjusting entry has been made until year end. Case 2 The Planner Co. Ltd. has a calendar year-end accounting period. On July 1, the company purchased office equipment for $28,800. The estimated useful life of the equipment is 6 years. No adjusting entry has been made until year end. Case 3 Fanner Realty is in the business of renting several apartment buildings and prepares monthly financial statements. It has been determined that 3 tenants in $600 per month apartments and one tenant in the $1,000 per month apartment had not paid their December rent as of December 31