Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9 - 12b please provide the correct answers for the answers i have marked X in red below: please fill this out using the same

9 - 12b

please provide the correct answers for the answers i have marked X in red below:

please fill this out using the same exact format:

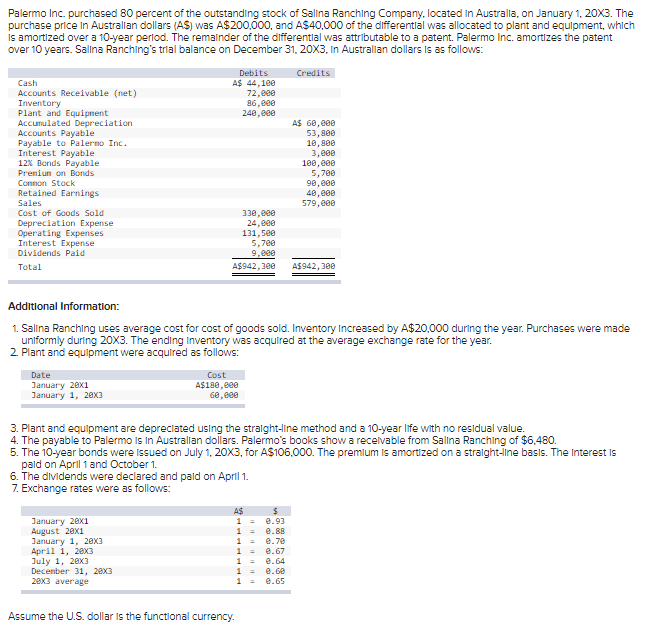

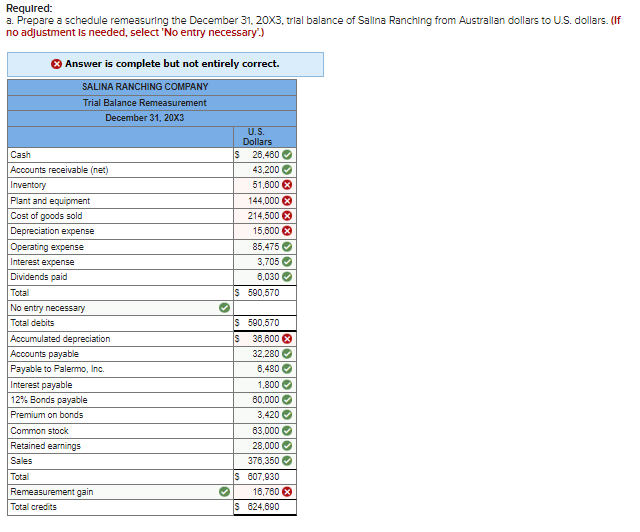

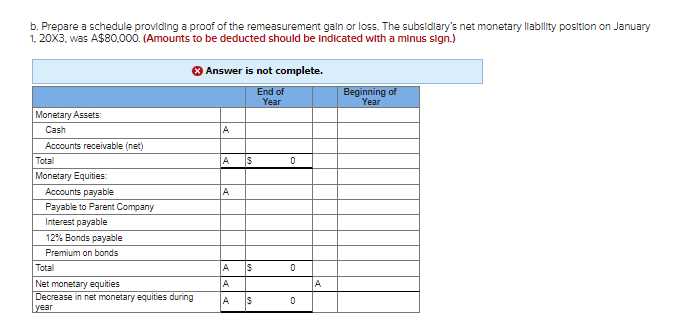

Palermo Inc. purchased 80 percent of the outstanding stock of Salina Ranching Company, Iocated in Australla, on January 1, 20X3. The purchase price in Australlan dollars (AS) was A $200,000, and A$40,000 of the dlfferentlal was allocated to plant and equipment, which is amortized over a 10-year perlod. The remainder of the differentlal was attrlbutable to a patent. Palermo Inc. amortizes the patent over 10 years. Salina Ranching's trial balance on December 31, 20X3, In Australlan dollars is as follows: Additional Information: 1. Salina Ranching uses average cost for cost of goods sold. Inventory Increased by A$20,000 during the year. Purchases were made unlformly during 203. The ending Inventory was acquired at the average exchange rate for the year. 2. Plant and equipment were acquired as follows: 3. Plant and equipment are depreclated using the straight-IIne method and a 10-year life with no residual value. 4. The payable to Palermo is in Australlan dollars. Palermo's books show a recelvable from Salina Ranching of $6,480. 5. The 10-year bonds were Issued on July 1,203, for A$106,000. The premlum is amortized on a stralght-Iine basis. The interest is pald on April 1 and October 1. 6. The dividends were declared and pald on April 1. 7. Exchange rates were as follows: Assume the U.S. dollar is the functional currency. Required: a. Prepare a schedule remeasuring the December 31, 20X3, tral balance of Salina Ranching from Australlan dollars to U.S. dollars. (If no adjustment is needed, select 'No entry necessary'.) b. Prepare a schedule providing a proof of the remeasurement gain or loss. The subsidlary's net monetary liability position on January 1, 20X3, was A$80,000. (Amounts to be deducted should be indicated with a minus sign.)

Palermo Inc. purchased 80 percent of the outstanding stock of Salina Ranching Company, Iocated in Australla, on January 1, 20X3. The purchase price in Australlan dollars (AS) was A $200,000, and A$40,000 of the dlfferentlal was allocated to plant and equipment, which is amortized over a 10-year perlod. The remainder of the differentlal was attrlbutable to a patent. Palermo Inc. amortizes the patent over 10 years. Salina Ranching's trial balance on December 31, 20X3, In Australlan dollars is as follows: Additional Information: 1. Salina Ranching uses average cost for cost of goods sold. Inventory Increased by A$20,000 during the year. Purchases were made unlformly during 203. The ending Inventory was acquired at the average exchange rate for the year. 2. Plant and equipment were acquired as follows: 3. Plant and equipment are depreclated using the straight-IIne method and a 10-year life with no residual value. 4. The payable to Palermo is in Australlan dollars. Palermo's books show a recelvable from Salina Ranching of $6,480. 5. The 10-year bonds were Issued on July 1,203, for A$106,000. The premlum is amortized on a stralght-Iine basis. The interest is pald on April 1 and October 1. 6. The dividends were declared and pald on April 1. 7. Exchange rates were as follows: Assume the U.S. dollar is the functional currency. Required: a. Prepare a schedule remeasuring the December 31, 20X3, tral balance of Salina Ranching from Australlan dollars to U.S. dollars. (If no adjustment is needed, select 'No entry necessary'.) b. Prepare a schedule providing a proof of the remeasurement gain or loss. The subsidlary's net monetary liability position on January 1, 20X3, was A$80,000. (Amounts to be deducted should be indicated with a minus sign.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started