Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. (14 points) A local restaurant is trying to evaluate opening a new location. This location is in a completely different neighborhood, and they

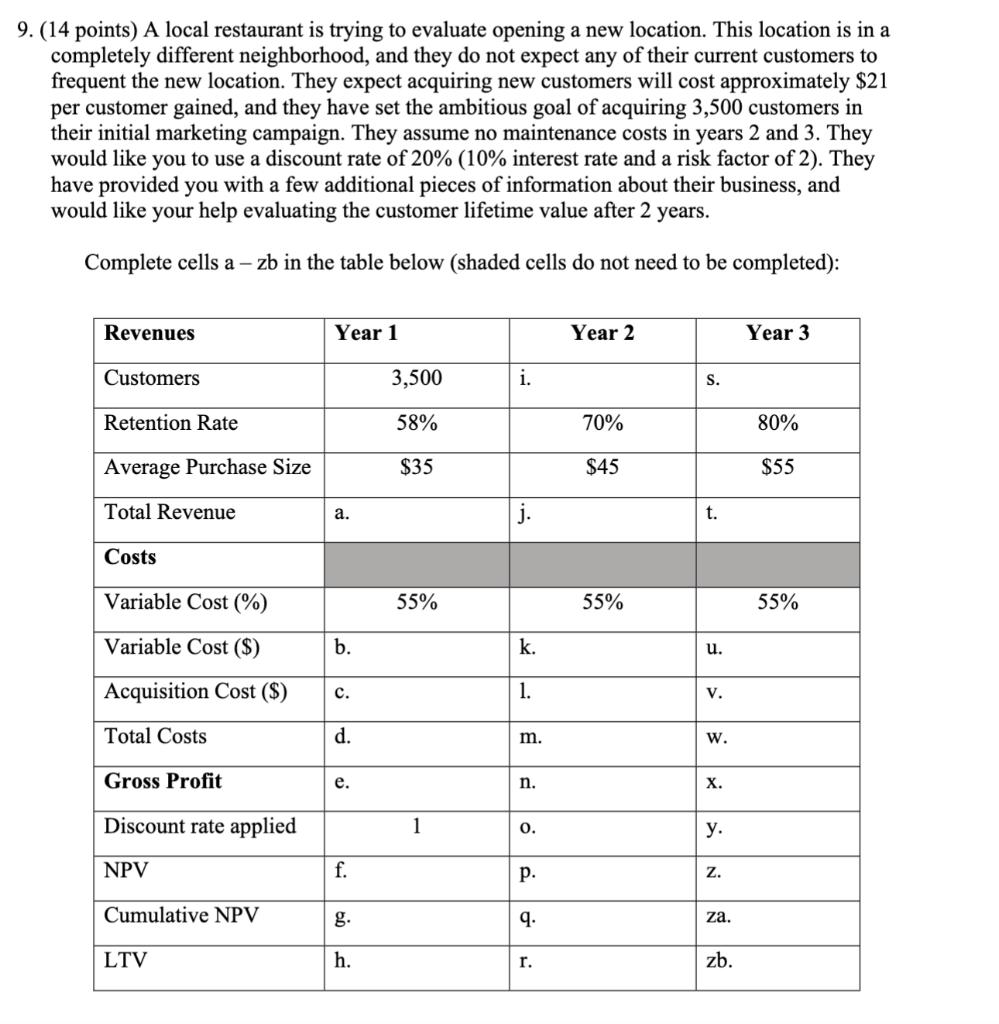

9. (14 points) A local restaurant is trying to evaluate opening a new location. This location is in a completely different neighborhood, and they do not expect any of their current customers to frequent the new location. They expect acquiring new customers will cost approximately $21 per customer gained, and they have set the ambitious goal of acquiring 3,500 customers in their initial marketing campaign. They assume no maintenance costs in years 2 and 3. They would like you to use a discount rate of 20% (10% interest rate and a risk factor of 2). They have provided you with a few additional pieces of information about their business, and would like your help evaluating the customer lifetime value after 2 years. Complete cells a - zb in the table below (shaded cells do not need to be completed): Revenues Year 1 Year 2 Year 3 Customers 3,500 i. Retention Rate 58% 70% 80% Average Purchase Size $35 $45 $55 Total Revenue j. Costs Variable Cost (%) 55% 55% 55% Variable Cost ($) k. Acquisition Cost ($) 1. Total Costs m. Gross Profit n. Discount rate applied O. NPV P. Cumulative NPV q. LTV r. a. b. C. d. e. f. g. h. 1 S. t. u. V. W. X. y. Z. za. zb.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Revenues Year 1 Year 2 Year 3 Customers 3500 2030 1421 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started