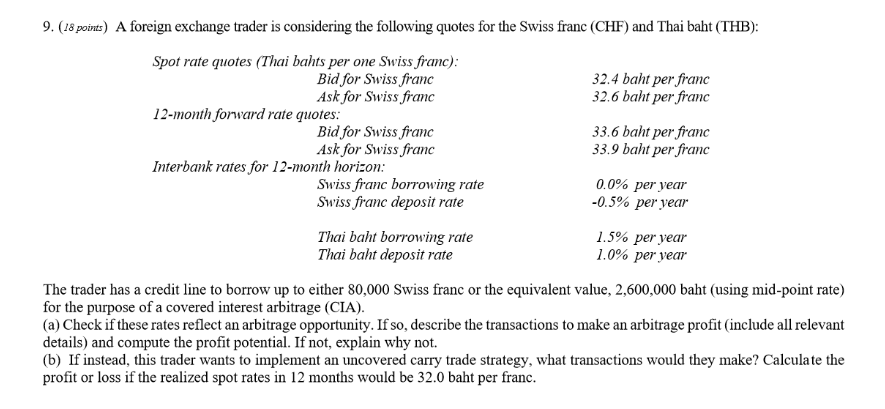

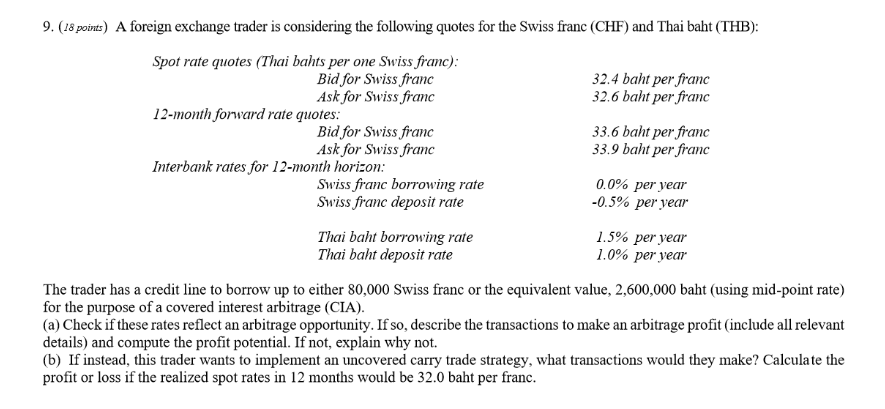

9. (18 points) A foreign exchange trader is considering the following quotes for the Swiss franc (CHF) and Thai baht (THB): Spot rate quotes (Thai bahts per one Swiss franc): Bid for Swiss franc 32.4 baht per franc Ask for Swiss franc 32.6 baht per franc 12-month forward rate quotes: Bid for Swiss franc 33.6 baht per franc Ask for Swiss franc 33.9 baht per franc Interbank rates for 12-month horizon: Swiss franc borrowing rate 0.0% per year Swiss franc deposit rate -0.5% per year Thai baht borrowing rate 1.5% per year Thai baht deposit rate 1.0% per year The trader has a credit line to borrow up to either 80,000 Swiss franc or the equivalent value, 2,600,000 baht (using mid-point rate) for the purpose of a covered interest arbitrage (CIA). (a) Check if these rates reflect an arbitrage opportunity. If so, describe the transactions to make an arbitrage profit (include all relevant details) and compute the profit potential. If not, explain why not. (b) If instead, this trader wants to implement an uncovered carry trade strategy, what transactions would they make? Calculate the profit or loss if the realized spot rates in 12 months would be 32.0 baht per franc. 9. (18 points) A foreign exchange trader is considering the following quotes for the Swiss franc (CHF) and Thai baht (THB): Spot rate quotes (Thai bahts per one Swiss franc): Bid for Swiss franc 32.4 baht per franc Ask for Swiss franc 32.6 baht per franc 12-month forward rate quotes: Bid for Swiss franc 33.6 baht per franc Ask for Swiss franc 33.9 baht per franc Interbank rates for 12-month horizon: Swiss franc borrowing rate 0.0% per year Swiss franc deposit rate -0.5% per year Thai baht borrowing rate 1.5% per year Thai baht deposit rate 1.0% per year The trader has a credit line to borrow up to either 80,000 Swiss franc or the equivalent value, 2,600,000 baht (using mid-point rate) for the purpose of a covered interest arbitrage (CIA). (a) Check if these rates reflect an arbitrage opportunity. If so, describe the transactions to make an arbitrage profit (include all relevant details) and compute the profit potential. If not, explain why not. (b) If instead, this trader wants to implement an uncovered carry trade strategy, what transactions would they make? Calculate the profit or loss if the realized spot rates in 12 months would be 32.0 baht per franc