Answered step by step

Verified Expert Solution

Question

1 Approved Answer

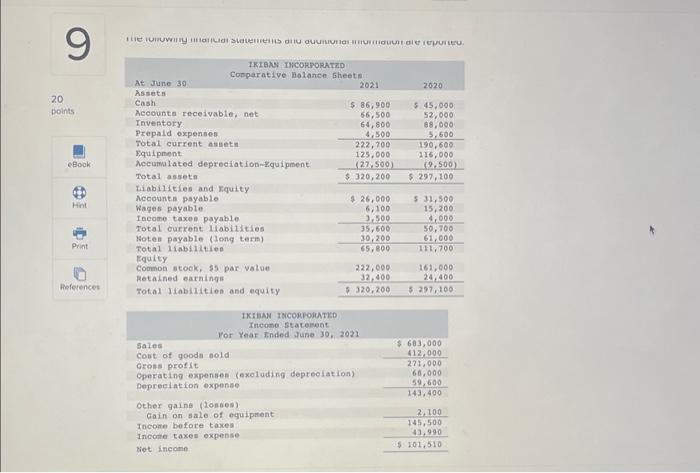

9 20 points eBook Hint Print References The followiny ilancial Statements and duuilivildi andre reported. At June 30 Assets Cash Accounts receivable, net Inventory Prepaid

9 20 points eBook Hint Print References The followiny ilancial Statements and duuilivildi andre reported. At June 30 Assets Cash Accounts receivable, net Inventory Prepaid expenses Total current assets IKIBAN INCORPORATED Comparative Balance Sheets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity Sales Cost of goods sold Gross profit $ 86,900 66,500 64,800 4,500 Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income 2021 222,700 125,000 (27,500) $ 320,200 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2021 $ 26,000 6,100 3,500 Operating expenses (excluding depreciation) Depreciation expense 222,000 32,400 $ 320,200 35,600 30,200 65,800 2020 $ 45,000 52,000 88,000 5,600 190,600 116,000 (9,500) $ 297,100 $ 31,500 15,200 4,000 50,700 61,000 111,700 161,000 24,400 $ 297,100 $ 683,000 412,000 271,000 68,000 59,600 143,400 2,100 145,500 43,990 $ 101,510

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started