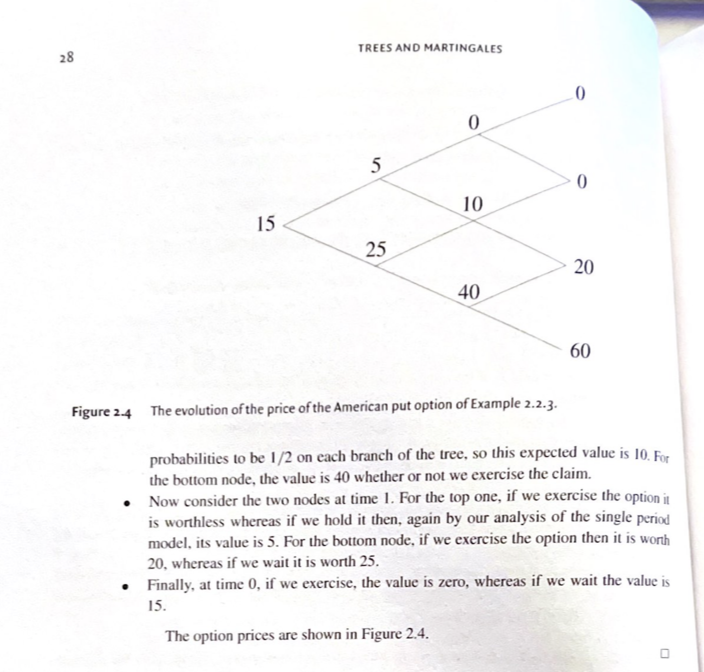

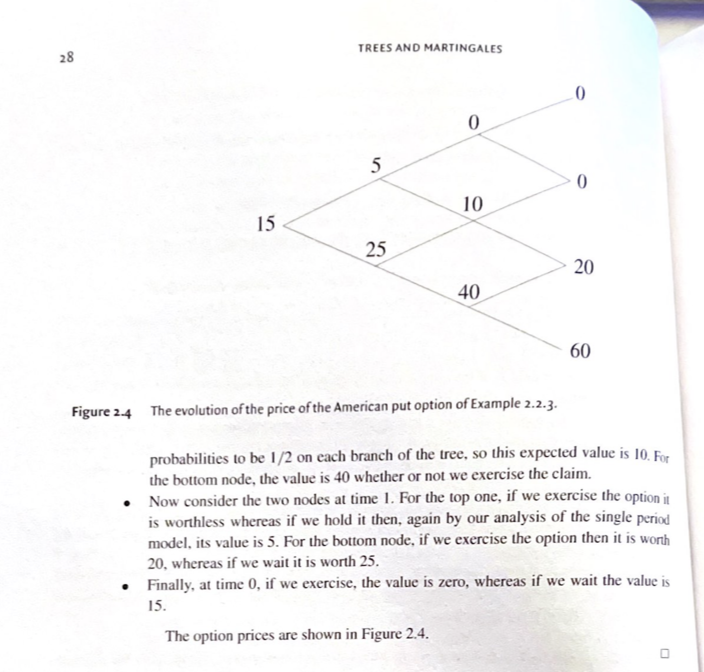

9 9 Consider the American put option of Example 2.2.3, but now suppose that interest rates are such that a $1 cash bond at time it is worth $1.1 at time (i+1)8t. Find the value of the put. At what time will it be exercised? The case of American put options is harder (even without dividends). We illustrate with an example. Put on non- dividend- paying stock Example 2.2.3 Suppose once again that our asset price evolves according to the recombinant tree of Figure 2.3. To illustrate the method, again we suppose that the risk-free interest rate is zero (but see the second paragraph of Remark 2.2.4). What is the value of a three month American put option with strike price 100? Solution: As in the case of a European option, we work our way backwards through the tree. The value of the claim at time 3, reading from top to bottom, is 0, 0, 20, 60. At time 2, we must consider two possibilities: the value if we exercise the claim, and the value if we do not. For the top node it is easy. The value is zero either way. For the second node, the stock price is equal to the strike price, so the value is zero if we exercise the option. the other hand, if we don't, then from our analysis of the single step binary model, the value of the claim is the expected value under the risk-neutral probabilities of the claim at time 3. We already calculated the risk-neutral TREES AND MARTINGALES 28 0 0 5 0 10 15 25 20 40 60 Figure 24 The evolution of the price of the American put option of Example 2.2.3. probabilities to be 1/2 on each branch of the tree, so this expected value is 10. For the bottom node, the value is 40 whether or not we exercise the claim. Now consider the two nodes at time 1. For the top one, if we exercise the option it is worthless whereas if we hold it then, again by our analysis of the single period model, its value is 5. For the bottom node, if we exercise the option then it is worth 20, whereas if we wait it is worth 25. Finally, at time 0, if we exercise, the value is zero, whereas if we wait the value is 15. The option prices are shown in Figure 2.4