Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9 A B C D E F G H Solution: 3. Mr. Arya won Rs.5,00,000 from lottery on 2nd February 2020. He also won

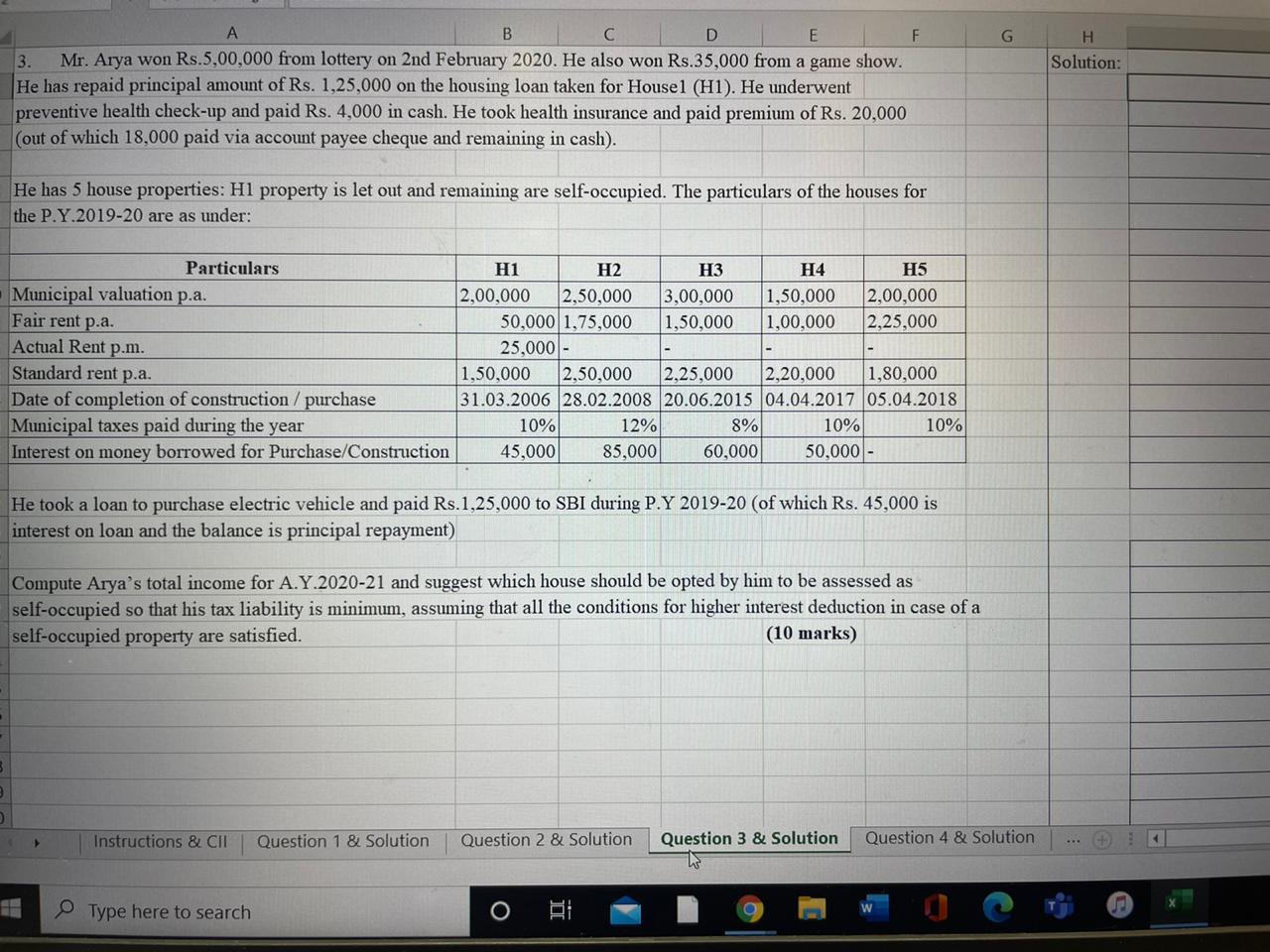

9 A B C D E F G H Solution: 3. Mr. Arya won Rs.5,00,000 from lottery on 2nd February 2020. He also won Rs.35,000 from a game show. He has repaid principal amount of Rs. 1,25,000 on the housing loan taken for House1 (H1). He underwent preventive health check-up and paid Rs. 4,000 in cash. He took health insurance and paid premium of Rs. 20,000 (out of which 18,000 paid via account payee cheque and remaining in cash). He has 5 house properties: H1 property is let out and remaining are self-occupied. The particulars of the houses for the P.Y.2019-20 are as under: Particulars Municipal valuation p.a. Fair rent p.a. Actual Rent p.m. Standard rent p.a. Date of completion of construction/purchase Municipal taxes paid during the year Interest on money borrowed for Purchase/Construction H1 2,00,000 H2 H3 H4 2,50,000 50,000 1,75,000 25,000 - 3,00,000 1,50,000 1,50,000 1,00,000 H5 2,00,000 2,25,000 - 1,50,000 2,50,000 2,25,000 2,20,000 1,80,000 31.03.2006 28.02.2008 20.06.2015 04.04.2017 05.04.2018 10% 45,000 12% 85,000 8% 60,000 10% 50,000- 10% He took a loan to purchase electric vehicle and paid Rs.1,25,000 to SBI during P.Y 2019-20 (of which Rs. 45,000 is interest on loan and the balance is principal repayment) Compute Arya's total income for A.Y.2020-21 and suggest which house should be opted by him to be assessed as self-occupied so that his tax liability is minimum, assuming that all the conditions for higher interest deduction in case of a self-occupied property are satisfied. (10 marks) Instructions & CII Question 1 & Solution Question 2 & Solution Type here to search O i Question 3 & Solution Question 4 & Solution L W

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started