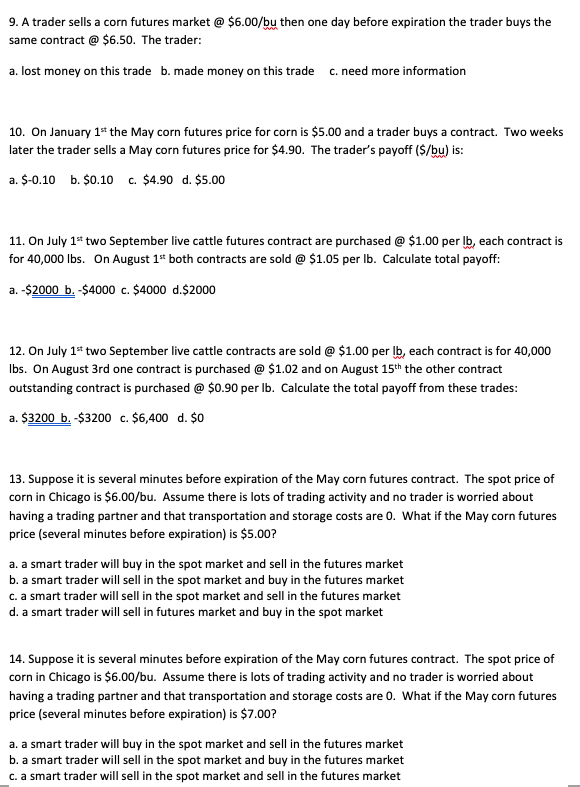

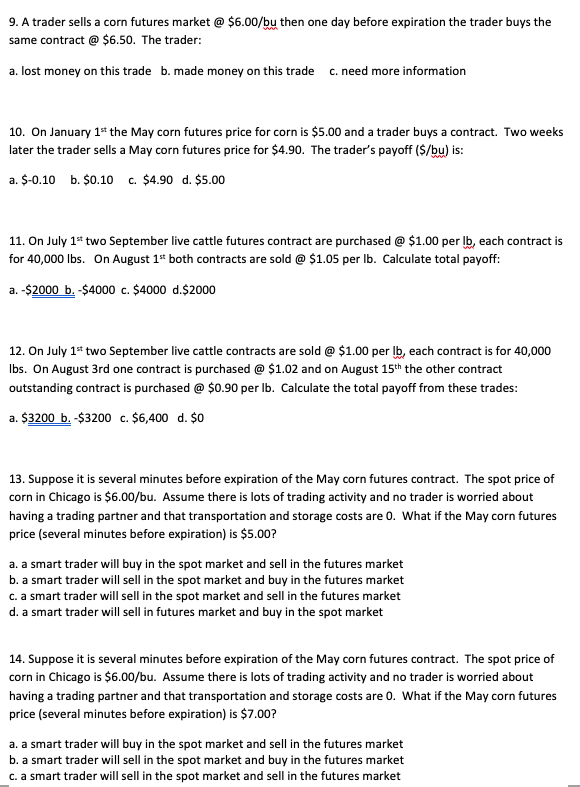

9. A trader sells a corn futures market @ $6.00/bu then one day before expiration the trader buys the same contract @ $6.50. The trader: a. lost money on this trade b. made money on this tradec. need more information 10. On January 1* the May corn futures price for corn is $5.00 and a trader buys a contract. Two weeks later the trader sells a May corn futures price for $4.90. The trader's payoff ($/bu) is: a. $-0.10 6. $0.10 c. $4.90 d. $5.00 11. On July 1st two September live cattle futures contract are purchased @ $1.00 per lb, each contract is for 40,000 lbs. On August 1st both contracts are sold @ $1.05 per lb. Calculate total payoff: a. -$2000 b. -$4000 C. $4000 d.$2000 12. On July 1* two September live cattle contracts are sold @ $1.00 per lb, each contract is for 40,000 lbs. On August 3rd one contract is purchased @ $1.02 and on August 15th the other contract outstanding contract is purchased @ $0.90 per lb. Calculate the total payoff from these trades: a. $3200 b. $3200 c. $6,400 d. $0 13. Suppose it is several minutes before expiration of the May corn futures contract. The spot price of corn in Chicago is $6.00/bu. Assume there is lots of trading activity and no trader is worried about having a trading partner and that transportation and storage costs are 0. What if the May corn futures price (several minutes before expiration) is $5.00? a. a smart trader will buy in the spot market and sell in the futures market b. a smart trader will sell in the spot market and buy in the futures market C. a smart trader will sell in the spot market and sell in the futures market d. a smart trader will sell in futures market and buy in the spot market 14. Suppose it is several minutes before expiration of the May corn futures contract. The spot price of corn in Chicago is $6.00/bu. Assume there is lots of trading activity and no trader is worried about having a trading partner and that transportation and storage costs are 0. What if the May corn futures price (several minutes before expiration) is $7.00? a. a smart trader will buy in the spot market and sell in the futures market b. a smart trader will sell in the spot market and buy in the futures market c. a smart trader will sell in the spot market and sell in the futures market