Answered step by step

Verified Expert Solution

Question

1 Approved Answer

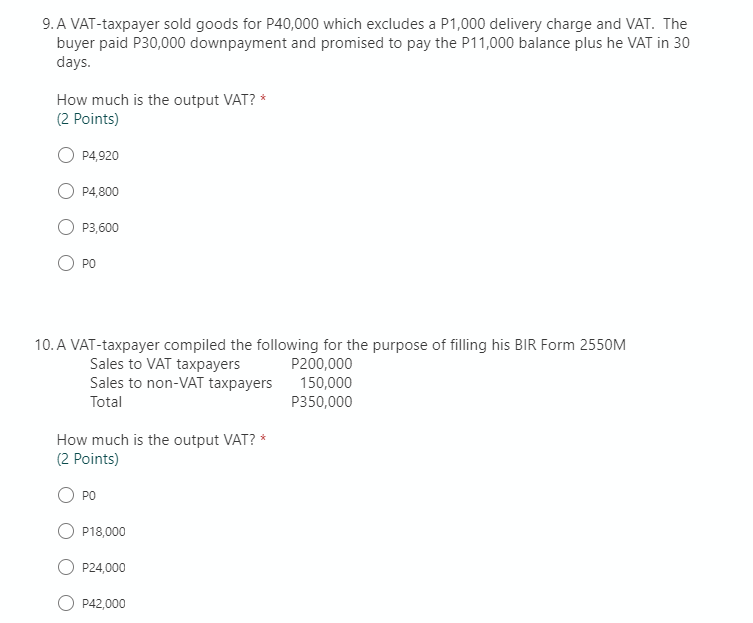

9. A VAT-taxpayer sold goods for P40,000 which excludes a P1,000 delivery charge and VAT. The buyer paid P30,000 downpayment and promised to pay

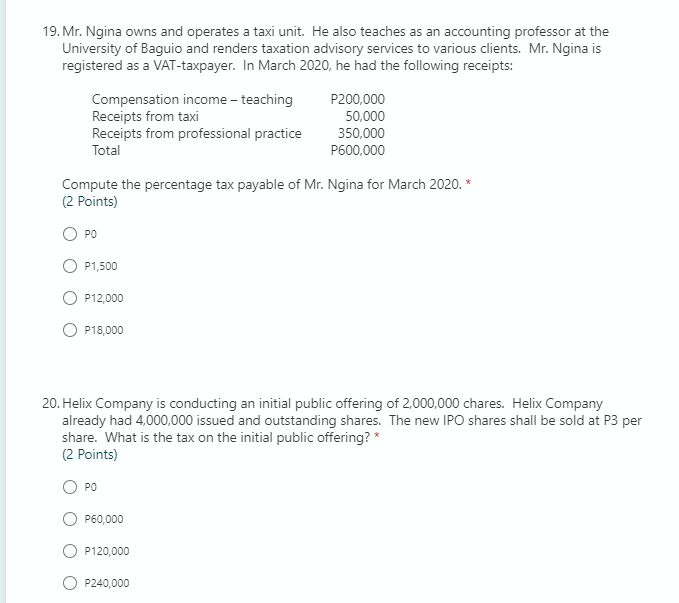

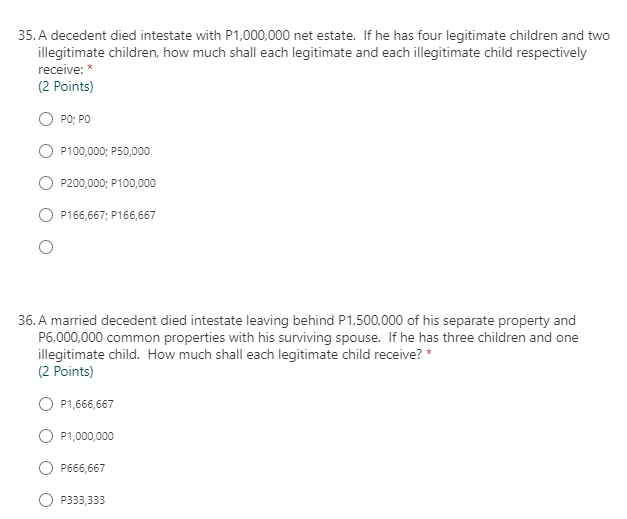

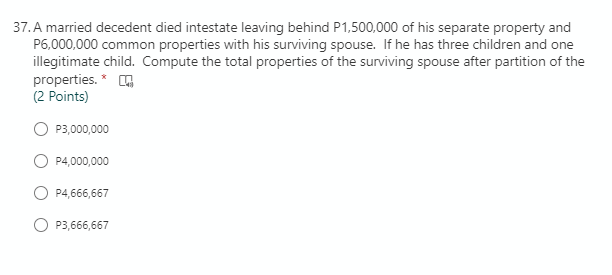

9. A VAT-taxpayer sold goods for P40,000 which excludes a P1,000 delivery charge and VAT. The buyer paid P30,000 downpayment and promised to pay the P11,000 balance plus he VAT in 30 days. How much is the output VAT? * (2 Points) P4,920 P4,800 P3,600 PO 10. A VAT-taxpayer compiled the following for the purpose of filling his BIR Form 2550M Sales to VAT taxpayers P200,000 150,000 Sales to non-VAT taxpayers Total P350,000 How much is the output VAT? * (2 Points) PO P18,000 P24,000 P42,000 19. Mr. Ngina owns and operates a taxi unit. He also teaches as an accounting professor at the University of Baguio and renders taxation advisory services to various clients. Mr. Ngina is registered as a VAT-taxpayer. In March 2020, he had the following receipts: Compensation income - teaching Receipts from taxi Receipts from professional practice Total Compute the percentage tax payable of Mr. Ngina for March 2020.* (2 Points) PO P1,500 O P12,000 O P18,000 P200,000 50,000 350,000 P600,000 20. Helix Company is conducting an initial public offering of 2,000,000 chares. Helix Company already had 4,000,000 issued and outstanding shares. The new IPO shares shall be sold at P3 per share. What is the tax on the initial public offering? * (2 Points) PO P60,000 O P120,000 O P240,000 35. A decedent died intestate with P1,000,000 net estate. If he has four legitimate children and two illegitimate children, how much shall each legitimate and each illegitimate child respectively receive: (2 Points) PO; PO P100,000; P50,000 P200,000; P100,000 P166,667; P166,667 36. A married decedent died intestate leaving behind P1,500,000 of his separate property and P6,000,000 common properties with his surviving spouse. If he has three children and one illegitimate child. How much shall each legitimate child receive? * (2 Points) O P1,666,667 O P1,000,000 P666,667 P333,333 37. A married decedent died intestate leaving behind P1,500,000 of his separate property and P6,000,000 common properties with his surviving spouse. If he has three children and one illegitimate child. Compute the total properties of the surviving spouse after partition of the properties. * (2 Points) P3,000,000 P4,000,000 P4,666,667 P3,666,667

Step by Step Solution

★★★★★

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Lets work through the questions one by one 9 To calculate the output VAT we need to first find the t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started