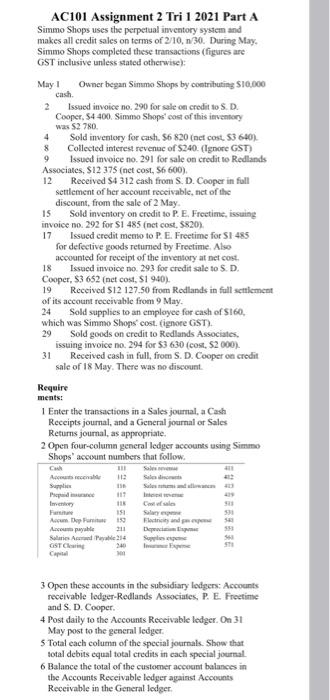

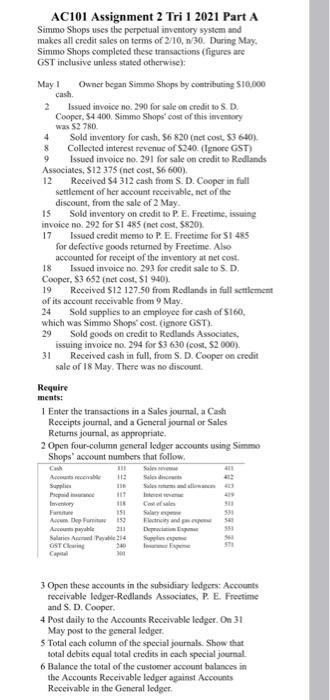

9 AC101 Assignment 2 Tri 1 2021 Part A Simmo Shops uses the perpetual inventory system and makes all credit sales on terms of 2/10, 1/30. During May, Simmo Shops completed these transactions (figures are GST inclusive unless stated otherwise): May 1 Owner began Simmo Shop by contributing $10.000 cash 2 Issued invoice no. 290 for sale on credit to S.D. Cooper, 54 400 Simmo Shops' cost of this inventory was $2780 4 Sold inventory for cash. 56 820 (net cost $36-40). 8 Collected interest revenue of $240. (Ignore GST) Issued invoice no. 291 for sale on credit to Redlands Associates, S12 375 (net cost, S6 600), 12 Received 84 312 cash from S. D. Cooper in full settlement of her account receivable, net of the discount, from the sale of 2 May 15 Sold inventory on credit to P. E. Freetime, issuing invoice no. 292 for $1 485 (net cost, 5820). 17 Issued credit memoto P E. Freetime for S1 485 for defective goods returned by Freetime. Also accounted for receipt of the inventory at netcost. 18 Issued invoice no. 293 for credit sale to S. D. Cooper, $3 652 (net cost, $1 940). 19 Received 512 127.50 from Redlands in full settlement of its account receivable from 9 May. 24 Sold supplies to an employee for cash of S160, which was Simmo Shops' cost. (ignore GST). 29 Sold goods on credit to Redlands Associates issuing invoice no. 294 for $3 630 (cost, S2000). Received cash in full, from S. D. Cooper on credit sale of 18 May. There was no discount. Require ments: 1 Enter the transactions in a Sales journal, a Cash Receipts journal, and a General journal of Sales Returns journal, as appropriate 2 Open four-column general ledger accounts using Simmo Shops' account numbers that follow. Ch Se 118 Celes Fame 181 Salary Accum. Deputu 159 Flits and Accumpayable teppe Sole 24 OSTC 3 Open these accounts in the subsidiary ledgers: Accounts receivable ledger-Redlands Associates, P. E. Freetime and S. D. Cooper. 4 Post daily to the Accounts Receivable ledger. On 31 May post to the general ledger 5 Total each column of the special journals. Show that total debits equal total credits in each special journal 6 Balance the total of the customer account balances in the Accounts Receivable ledger against Accounts Receivable in the General ledger 9 AC101 Assignment 2 Tri 1 2021 Part A Simmo Shops uses the perpetual inventory system and makes all credit sales on terms of 2/10, 1/30. During May, Simmo Shops completed these transactions (figures are GST inclusive unless stated otherwise): May 1 Owner began Simmo Shop by contributing $10.000 cash 2 Issued invoice no. 290 for sale on credit to S.D. Cooper, 54 400 Simmo Shops' cost of this inventory was $2780 4 Sold inventory for cash. 56 820 (net cost $36-40). 8 Collected interest revenue of $240. (Ignore GST) Issued invoice no. 291 for sale on credit to Redlands Associates, S12 375 (net cost, S6 600), 12 Received 84 312 cash from S. D. Cooper in full settlement of her account receivable, net of the discount, from the sale of 2 May 15 Sold inventory on credit to P. E. Freetime, issuing invoice no. 292 for $1 485 (net cost, 5820). 17 Issued credit memoto P E. Freetime for S1 485 for defective goods returned by Freetime. Also accounted for receipt of the inventory at netcost. 18 Issued invoice no. 293 for credit sale to S. D. Cooper, $3 652 (net cost, $1 940). 19 Received 512 127.50 from Redlands in full settlement of its account receivable from 9 May. 24 Sold supplies to an employee for cash of S160, which was Simmo Shops' cost. (ignore GST). 29 Sold goods on credit to Redlands Associates issuing invoice no. 294 for $3 630 (cost, S2000). Received cash in full, from S. D. Cooper on credit sale of 18 May. There was no discount. Require ments: 1 Enter the transactions in a Sales journal, a Cash Receipts journal, and a General journal of Sales Returns journal, as appropriate 2 Open four-column general ledger accounts using Simmo Shops' account numbers that follow. Ch Se 118 Celes Fame 181 Salary Accum. Deputu 159 Flits and Accumpayable teppe Sole 24 OSTC 3 Open these accounts in the subsidiary ledgers: Accounts receivable ledger-Redlands Associates, P. E. Freetime and S. D. Cooper. 4 Post daily to the Accounts Receivable ledger. On 31 May post to the general ledger 5 Total each column of the special journals. Show that total debits equal total credits in each special journal 6 Balance the total of the customer account balances in the Accounts Receivable ledger against Accounts Receivable in the General ledger 9 AC101 Assignment 2 Tri 1 2021 Part A Simmo Shops uses the perpetual inventory system and makes all credit sales on terms of 2/10, 1/30. During May, Simmo Shops completed these transactions (figures are GST inclusive unless stated otherwise): May 1 Owner began Simmo Shop by contributing $10.000 cash 2 Issued invoice no. 290 for sale on credit to S.D. Cooper, 54 400 Simmo Shops' cost of this inventory was $2780 4 Sold inventory for cash. 56 820 (net cost $36-40). 8 Collected interest revenue of $240. (Ignore GST) Issued invoice no. 291 for sale on credit to Redlands Associates, S12 375 (net cost, S6 600), 12 Received 84 312 cash from S. D. Cooper in full settlement of her account receivable, net of the discount, from the sale of 2 May 15 Sold inventory on credit to P. E. Freetime, issuing invoice no. 292 for $1 485 (net cost, 5820). 17 Issued credit memoto P E. Freetime for S1 485 for defective goods returned by Freetime. Also accounted for receipt of the inventory at netcost. 18 Issued invoice no. 293 for credit sale to S. D. Cooper, $3 652 (net cost, $1 940). 19 Received 512 127.50 from Redlands in full settlement of its account receivable from 9 May. 24 Sold supplies to an employee for cash of S160, which was Simmo Shops' cost. (ignore GST). 29 Sold goods on credit to Redlands Associates issuing invoice no. 294 for $3 630 (cost, S2000). Received cash in full, from S. D. Cooper on credit sale of 18 May. There was no discount. Require ments: 1 Enter the transactions in a Sales journal, a Cash Receipts journal, and a General journal of Sales Returns journal, as appropriate 2 Open four-column general ledger accounts using Simmo Shops' account numbers that follow. Ch Se 118 Celes Fame 181 Salary Accum. Deputu 159 Flits and Accumpayable teppe Sole 24 OSTC 3 Open these accounts in the subsidiary ledgers: Accounts receivable ledger-Redlands Associates, P. E. Freetime and S. D. Cooper. 4 Post daily to the Accounts Receivable ledger. On 31 May post to the general ledger 5 Total each column of the special journals. Show that total debits equal total credits in each special journal 6 Balance the total of the customer account balances in the Accounts Receivable ledger against Accounts Receivable in the General ledger 9 AC101 Assignment 2 Tri 1 2021 Part A Simmo Shops uses the perpetual inventory system and makes all credit sales on terms of 2/10, 1/30. During May, Simmo Shops completed these transactions (figures are GST inclusive unless stated otherwise): May 1 Owner began Simmo Shop by contributing $10.000 cash 2 Issued invoice no. 290 for sale on credit to S.D. Cooper, 54 400 Simmo Shops' cost of this inventory was $2780 4 Sold inventory for cash. 56 820 (net cost $36-40). 8 Collected interest revenue of $240. (Ignore GST) Issued invoice no. 291 for sale on credit to Redlands Associates, S12 375 (net cost, S6 600), 12 Received 84 312 cash from S. D. Cooper in full settlement of her account receivable, net of the discount, from the sale of 2 May 15 Sold inventory on credit to P. E. Freetime, issuing invoice no. 292 for $1 485 (net cost, 5820). 17 Issued credit memoto P E. Freetime for S1 485 for defective goods returned by Freetime. Also accounted for receipt of the inventory at netcost. 18 Issued invoice no. 293 for credit sale to S. D. Cooper, $3 652 (net cost, $1 940). 19 Received 512 127.50 from Redlands in full settlement of its account receivable from 9 May. 24 Sold supplies to an employee for cash of S160, which was Simmo Shops' cost. (ignore GST). 29 Sold goods on credit to Redlands Associates issuing invoice no. 294 for $3 630 (cost, S2000). Received cash in full, from S. D. Cooper on credit sale of 18 May. There was no discount. Require ments: 1 Enter the transactions in a Sales journal, a Cash Receipts journal, and a General journal of Sales Returns journal, as appropriate 2 Open four-column general ledger accounts using Simmo Shops' account numbers that follow. Ch Se 118 Celes Fame 181 Salary Accum. Deputu 159 Flits and Accumpayable teppe Sole 24 OSTC 3 Open these accounts in the subsidiary ledgers: Accounts receivable ledger-Redlands Associates, P. E. Freetime and S. D. Cooper. 4 Post daily to the Accounts Receivable ledger. On 31 May post to the general ledger 5 Total each column of the special journals. Show that total debits equal total credits in each special journal 6 Balance the total of the customer account balances in the Accounts Receivable ledger against Accounts Receivable in the General ledger